|

|

|

|

|||||

|

|

Hims & Hers Health, Inc.’s HIMS investors have been experiencing some short-term losses lately. The San Francisco, CA-based health and wellness platform’s stock has lost 39.2% compared with the industry’s 18.9% decline in the past three months. It has also underperformed the sector and the S&P 500’s gains of 7.6% and 4.1%, respectively, in the same time frame.

Two major recent developments of HIMS are its entry in Canada following the recent completion of its acquisition of Canadian digital health platform, Livewell, and its expansion in the U.K., which includes the official introduction of the Hers platform to enable eligible women across the U.K. receive access to its holistic weight management care (both in December 2025). The company also announced third-quarter 2025 results in November.

Hims & Hers posted a strong improvement in its top line during third-quarter 2025, supported by solid performance across both revenue channels. The quarter saw encouraging growth in subscribers as well as higher monthly online revenue per average subscriber. However, HIMS’ weak bottom-line performance in the third quarter was a setback. Additionally, the decline in both margins was unfavorable for the stock.

Over the past three months, the stock’s performance has remained weak, underperforming its peers like Teladoc Health, Inc. TDOC and Doximity, Inc. DOCS. Teladoc Health and Doximity’s shares have lost 14.5% and 35.9%, respectively, in the same time frame.

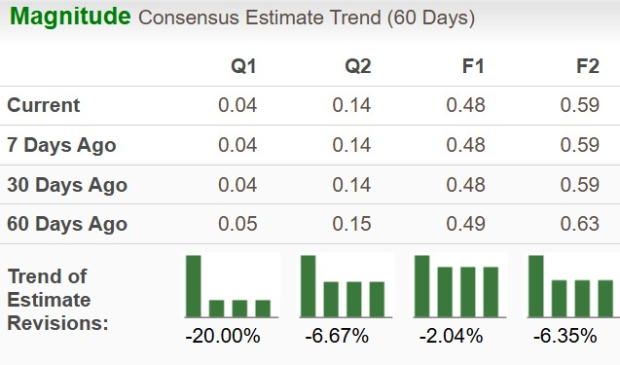

The Zacks Consensus Estimate for revenues for the first quarter and the full-year 2026 is currently pegged at $628.8 million and $2.76 billion, respectively, while the same for earnings per share is 14 cents and 59 cents.

Hims & Hers continues to depend heavily on marketing to drive customer acquisition, and that reliance can become a valuation pressure point when investors worry about efficiency. The company highlights that advertising costs can rise and campaign performance may fluctuate, meaning customer acquisition costs could increase and reduce the leverage expected from scale.

A second concern is the durability of subscriber behavior. While subscription revenue supports stability, the business remains exposed to churn and shifting consumer preferences. Hims & Hers notes that weaker retention, lower engagement, or changes in purchasing patterns could materially affect revenue growth, especially as it expands into newer categories.

Regulatory and supply sensitivities tied to personalized offerings add another layer of uncertainty. Hims & Hers acknowledges that certain customized and compounded products have contributed meaningfully to revenue. However, they introduce exposure to evolving regulations, product availability constraints and third-party dependencies that could disrupt momentum if conditions change.

HIMS’ acquisition-driven expansion introduces integration and forecasting risk. Recent deals, including its international expansion move, broaden its footprint but require smooth operational integration, alignment of systems and execution across new regions. Management also notes that elements of the purchase accounting for acquired businesses are still being finalized, which leaves room for later adjustments that can influence reported results and investor perception.

At the same time, internal execution pressure is heightened by financial reporting and compliance expectations that come with scaling. Hims & Hers has stated that its disclosure controls and procedures are not effective, and it continues to emphasize the need to improve internal processes as the organization grows. Even when operating performance remains strong, weaknesses in reporting and control systems can raise concerns about consistency, transparency and the ability to sustain rapid expansion without higher compliance costs or operational strain.

Hims & Hers shares are being supported by accelerating international expansion, as the company continues to widen its addressable market beyond the United States. It has officially entered Canada following its acquisition of Livewell, describing the move as a step toward offering more affordable, personalized care to a broader population, with a focus on scaling access through digital-first delivery. Management also highlighted the opportunity to build deeper local execution by bringing Livewell’s founder into a leadership role, signaling an intent to establish a stronger presence and expand its playbook in a new geography.

A second factor is HIMS’ push to deepen its platform through diagnostics and technology-led care, aimed at making the ecosystem more comprehensive and data-driven. The launch of Labs broadens Hims & Hers’ preventive health offering by giving customers an in-depth testing experience paired with simplified results, doctor-developed action plans and pathways into personalized treatments. In parallel, the planned acquisition of YourBio will add patented, virtually painless blood-sampling technology designed to modernize blood collection and strengthen internal innovation — supporting a more seamless end-to-end experience across testing, insights and ongoing care.

HIMS’ forward 12-month P/S of 2.9X is lower than the industry’s average of 4.9X but is higher than its three-year median of 2.6X.

Teladoc Health and Doximity’s forward 12-month P/S currently stand at 0.5X and 12.5X, respectively.

Estimates for Hims & Hers’ 2026 earnings per share (EPS) have moved 6.4% south to 59 cents in the past 60 days.

Estimates for Teladoc Health’s 2026 loss per share have widened from 82 cents to 84 cents in the past 60 days.

Estimates for Doximity’s fiscal 2026 EPS have moved a penny north to $1.56 in the past 60 days.

There is no denying that Hims & Hers is well-positioned in terms of its expanding care ecosystem and global opportunities, supported by its official entry into Canada following the Livewell acquisition and the launch of the Hers platform in the U.K. to broaden access to holistic weight management care. However, holding on to this Zacks Rank #4 (Sell) company at present does not seem prudent, as near-term pressure is building from its weak bottom-line performance and declining margins, along with sustainability concerns tied to heavy marketing dependence, customer acquisition efficiency and potential churn. Regulatory and supply sensitivities around customized and compounded offerings also add uncertainty, while acquisition-driven expansion introduces integration and reporting-control risks that could weigh on sentiment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Meanwhile, the valuation indicates superior performance expectations compared with its industry peers. It is still valued lower than the industry, which suggests potential room for growth if it can align more closely with overall market performance. The favorable Zacks Style Score with a Growth Score of A suggests turnaround potential for HIMS.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite