|

|

|

|

|||||

|

|

Hormel Foods Corporation (HRL) posted strong top-line growth in its third quarter of fiscal 2025, with organic sales up 6%. Yet earnings failed to keep pace, weighed down by a sudden surge in commodity markets. Pork bellies rose about 30% year over year, beef prices held near record highs, the pork cut-out rose 10% and pork trim climbed 20%, together creating roughly 400 basis points of raw material cost inflation in the fiscal quarter.

To mitigate this pressure, Hormel Foods has rolled out targeted pricing initiatives across key product lines. The value-added turkey portfolio was an early test case: pricing announced late in the fiscal second quarter flowed through in the fiscal third quarter, allowing the Jennie-O brand to capture dollar share growth while restoring profitability. Still, management acknowledged that retail price increases carry a longer lag time before appearing in results, making immediate recovery difficult.

The company expects incremental pricing measures to begin contributing in the fiscal fourth quarter and more meaningfully in the first quarter of fiscal 2026. Foodservice pricing typically adjusts more quickly with commodity swings, but sharp spikes can create temporary compression. Retail remains more sensitive, as Hormel Foods must weigh price increases against elasticity risks and the potential for consumer trade-down.

In short, Hormel Foods is leaning on pricing as its most direct tool to address commodity inflation. The impact of these actions will depend on how consumers respond in a cautious spending environment and whether demand holds across key brands such as Jennie-O and SPAM. Pricing is expected to provide some relief to margins, although the benefits are likely to flow through gradually rather than immediately.

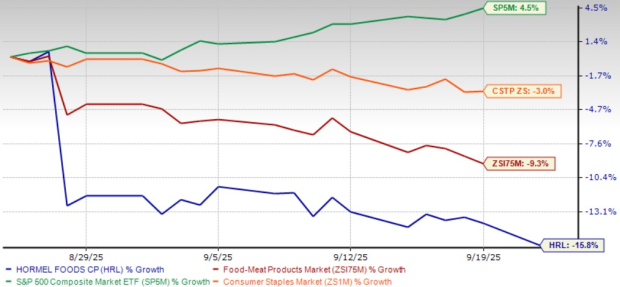

Shares of this Zacks Rank #5 (Strong Sell) company have lost 15.8% in the past month compared with the industry and the broader Consumer Staples sector’s decline of 9.3% and 3%, respectively. HRL has also underperformed the S&P 500 index’s growth of 4.5% during the same period.

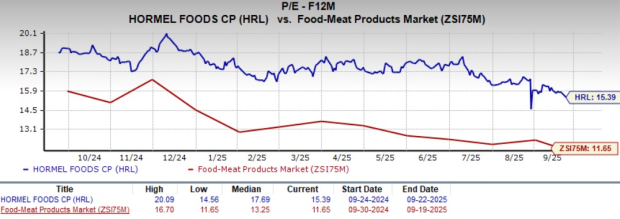

Hormel Foods currently trades at a forward 12-month P/E ratio of 15.39 compared with the industry average of 11.65. This valuation places the stock at a premium relative to peers, indicating broader market expectations around its business stability and ability to navigate current cost and demand dynamics.

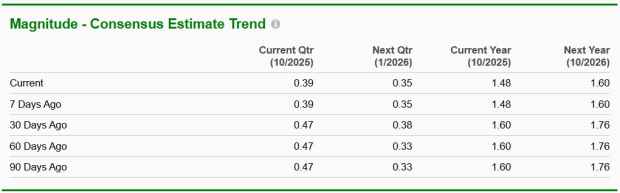

The Zacks Consensus Estimate for earnings per share has seen downward revisions. Over the past 30 days, the consensus estimate has decreased 12 cents to $1.48 for the current fiscal year and 16 cents to $1.60 per share for the next fiscal year.

Smithfield Foods, Inc. (SFD) produces packaged meats and fresh pork in the United States and internationally. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Smithfield Foods’ current fiscal-year sales and earnings indicates growth of 7.1% and 28.7%, respectively, from the prior-year levels. SFD delivered a trailing four-quarter earnings surprise of 6.6%, on average.

Celsius Holdings, Inc. (CELH) develops, processes, manufactures, markets, sells and distributes functional energy drinks. It flaunts a Zacks Rank #1 at present. CELH delivered a trailing four-quarter earnings surprise of 5.4%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings indicates growth of 77.7% and 54.3%, respectively, from the prior-year levels.

Laird Superfood, Inc. (LSF) manufactures and markets plant-based, natural and functional food in the United States. It currently carries a Zacks Rank # 2 (Buy). LSF delivered a trailing four-quarter earnings surprise of 11.3%, on average.

The Zacks Consensus Estimate for Laird Superfood’s current fiscal-year sales and earnings indicates growth of 21% and 23.8%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 min | |

| 13 min | |

| 9 hours | |

| 10 hours | |

| 13 hours | |

| 18 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite