|

|

|

|

|||||

|

|

Marvell Technology MRVL and Micron Technology MU are two semiconductor stocks riding the artificial intelligence (AI) infrastructure wave — but in very different ways. While Marvell Technology plays a key role in the custom silicon and data center connectivity space, Micron Technology is focused on memory technologies crucial to powering AI models.

With the AI boom to continue driving growth for the semiconductor industry, the question remains: Which stock makes for a better investment pick today? Let’s dive into the fundamentals, valuations, growth outlook and risks for each company.

Marvell Technology is benefiting from AI-data centers, high performance computing clients and hyperscalers’ increasing reliance on custom silicon for AI workloads. Marvell Technology’s connectivity businesses, encompassing its optics division, are experiencing robust growth as the industry is transitioning to 1.6 Terabit optical interconnects.

Marvell Technology’s advanced optical interconnects, like the 1.6T PAM DSP, are enabling data centers to move faster while consuming less power, providing a critical advantage as AI infrastructure scales. Marvell Technology’s Silicon Photonics Light Engines support speeds up to 6.4T by combining several parts into compact modules, making them ideal for both plug-in and co-packaged uses.

Its latest introduction, the co-packaged optics solutions, which feature higher interconnect densities, longer reach and scalable networking architecture, are an upgrade over the slower previous generation. The transition from older-generation copper-based networking to high-speed optical connectivity in AI infrastructure represents a massive opportunity.

However, macroeconomic and geopolitical uncertainties remain a meaningful overhang on Marvell Technology’s near-term performance. Global trade tensions, evolving U.S. chip export restrictions, and tariffs create operational and demand-side risks, particularly given MRVL’s reliance on hyperscalers and global supply chains.

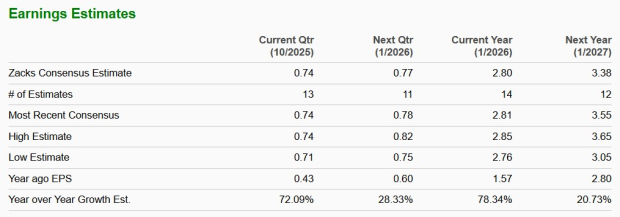

Marvell Technology’s rapid growth in AI-driven custom silicon is heavily tied to hyperscalers, creating concentration risk. Marvell Technology’s outlook for the third quarter of fiscal 2026 signals softer near-term growth. The company guided revenues of $2.06 billion (+/- 5%), representing just 2.5% sequential growth, a slowdown compared to recent quarters. The Zacks Consensus Estimate for fiscal 2026 earnings is pegged at $2.80 per share, suggesting a 78.3% year-over-year increase.

Micron Technology is benefiting from rapidly expanding AI-driven memory and storage markets. The positive impact of inventory improvement across multiple end markets is adding to the top-line growth. Robust demand for its high bandwidth memory (HBM) products has been noteworthy.

The company’s HBM chips are experiencing robust traction due to their growing use in high-performance computing, hyperscalers and artificial intelligence data centers. Micron is strengthening its industry partnerships to capitalize on AI and data center growth. On the third-quarter fiscal 2025 earnings call, management highlighted deepening collaborations with leading hyperscalers, AI model developers and GPU providers.

Micron Technology is actively engaged in long-term agreements with NVIDIA, AMD and Intel, enabling MU to capture a larger share of the AI infrastructure market. Micron Technology’s focus on long-term supply agreements with major cloud and enterprise customers ensures stable revenue streams and reduces the risk of pricing volatility.

Micron Technology’s expanding portfolio has been noteworthy. In June 2025, Micron Technology announced that it had begun shipping HBM4 36GB 12-high memory samples to key customers, delivering industry-leading power efficiency and performance to support next-generation AI data center platforms.

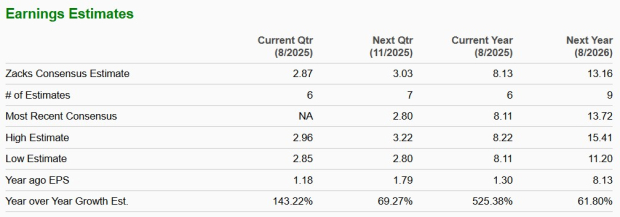

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $17.2 billion, indicating growth of 48% year over year. The Zacks Consensus Estimate for fiscal 2025 earnings is pegged at $8.13 per share, suggesting a whopping 525% year-over-year increase.

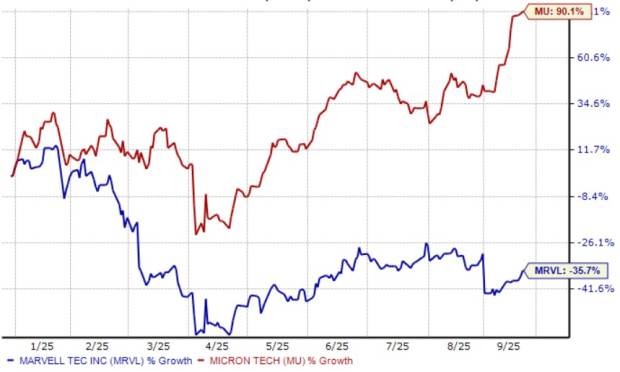

Year to date, MRVL shares have plunged 35.7% compared with the surge of 90.1% in MU shares.

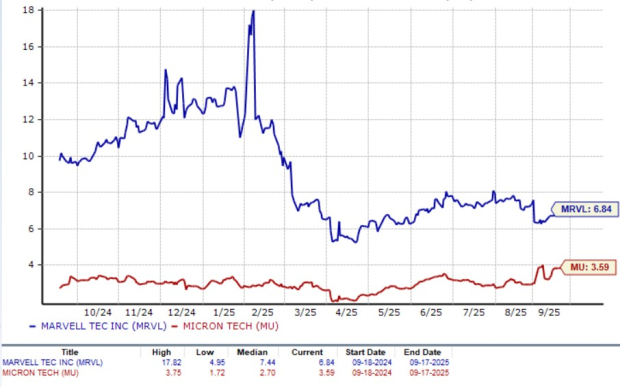

MU is trading at a forward sales multiple of 3.59X, way above its median of 2.70X, over the past year. MRVL’s forward sales multiple sits at 6.84X, significantly lower than its median of 7.44X over the past year.

Marvell Technology stands at the forefront of the AI infrastructure boom, with its custom silicon and advanced optical interconnect solutions positioning it as a key enabler of hyperscaler growth. Nonetheless, near-term risks cannot be ignored. Heavy dependence on a concentrated set of hyperscaler customers, lumpiness in custom silicon ramps, and external pressures from trade restrictions and tariffs create volatility in quarterly performance.

Micron Technology is emerging as a key beneficiary of the AI-driven surge in memory and storage demand, with its high-bandwidth memory portfolio at the center of next-generation data center and HPC growth. Strong industry partnerships with NVIDIA, AMD, and Intel, alongside long-term supply agreements with hyperscalers, position the company to secure stable revenues while reducing exposure to pricing swings.

Considering these factors, along with favorable earnings estimate revisions, Micron Technology seems to be a better investment choice in the current market environment. While Marvell Technology carries a Zacks Rank #3 (Hold), Micron Technology has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite