|

|

|

|

|||||

|

|

Itron, Inc. (ITRI) recently inked a joint marketing agreement with Current Lighting Solutions (Current), a top provider of advanced and sustainable lighting. The initiative combines Itron’s CityEdge portfolio of intelligent control and management technologies with Current’s high-efficiency LED luminaires, including its cutting-edge Evolve Roadway product line. This collaboration is set to transform the way cities and utilities deploy, operate and optimize streetlighting systems, delivering benefits that extend beyond illumination.

In October 2024, Itron introduced its CityEdge portfolio, an open, flexible platform that integrates IoT technologies to address current and future urban challenges. Rebranding its proven smart city and lighting solutions, CityEdge supports cities in five essential areas — smart lighting, traffic management, sustainability, public safety and utilities like energy and water.

The advent of LED lighting technology has already transformed the landscape. LEDs deliver more lumens per watt, last longer and reduce maintenance needs. However, as cities deploy brighter and more efficient lighting, new challenges emerge. Over-illumination and light pollution can have adverse environmental impacts if not properly managed. Itron’s intelligent controls solve this challenge. By pairing advanced lighting fixtures with intelligent management platforms, cities can dynamically adjust brightness, tailor illumination to actual needs and integrate with broader smart city applications.

Itron’s CityEdge portfolio enhances the value of smart lighting by giving cities precise control over their streetlight infrastructure. In addition to dimming and reducing energy costs, CityEdge enables remote asset monitoring and fault detection. The platform also integrates with sensors for air quality, traffic and weather, extending its use across multiple smart city applications that improve community safety. When paired with Current’s luminaires, CityEdge not only delivers a more adaptive lighting environment but also streamlines operations through automated asset management and data collection via Digital Addressable Lighting Interface (DALI) drivers.

Current Lighting Solutions brings its Evolve Roadway product line to the partnership, including the ERLx and ERNx families. These fixtures are designed specifically for outdoor environments and optimized for streetlighting. These deliver exceptional lumens per watt along with advanced glare control and precise optics, ensuring uniform light distribution and enhanced visibility. By integrating these fixtures with CityEdge’s advanced controls, cities can achieve precision illumination, ensuring lights are bright where needed and dimmed when traffic or pedestrian activity is low.

Itron’s CityEdge portfolio continues to gain steady traction. In March 2025, Itron announced that its CityEdge portfolio was leveraged by the City of Helsingborg in Sweden to drive smart city transformation. This marks the first phase in Helsingborg’s ambitious journey to become a smart, sustainable and data-driven city.

A solid backlog and growing adoption of its grid edge intelligence platform position the company to capitalize on global energy, water and smart infrastructure trends. The platform’s growth is being driven by various factors, including data center-related demand growth, reindustrialization and production localization, as well as electrification of transportation and homes. Itron added that automation of water infrastructure, safety applications for gas customers and the digitalization of their operations were other growth drivers.

Steady market demand, backed by strong opportunities in grid resiliency, capacity, safety and automation, augurs well. This growth is driven by the continued uptake of its grid intelligence platform, shipping more than 15.3 million distributed intelligence-capable endpoints. The growing adoption of DI-capable technology highlights its critical role in helping utilities build flexible infrastructure with real-time data and analytics. Due to the back-end-loaded nature of 2024 bookings and the usual time lag from bookings to revenue, most new bookings will likely contribute to revenues beyond 2025.

However, the company is seeing customers pull back, slowing activity and delaying decisions amid macroeconomic uncertainty and shifting trade policies. While long-term expectations are intact, near-term demand is weakening as clients pause to gauge the impact of growing macro headwinds. Regulatory complexity, project delays and slower customer decisions are weighing on demand, forcing a nearly 3% cut to full-year revenue guidance at the midpoint.

It now projects 2025 revenues of $2.35-$2.4 billion compared with the previous estimate of $2.4-$2.5 billion. Third-quarter revenues are expected at $570–$585 million, with the midpoint down 6% year over year, signaling weaker near-term performance.

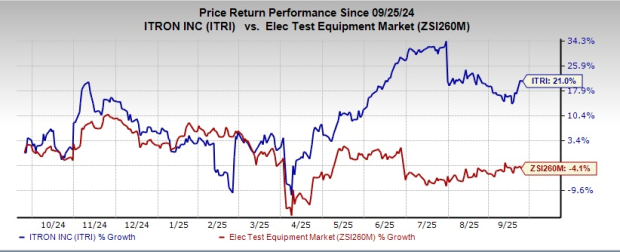

ITRI currently carries a Zacks Rank #2 (Buy). The stock has gained 21% in the past year against the Zacks Electronics - Testing Equipment industry’s decline of 4.1%.

Ubiquiti Inc. (UI) carries a Zacks Rank #1(Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here

In the last reported quarter, it delivered an earnings surprise of 61.29%. Ubiquiti invests significantly in research and development activities to develop innovative products and state-of-the-art technology, expanding its addressable market and staying at the cutting edge of networking technology. The company believes its new product pipeline will help increase average selling prices for high-performance, best-value products, thus boosting the top line. Ubiquiti is witnessing healthy traction in the Enterprise Technology segment.

Headquartered in Carlsbad, CA, Viasat Inc. (VSAT) carries a Zacks Rank #2. It designs, develops and markets advanced digital satellite telecommunications and other wireless networking and signal processing equipment. It provides high-bandwidth, high-performance communication solutions to the public, as well as to military, enterprise, and government agencies. Viasat’s impressive bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models.

InterDigital, Inc. (IDCC) currently carries a Zacks Rank #1. The company delivered an average earnings surprise of 54.27% in the trailing four quarters.

InterDigital’s global footprint, diversified product portfolio and the ability to penetrate different markets are impressive. It is focused on pursuing agreements with unlicensed customers in the handset and consumer electronics markets. Apart from its strong portfolio of wireless technology solutions, the addition of technologies related to sensors, user interface and video to its offerings is likely to drive significant value, considering the massive size of the market it licenses.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 10 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 |

U.S.-Iran Attacks, Trump Tariffs: Where Should Investors Draw The Line?

UI

Investor's Business Daily

|

| Mar-04 | |

| Mar-04 |

U.S.-Iran Attacks And Risk Management: Where Should Investors Draw The Line?

UI

Investor's Business Daily

|

| Mar-04 | |

| Mar-04 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite