|

|

|

|

|||||

|

|

The demand for clean electricity is rising sharply due to several factors, including the development of massive artificial intelligence-powered data centers, urbanization, industrial expansion, increasing global temperatures that increase the need for air conditioning, and the growing popularity of electric vehicles. Compared to other clean energy sources, nuclear power plants require significantly less land to generate the same amount of electricity. While all conventional energy sources produce waste during electricity generation, nuclear energy stands out for its systematic management and safe storage of waste.

Nuclear power plants are known for their high capacity factor, which means they can operate at or near their maximum output for an extended period. Nuclear power provides carbon-free electricity and a continuous power supply, even in extreme weather conditions. Production tax credits are also advantageous for nuclear energy because they help offset the high upfront costs of constructing nuclear power plants, making them more competitive than alternative energy sources.

With this increasing importance, utility stocks like Constellation Energy Corporation CEG and Ameren Corporation AEE are becoming attractive investment options.

Constellation Energy is capitalizing on the growing demand for clean energy by leveraging its diverse portfolio, particularly its nuclear fleet. CEG is an industry leader in operating nuclear plants safely, efficiently and reliably. Its nuclear fleet capacity factor was an impressive 94.8% in the second quarter of 2025.

Constellation Energy generates 10% of the nation’s carbon-free energy. Its fleet of nuclear, hydro, wind, and solar generation facilities produces enough energy to power more than 16 million homes and businesses through more than 32,400 megawatts (MW) of capacity and an annual output that is nearly 90% carbon-free.

Ameren is focused on offering electricity through cleaner and more diverse sources of energy generation, such as solar, wind, natural gas, hydro and nuclear power. AEE’s Callaway Energy Center is the only nuclear energy center among its 15 generating facilities. Callaway is the second largest power producer on the Ameren Missouri system, producing 24% of the company's electricity. The electricity generated by the facility is sufficient to meet the annual needs of approximately 780,000 average households.

The company is also focused on advancements in energy technologies, including carbon capture, utilization, and sequestration, hydrogen fuel for electric production and energy storage, next-generation nuclear, and large-scale long-cycle battery energy storage. AEE aims to add 1,500 MWs of nuclear generation by 2040.

Let's compare the two stocks' fundamentals to determine which one is a better investment option at present.

The Zacks Consensus Estimate for Constellation Energy’s 2025 and 2026 earnings per share (EPS) has declined 0.84% for 2025 and increased 0.51% for 2026 in the past 60 days.

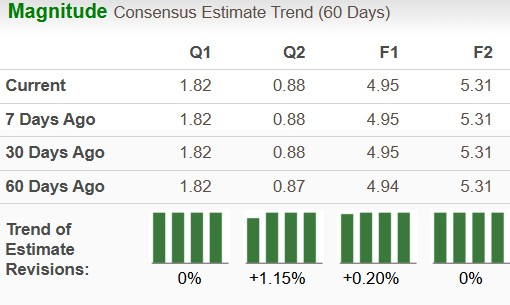

The Zacks Consensus Estimate for Ameren’s EPS has increased 0.20% for 2025 and remained unchanged for 2026 in the past 60 days.

Constellation Energy expects capital expenditures of nearly $3 billion and $3.5 billion for 2025 and 2026, respectively. Nearly 35% of projected capital expenditures are allocated to the acquisition of nuclear fuel, which includes additional nuclear fuel to replenish inventory levels.

Ameren expects to spend up to $26.3 billion, comprising up to $16.8 billion, $4.9 billion and $4.6 billion for Ameren Missouri, Ameren Illinois and Ameren Transmission, respectively, during the 2025-2029 period. The company projects a solid pipeline of regulated infrastructure investments of more than $63 billion in the 2025-2034 period.

ROE measures how efficiently a company is utilizing its shareholders’ funds to generate profits. Constellation Energy’s current ROE is 21.61% compared with Ameren’s 10.38%.

Utility companies generally distribute dividends and increase shareholders’ value. Currently, the dividend yield for Constellation Energy is 0.48% compared with the Zacks S&P 500 Composite’s average of 1.11%, and the same for Ameren is 2.82%.

In the past three months, shares of Constellation Energy and Ameren have risen 1.9% and 5.7%, respectively.

Constellation Energy is the largest nuclear power operator in the United States, with a significant portfolio of nuclear power plants. Ameren is focused on enhancing its operations through next-generation nuclear technology. Both companies have the potential to expand even further and meet the increasing demand for clean energy efficiently.

However, our choice at the moment is Ameren, given its better price performance, earnings growth for 2025 and dividend yield. Both CEG and AEE stocks carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 7 hours | |

| 7 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Utility Stocks Ameren, CenterPoint Power Up In Buy Zones Amid Volatile Stock Market

AEE

Investor's Business Daily

|

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite