|

|

|

|

|||||

|

|

Virtual healthcare and physician-focused digital platforms are reshaping U.S. healthcare delivery, with Hims & Hers Health, Inc. HIMS and Doximity, Inc. DOCS at the forefront. Hims & Hers operates a consumer-first platform that provides affordable, subscription-based access to licensed providers, personalized treatments and curated prescription and non-prescription products, spanning sexual health, mental wellness, dermatology and weight loss. Doximity, the leading digital network for U.S. medical professionals with over two million members, offers physician-centric tools that streamline workflows, support telehealth through its Dialer product and power AI-driven administrative efficiencies.

While HIMS emphasizes affordability and consumer health access, DOCS leverages its physician network and enterprise solutions. With both companies showing promise with rising digital health demand, the question arises: which stock is the better buy at this moment? Let's delve deeper.

HIMS (up 11.1%) has underperformed DOCS (up 21.8%) over the past three months. However, in the past year, Hims & Hers has rallied 208.8% compared with Doximity’s gain of 73.4%.

Meanwhile, HIMS is trading at a forward 12-month price-to-sales (P/S) ratio of 4.6, above its median of 2.5X over the past three years. DOCS’ forward sales multiple sits at 20.9X, above its last three-year median of 12.6X. While both HIMS and DOCS appear expensive when compared with the Medical sector average of 2.2X, HIMS seems to be less expensive. Currently, Hims & Hers has a Zacks Style Score with a Growth Score of A, while Doximity has a Zacks Style Score with a Growth Score of B.

Hims & Hers is actively diversifying its offerings, moving beyond core areas like sexual health and dermatology into weight loss, testosterone, and other chronic conditions. The rollout of generic semaglutide presents a meaningful opportunity to capture share in the fast-growing obesity treatment market. At the same time, international growth is accelerating, with the ZAVA acquisition strengthening its European footprint and plans to enter Canada in 2026. These moves broaden its total addressable market and highlight management’s ability to scale into categories with high demand.

HIMS is investing significantly in AI to enhance diagnostics, personalize treatments and streamline access to care. The appointment of Mo Elshenawy signals Hims & Hers’ commitment to becoming a technology-driven healthcare platform. By embedding AI into its infrastructure, the company aims to standardize high-quality care globally, making its services more scalable and efficient over time.

Hims & Hers’ upsized $870 million convertible notes offering underscores its ability to secure resources for long-term growth. Proceeds are earmarked for global expansion, targeted acquisitions and technology development, including AI and advanced diagnostics. This capital strength provides flexibility to pursue strategic opportunities while reinforcing investor confidence in its growth trajectory. Strong revenue performance further supports its disciplined approach to deploying capital.

Doximity continues to strengthen its position as the leading digital platform for U.S. medical professionals, with more than 80% of physicians active on its network. Engagement has reached record highs, with more than one million prescribers using the newsfeed and 630,000 prescribers leveraging workflow tools like Dialer and scheduling. This deep penetration creates a sticky ecosystem that attracts sustained adoption and supports recurring revenue growth.

AI is emerging as a critical growth driver. The launch of Doximity Scribe, which automates clinical note-taking, has seen strong physician adoption, with more than 75% of users returning weekly. The acquisition of Pathway further strengthens its AI suite, bringing one of the most advanced medical datasets and clinical reference tools into the platform. These offerings not only enhance productivity but also expand the platform’s value proposition to healthcare providers.

Doximity’s growth is also fueled by strong adoption among pharmaceutical and health system clients. Its expanding commercial product portfolio and data-driven client portal have driven upsells, particularly among SMB customers, contributing to broad-based growth. This combination of diversified revenue streams and long-term customer stickiness underpins both stability and scalability.

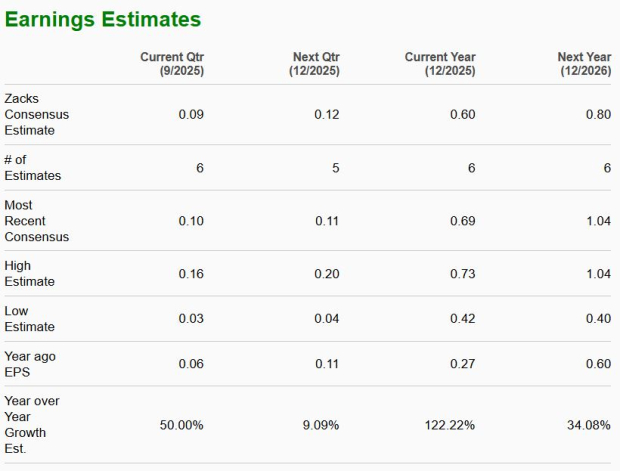

The Zacks Consensus Estimate for HIMS’ 2025 earnings per share (EPS) suggests a 122.2% improvement from 2024.

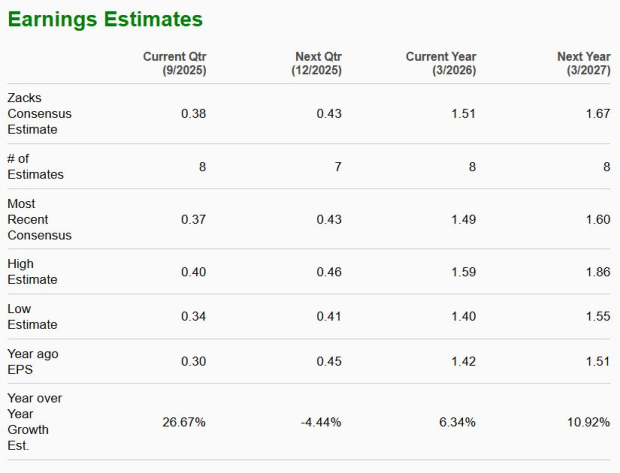

The Zacks Consensus Estimate for DOCS’ fiscal 2026 EPS implies an improvement of 6.3% from fiscal 2025.

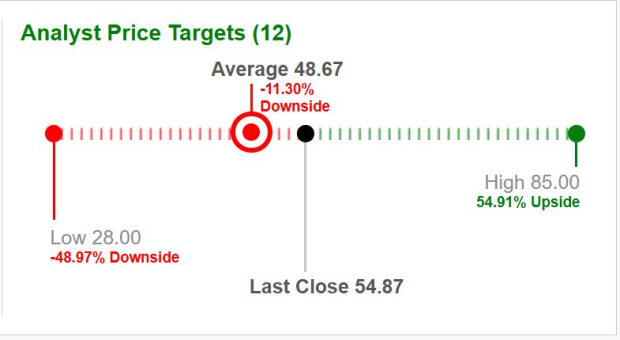

Based on short-term price targets offered by 12 analysts, the average price target for Hims & Hers comes to $48.67, implying a decline of 11.3% from the last close.

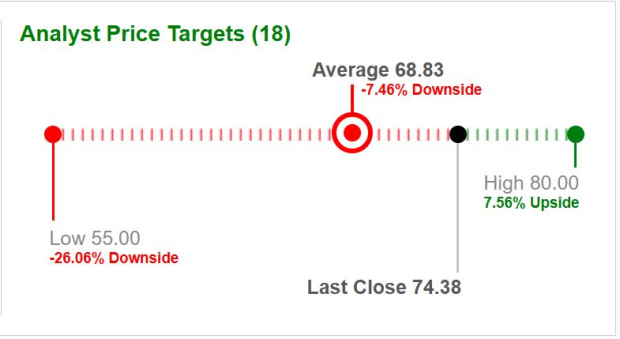

Based on short-term price targets offered by 18 analysts, the average price target for Doximity comes to $68.83, implying an increase of 7.5% from the last close.

While both Hims & Hers and Doximity are promising players in the physician-focused digital platform space, HIMS, a Zacks Rank #3 (Hold) firm, presents a more stable and financially sound investment opportunity at this stage. With strong profitability and margins along with consistently growing user engagement, Hims & Hers offers a capital-efficient model that generates substantial free cash flow and delivers steady returns. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Doximity, also a Zacks Rank #3 stock, is rapidly growing and expanding its clinical footprint. The company offers physician-centric tools that streamline workflows and support telehealth care, which looks promising. For investors seeking lower execution risk, financial predictability and a proven track record, Hims & Hers emerges as a more compelling choice. Also, the valuation ratio suggests that although both companies appear to be expensive, Doximity seems to be trading in the overpriced category at present. This presents another compelling reason for investors to favor Hims & Hers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 4 hours | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite