|

|

|

|

|||||

|

|

Earlier this week, President Trump announced a wide range of reciprocal tariffs, sparking another round of selling pressure and a leg lower in the stock market.

Markets had initially grinded higher in the days leading up to Trump’s tariff reveal. But that positive momentum reversed course as Trump imposed a baseline 10% tariff rate, with additional tariffs added for countries that the administration considers to be the worst offenders.

It’s clear that markets were not expecting such surprisingly steep tariffs, prompted by what economists are saying is the heaviest tariff policy on US imports in at least a century. The market is attempting to price in a potentially long, drawn out tariff war.

Through it all, the most important thing for us to do is to manage risk effectively. We should be targeting stocks that are leaders in this environment, not chasing stocks that have entered downtrends.

We’ve undoubtedly witnessed a defensive rotation in 2025. Utilities are one group that tend to hold up better during market corrections, and we’re seeing that play out again this year.

American Electric Power AEP shares have outperformed the market by a wide margin so far this year. The company is part of the Zacks Utility – Electric Power industry group, which currently ranks in the top 28% out of more than 250 Zacks Ranked Industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform the market over the next 3 to 6 months.

Not only has this group outperformed the market over the past year, it is also up nearly 7% in 2025. We can see how stocks in this group have diverged from the general market:

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its sector and industry group combination. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1.

American Electric Power stock is hitting a series of 52-week highs on increasing volume. While there are many ways to take advantage of this bullish move, options provide us with flexibility, enabling us to tailor our strategy to the current market environment.

Before we analyze today’s trade, let’s review some option fundamentals as a refresher. There is no need to worry about complex mathematical formulas or equations. Over the years I’ve found that the more complicated a strategy is, the less likely it is to work over the long run.

Options are standardized contracts that give the buyer the right – but not the obligation – to buy or sell the underlying stock at a fixed price, which is known as the strike price. A call option gives the buyer the right to buy a particular security, while a put option gives the buyer the right to sell the same. The investor who purchases an option, whether a put or call, is the option buyer, while the investor who sells a put or call is the seller or writer.

These contracts are valid for a specific period of time which ends on expiration day. There are weekly options, monthly options, and even LEAPS options which are longer-term options that have an expiration date of greater than one year.

Options consist of time value and intrinsic value. In-the-money options consist of both components; at-the-money and out-of-the-money options consist only of time value. At options expiration, options lose all time value.

Below we’re going to explore a call option purchase strategy.

American Electric Power is in a price uptrend and is a good candidate for a call option purchase:

When done correctly, trading options provides huge profit opportunities with limited risk.

In today’s trade, we’re going to target the May 16th expiration date and the 90-strike price. Purchasing this option gives us the right, but not the obligation, to buy 100 shares of AEP stock at $109.76 on or before May 16th, which is a bit over 1 month from now.

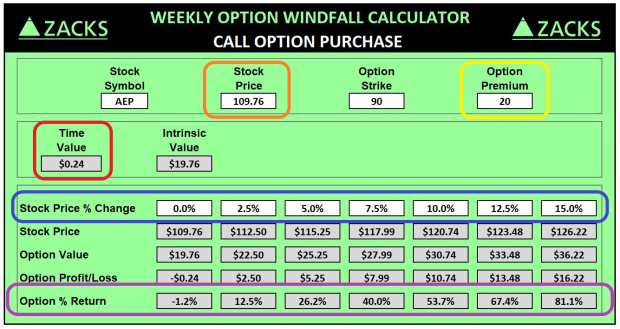

The table below displays the risk/reward profile for this trade. American Electric Power stock is currently trading at $109.76 (orange box). We are purchasing 1 May 16 90-strike call at 20 points, which is the option premium. Since options account for 100 shares of the underlying stock, the total cost for this call option trade is $2,000 as we can see in the yellow highlighted box.

The top (blue) row shows the performance of AEP stock based on different percentage scenarios at expiration. The bottom (purple) row shows the corresponding percentage return for our call option trade. We can see that if AEP remains flat, this trade would encounter a minor loss of 1.2%. If AEP moves up 5%, this trade will realize a 26.2% profit. If AEP advances 15%, we would realize an 81.1% profit.

This illustration shows the inherent leverage that options provide. A stock investor who bought 100 shares of AEP would have to contribute $10,976 which is a bigger investment. A 15% increase in the stock price would yield a $1,646 profit.

On the other hand, in this example the option trader only needs to contribute $2,000 to control the same amount of underlying AEP shares. A 15% move in AEP stock would net a $1,622 option profit – a nearly identical profit amount with less than one-fifth of the investment!

Also note that this option contains relatively little time value. The 0.24 points worth of time value (red box) equate to just 0.2% of the underlying stock price. A good way to manage risk when buying call options is to minimize time value and maximize intrinsic value, as time value decays rapidly in the days leading up to option expiration.

With American Electric Power displaying signs of outperformance, the stage is set for AEP stock to continue its bullish run. A durable backing from the utilities sector should help push shares to new heights.

A great way to take advantage of this move is via low-risk call options. This allows us to leverage American Electric Power stock returns with the power of options. Be sure to keep track of how AEP stock performs as we move further into 2025.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite