|

|

|

|

|||||

|

|

Artificial intelligence, or AI, is reshaping the defense and national security landscape, creating investment opportunities in companies that blend advanced software with mission-critical government contracts. Two names at the forefront of this movement are BigBear.ai BBAI and Palantir Technologies PLTR. Both firms specialize in AI-driven solutions tailored for defense, intelligence, and critical infrastructure, yet they differ widely in scale, financial strength and execution strategies.

BigBear.ai is emerging as a nimble defense-focused AI player, leveraging biometric identity, supply chain security and autonomous systems. Palantir, by contrast, has established itself as a global leader in enterprise AI, with government and commercial customers increasingly adopting its Artificial Intelligence Platform (AIP).

Both stocks have delivered strong returns in 2025. BigBear.ai has surged 52.4% in the past three months and 79.1% year to date (YTD), while Palantir has climbed 27.1% in three months and 140.8% YTD. These gains reflect investor enthusiasm for the AI-defense narrative but also highlight diverging risk-reward profiles. Both stocks’ YTD gains are above the Zacks Computer and Technology sector’s 23.6% rise.

BBAI & PLTR Stocks YTD Performance

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

BigBear.ai is positioning itself as a mission-ready AI company with strong ties to defense and homeland security. The passage of the “One Big Beautiful Bill” (OB3), which allocates more than $300 billion in supplemental funding to the Department of Defense and Homeland Security, is a game-changer for the company. Management highlighted that billions earmarked for border technology, biometrics, and defense autonomy directly align with BigBear.ai’s offerings, including ConductorOS (autonomous command and control), Shipyard AI (supply chain/shipbuilding), and veriScan (biometric identity solutions).

Financially, the company just recorded its strongest balance sheet ever, with $391 million in cash and, for the first time, a net positive cash position exceeding debt. This liquidity gives BigBear.ai the firepower to invest aggressively in growth and pursue M&A opportunities. Unlike past years when the company was constrained, management can now take the “offense” in winning contracts and scaling internationally. Recent partnerships in the UAE and Panama demonstrate its global expansion push.

However, BigBear.ai’s fundamentals remain challenged. Second-quarter 2025 revenues fell 18% year over year to $32.5 million, pressured by disruptions in U.S. Army contracts. Adjusted EBITDA turned more negative at $8.5 million, and the company posted a staggering $228.6 million net loss, primarily due to goodwill impairment and derivative revaluation. Management withdrew adjusted EBITDA guidance for 2025 and now expects revenues of $125–$140 million, underscoring near-term execution risk.

Compared to Palantir, BigBear.ai is far smaller in scale and still loss-making. Its growth outlook depends heavily on capturing new federal contracts, which introduces volatility. Yet its niche focus and alignment with OB3 funding could provide significant upside if execution improves. The stock’s sharp gains in recent months reflect optimism around these tailwinds, though volatility is likely to persist given its reliance on a few large deals.

Palantir delivered a solid second-quarter 2025, surpassing $1 billion in quarterly revenue for the first time, up 48% year over year, with adjusted operating margins expanding to 46%. Both its U.S. commercial and U.S. government businesses are firing: commercial revenue surged 93% and government revenue rose 53% year over year. A landmark 10-year, up-to-$10 billion enterprise contract with the U.S. Army consolidates 75 prior agreements into one, cementing Palantir as a central partner in defense AI.

Palantir’s contract momentum is unmatched. The company closed 157 deals worth more than $1 million, including 42 above $10 million. Total contract value bookings reached $2.3 billion, a 140% year-over-year increase. Remaining deal value stood at $7.1 billion, up 65% year over year. Such visibility into future revenue dwarfs that of BigBear.ai, which remains dependent on winning its next wave of awards.

Profitability and cash flow also distinguish Palantir. The firm generated $569 million in adjusted free cash flow in the second quarter with margins of 57%, while ending the quarter with $6 billion in cash. Palantir has now posted eight consecutive quarters of GAAP profitability—rare for a high-growth AI software company. Management raised full-year revenue guidance to $4.142–$4.150 billion, representing 45% year-over-year growth, and boosted adjusted income from operations to nearly $2 billion.

Whereas BigBear.ai is betting on OB3 funding and international expansion, Palantir is already deeply entrenched with the U.S. government and scaling rapidly in U.S. commercial markets. Its AIP platform has become a must-have for enterprises struggling to operationalize AI, with customers like Citibank, Fannie Mae and Lear reporting transformational benefits. Palantir’s model—small sales force, strong customer evangelism, and rapid deployment—has translated into best-in-class Rule of 40 scores above 90, signaling a rare balance of growth and profitability.

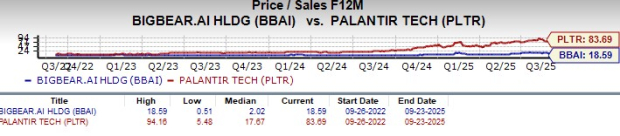

BBAI is trading at an 18.59X forward 12-month price-to-sales (P/S) ratio, much higher than its three-year median of 2.02X and higher than the Zacks Computer and Technology sector’s 7.15X. It may need clear signs of improving execution or a shift in federal spending trends to regain bullish momentum.

The main challenge for Palantir is valuation. Palantir trades at about 83.69X, far above BBAI and the sector. With its stock up 140.8% YTD, it trades at a significant premium relative to peers. Investors are betting on sustained hypergrowth and any slowdown could spark volatility. In contrast, BigBear.ai trades at a lower absolute valuation but carries higher execution and contract risk.

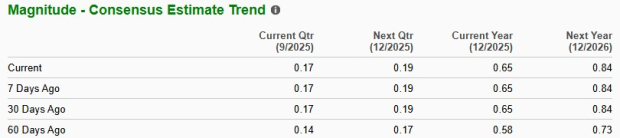

Over the past 60 days, the Zacks Consensus Estimate for Palantir has moved higher, signaling stronger growth prospects. In contrast, estimates for BigBear.ai have deteriorated, with projected losses for 2025 widening. Current estimates point to 58.5% growth for PLTR, while BBAI’s outlook suggests performance roughly in line with the prior year.

For BBAI Stock

For PLTR Stock

Both BigBear.ai and Palantir are well positioned to benefit from the surge in AI-driven defense and security spending. BigBear.ai offers higher speculative upside tied to OB3’s generational funding wave, international partnerships, and potential M&A-driven scale. Its leaner size means contract wins could significantly move the needle. However, current financial losses, reduced guidance, and contract dependency underscore its riskier profile.

Palantir —a Zacks Rank #2 (Buy) — by contrast, stands out as the more reliable long-term compounder. Its billion-dollar quarterly revenue base, entrenched government relationships and rapid expansion into U.S. commercial markets provide resilience and visibility. Strong profitability, ample cash reserves and consistent execution make it a sturdier bet in an increasingly competitive AI landscape. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

While BigBear.ai — a Zacks Rank #3 (Hold) — could deliver bursts of growth if contract wins align, Palantir’s scale, profitability and proven customer adoption give it the edge as the better AI defense stock for sustained upside potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

AI Stocks Hit Reset. Will Nvidia, Snowflake, CoreWeave, Salesforce Earnings Decide What's Next?

PLTR

Investor's Business Daily

|

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite