|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Howmet Aerospace Inc. HWM and Textron Inc. TXT are two familiar names operating in the aerospace and defense industry. As rivals, both companies are engaged in producing highly engineered aircraft components for commercial and military aircraft in the United States and internationally.

Both companies are poised to benefit from significant growth opportunities in the aerospace and defense space on account of the improving air traffic trend and the robust U.S. budgetary policy over the past several years. But which company is better positioned to deliver upside in 2025? Let’s compare their fundamentals, growth prospects and challenges to see which stock stands out now.

The strongest driver of Howmet’s business at the moment is the commercial aerospace market. The strength in air travel continues, as it has through 2024, with wide-body aircraft demand also picking up, supporting continued OEM spending. Pickup in air travel has been positive for the company as the increased usage of aircraft spurs spending on parts and products that it provides. Revenues from the commercial aerospace market increased 8% year over year in the second quarter of 2025, constituting 52% of its business. Also, in the first quarter, revenues from the market increased 9% year over year. The sustained strength was attributed to new, more fuel-efficient aircraft with reduced carbon emissions and increased spare demand for engines.

While the commercial aerospace market has remained the major driver, the defense side of the industry has also been witnessing positive momentum, cushioned by steady government support. Howmet has been witnessing robust orders for engine spares for the F-35 program and spares and new builds for legacy fighters. In the second quarter, revenues from the defense aerospace market surged 21% year over year, constituting 17% of the company’s revenues. In the first quarter, revenues from this market increased 19% year over year.

It's worth noting that in July 2025, the House of Representatives passed the fiscal year 2026 Defense Appropriations Act, providing a total discretionary allocation of $831.5 billion. Such robust budgetary provisions set the stage for Howmet, which remains focused on its defense business to win more contracts, which is likely to boost its top line.

HWM’s shareholder rewarding policies are also encouraging. In the first six months of 2025, it paid dividends of $83 million and repurchased shares worth $300 million. In August 2025, the company hiked its dividend by 20% to 12 cents per share (annually: 48 cents), marking its second dividend hike in 2025. Also, in July 2024, its board approved an increase in the share repurchase program by $2 billion to $2.487 billion of its common stock. As of July 31, 2025, Howmet’s total share repurchase authorization available was $1.8 billion.

Growth in commercial air passenger traffic has been benefiting Textron’s Aviation business unit. Evidently, strong fleet utilization, backed by improving commercial air travel, contributed to Textron Aviation unit’s revenue growth of 2.8% on a year-over-year basis in the second quarter of 2025. Thanks to growing air travel, Textron has also been witnessing strong order activity, which resulted in a backlog of $7.85 billion for the Aviation segment. Such a robust backlog count strengthens Textron’s revenue-generating capacity in the coming quarters.

Besides its strong presence in the commercial aerospace market, Textron enjoys solid demand for its defense products as well. To this end, it is imperative to mention that in the first second quarter of 2025, the company’s Bell segment signed a contract with the Tunisian Air Force for 12 SUBARU Bell 412EPXs, while Textron Aviation partnered with Thai Aviation Industries to support the Royal Thai Air Force.

During the same period, Bell unit demonstrated a virtual prototype of the V-280 Valor to the U.S. Army, and Textron Systems secured a U.S. Navy contract to support mine countermeasure operations.

The company’s cash and cash equivalents amounted to $1.43 billion at the end of the second quarter. While Textron’s long-term debt totaled $3.38 billion as of June 30, 2025, its current debt was $0.36 billion. Although the long-term debt value is higher than its cash reserve, its current debt remains much lower than the cash balance. So, it seems that the company boasts a solid solvency position, at least in the short term.

However, persistence of supply-chain issues arising out of component shortages and delays is expected to result in production delays for some Textron’s products. Also, TXT may continue to experience cost increases for certain materials and components, which, along with increased energy and shipping costs and other inflationary pressures, may continue to adversely impact its profitability.

Also, if labor shortages continue in the near term, aircraft manufacturers like Textron may face challenges in the timely delivery of their finished products, amid ramped-up jet production rates, which, in turn, may impact its future operating results.

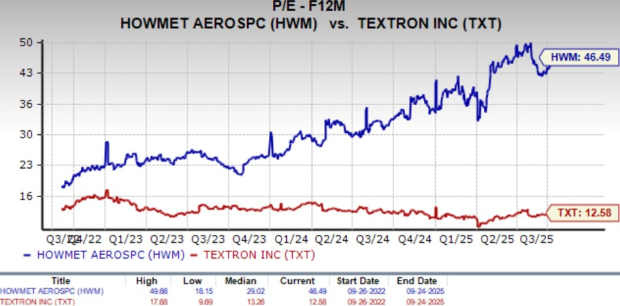

In the past year, Howmet shares have surged 90.7%, while Textron stock has lost 3.2%.

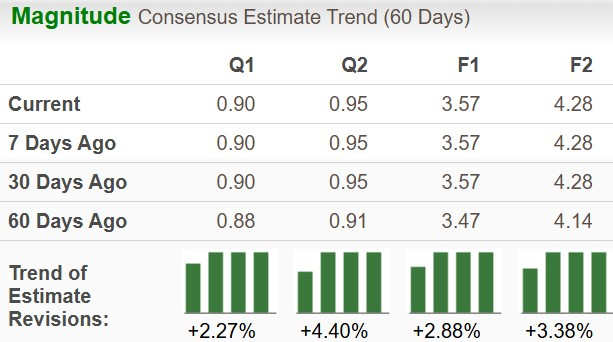

The Zacks Consensus Estimate for HWM’s 2025 sales and earnings per share (EPS) implies year-over-year growth of 9.4% and 32.7%, respectively. HWM’s EPS estimates for both 2025 and 2026 have increased over the past 60 days.

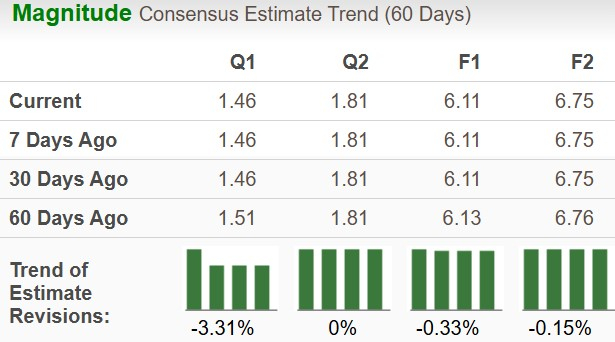

The Zacks Consensus Estimate for TXT’s 2025 sales and EPS implies year-over-year growth of 8.1% and 11.5%, respectively. However, TXT’s EPS estimates have declined over the past 60 days for both 2025 and 2026.

Textron is trading at a forward 12-month price-to-earnings ratio of 12.58X, below its median of 13.26X over the last three years. Howmet’s forward earnings multiple sits at 46.49X, much higher than its median of 29.02X over the same time frame.

Textron’s solid momentum in the commercial aerospace market, along with its robust pipeline of projects, favors well for its growth in the quarters ahead. Strong liquidity position for the short run is an added strength. However, this has been marred by the supply-chain challenges arising from component shortages, which might affect its near-term performance.

In contrast, Howmet’s market leadership position and persistent strength in both commercial and defense aerospace markets provide it with a competitive advantage to leverage the long-term demand prospects in the aerospace market. Despite its steeper valuation, HWM seems to be a better pick than TXT currently due to strong estimates, stock price appreciation and better prospects for sales and profit growth.

While HWM carries a Zacks Rank #2 (Buy), TXT currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite