|

|

|

|

|||||

|

|

Bank OZK OZK remains well-positioned for growth on the back of a diversified loan portfolio, efforts to improve fee income, organic expansionary moves and interest rate cuts. However, worsening asset quality and an elevated expense base are headwinds.

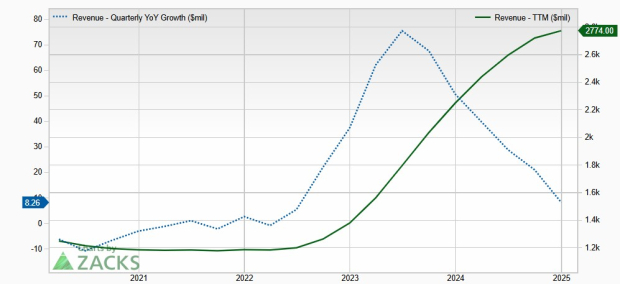

Solid Growth Strategy: Bank OZK’s growth is significantly driven by a de novo branching strategy alongside its inorganic measures. The bank’s revenues reflected a compound annual growth rate (CAGR) of 10.8% over the last five years ended 2024, primarily driven by steady loan growth (which witnessed an 11.1% CAGR over the same time frame) and higher fee income (accounted for 4.3% of total revenues in 2024). The company will likely keep expanding through its retail branch network. Management expects to grow branch count by 10% by the end of this year from the current 232.

Revenue Growth

Further, efforts to bolster fee income, growing emphasis on building a secondary mortgage banking business and a diversified loan portfolio will likely bolster top-line growth. We project total net revenues and loans to witness a CAGR of 4.1% and 4.2%, respectively, by 2027. The revenue growth will be primarily driven by net interest income (CAGR of 4.2%), trust income (CAGR of 9%), and loan service, maintenance, and other fees (CAGR of 9.8%).

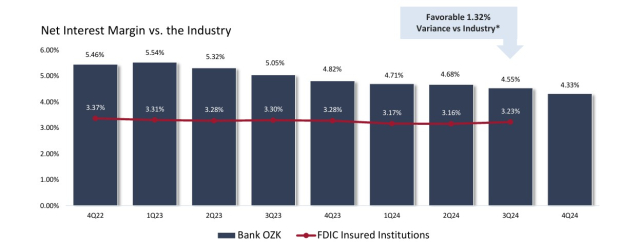

Interest Rate Cuts to Aid Net Interest Margin: Bank OZK expects the net interest margin (NIM) to stabilize gradually as the cost of interest-bearing deposits (COIBD) declines in response to the Federal Reserve's interest rate cuts. Though NIM contracted in 2024 to 4.56% from 5.16% in 2023 as COIBD rose, the company expects COIBD to decline going forward.

NIM Trends

Further, NIM expansion will be aided by time deposit repricing and variable loan rates hitting the floor in the second half of 2025. We estimate NIM to be 4.35% in 2025, 4.64% in 2026 and 4.75% in 2027.

Solid Balance Sheet: As of Dec. 31, 2024, Bank OZK’s total debt (comprising other borrowings and accrued interest payable and other liabilities) was $893.5 million, while cash and cash equivalents were $2.8 billion, demonstrating the strength of the balance sheet.

Moreover, at the end of 2024, its times interest earned of 31X witnessed an improvement. Hence, a robust liquidity position and earnings strength enable the bank to address its debt obligations, even in the event of economic turmoil.

Additionally, the company has been regularly hiking its quarterly dividends. In April 2025, it hiked its dividend for the 59th consecutive quarter. Also, in July 2024, the company announced a new share repurchase program worth $200 million with an expiration date of July 1, 2025. As of Dec. 31, 2024, about $199.5 million of buyback authorization remained available.

Thus, a strong balance sheet, robust capital position, lower debt-equity and dividend payout ratios compared with peers enable sustainable capital distributions.

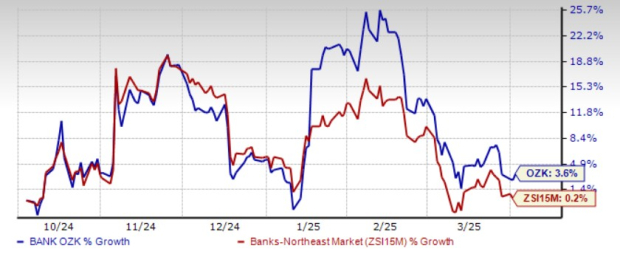

Bank OZK currently carries a Zacks Rank #3 (Hold). Over the past six months, shares of the company have gained 3.6%, outperforming the industry’s growth of 0.2%.

Yearly Price Performance

Deteriorating Asset Quality: Bank OZK’s deteriorating asset quality remains another concern. The bank’s provision for loss recorded a 46.2% CAGR over the past five years ended 2024, as the company continued to build reserves to tackle a tough operating environment. Further, net charge-offs (NCOs) recorded a CAGR of 23.5% over the same time period.

Uncertain economic conditions and weakness in borrowers' paying capability are likely to keep provisions and NCOs elevated in the near term. Our estimates suggest provision for credit losses to increase marginally, while NCOs are expected to rise 9% in 2025.

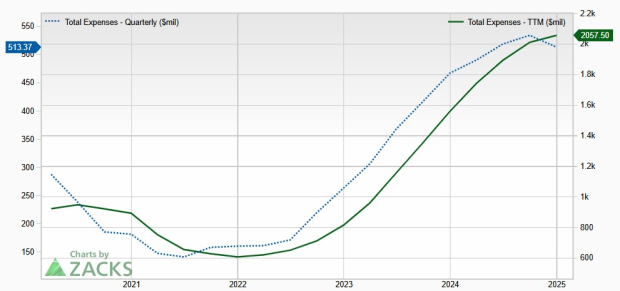

Mounting Expense Base: Bank OZK has been witnessing a continuous increase in non-interest expenses. The metric experienced a 6.6% CAGR over the last five years ended 2024. The increase was primarily driven by a rise in salaries and employee-benefit costs.

Expense Growth Trend

Given the ongoing expansion measures through branch openings in new regions, headcount is likely to increase to support growth, thus resulting in higher expenses. Moreover, inflationary pressures are also likely to weigh on the company’s expense base.

We anticipate non-interest expenses to witness a CAGR of 6.5% over the next three years, majorly owing to salaries and employee benefits expenses (CAGR of 7.8%) and net occupancy and equipment costs (CAGR of 5.9%).

Some better-ranked banks worth a look are Camden National Corporation CAC and ConnectOne Bancorp, Inc. CNOB, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

Estimates for CAC’s current-year earnings have been revised 2.6% upward in the past 30 days. The company’s shares have risen 2% over the past six months.

Estimates for CNOB’s current-year earnings have been revised 4.5% north in the past month. The company’s shares have lost 3.7% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-11 | |

| Mar-05 | |

| Mar-03 | |

| Feb-20 | |

| Feb-19 | |

| Feb-17 | |

| Feb-09 | |

| Feb-05 | |

| Feb-04 | |

| Feb-03 | |

| Jan-30 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite