|

|

|

|

|||||

|

|

Fidelity National Information Services, Inc. FIS recently completed the purchase of a leading Chicago-based integrated digital banking origination and decisioning solutions provider, Amount.

The integration of Amount allows FIS to further expand its innovative solutions suite that addresses every stage of the money lifecycle. When money is at rest, the platform enhances account opening through secure, compliant processes that minimize fraud and ensure trust.

When money is in motion, it accelerates credit card issuance and payment processing, enabling faster approvals and delivering seamless customer journeys. And when money is at work, it provides financial institutions with advanced tools to improve efficiency, broaden their product offerings and simplify lending operations.

The buyout seems to be a prudent move on the part of FIS since Amount delivers a premier digital account opening experience for both consumers and small businesses across lending, cards and deposits, and processed more than 150 million new account applications. Its cloud-native, unified platform, enhanced with embedded AI, streamlines the onboarding process for banks, lenders and credit unions.

The recent move is expected to solidify FIS’ Banking Solutions segment through addition of a digital-native, cloud-first capability. It will also enable its clients to grow deposits, loans and card portfolios more effectively and securely. Revenues from the unit advanced 4% year over year in the first half of 2025.

FIS continually invests in cutting-edge technologies and develops new solutions to strengthen the payment infrastructure. By leveraging ongoing software innovation, strategic acquisitions and equity investments, FIS expands its range of offerings, allowing it to cross-sell more services to existing clients while drawing in new ones. Additionally, FIS partners with other organizations to deliver integrated, end-to-end solutions to its customers.

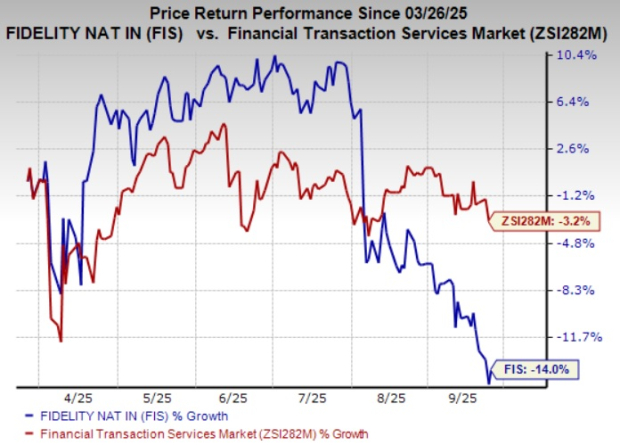

Shares of Fidelity National have lost 14% in the past six months compared with the industry’s 3.2% fall. FIS currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Business Services space are PagSeguro Digital Ltd. PAGS, Barrett Business Services, Inc. BBSI and Omnicom Group Inc. OMC. While PagSeguro Digital currently sports a Zacks Rank #1 (Strong Buy), Barrett Business Services and Omnicom carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of PagSeguro Digital outpaced estimates in each of the last four quarters, the average surprise being 10.12%. The Zacks Consensus Estimate for PAGS’ 2025 earnings indicates an improvement of 15.7% from the year-ago figure. The same for revenues implies growth of 9.6% from the year-ago number. The consensus mark for PAGS’ earnings has moved 8.5% north in the past 30 days.

Barrett Business Services’ earnings outpaced estimates in three of the trailing four quarters and matched the mark once, the average surprise being 21.04%. The Zacks Consensus Estimate for BBSI’s 2025 earnings indicates an improvement of 10.6% from the year-ago figure. The same for revenues implies growth of 9.5% from the prior-year reading. The consensus mark for BBSI’s earnings has moved 3.8% north in the past 60 days.

The bottom line of Omnicom outpaced estimates in each of the last four quarters, the average surprise being 3.18%. The Zacks Consensus Estimate for OMC’s 2025 earnings indicates an improvement of 5.2% from the year-ago figure. The same for revenues implies growth of 3.6% from the year-ago actual. The consensus mark for OMC’s earnings has moved 0.2% north in the past 60 days.

Shares of PagSeguro Digital and Barrett Business Services have gained 27.2% and 6.2%, respectively, in the past six months. However, Omnicom stock has lost 6.5% in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 | |

| Mar-02 | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite