|

|

|

|

|||||

|

|

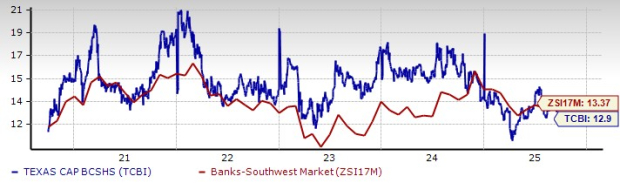

Over the past six months, shares of Texas Capital Bancshares, Inc. TCBI have appreciated 15.8% compared with the industry’s growth of 9%. The stock also outperformed its peers, BOK Financial Corporation BOKF and Cullen/Frost Bankers, Inc. CFR, which rallied 8.4% and 3.0%, respectively, in the same period.

Next, let’s examine the main factors likely to drive additional momentum for TCBI stock.

Fed’s Rate Cuts to Support NII: On Sept. 17, 2025, the Federal Reserve reduced rates by 25 basis points and signaled the possibility of additional cuts by the year-end. Lower policy rates are expected to encourage borrowing activity and support the net interest income (NII) growth for banks such as Texas Capital, BOK Financial and Cullen/Frost.

Coming back to TCBI, its NII has shown steady improvement, with a three-year compound annual growth rate (CAGR) of nearly 1% from 2021 to 2024. In the first half of 2025, NII rose 13.4% year over year, driven primarily by higher average earning assets and lower funding costs, partially offset by an increase in average interest-bearing liabilities. Thus, considering these trends, along with the ongoing impact of Fed rate cuts, is likely to support NII growth through the remainder of 2025.

Strategic Expansion to Drive Growth: Texas Capital has been steadily executing its 2021 strategic plan aimed at improving operating efficiency and expanding its business verticals. As part of this initiative, in September 2024, the company acquired a portfolio with approximately $400 million in committed exposure to healthcare companies, enhancing its corporate banking and healthcare segment.

Additionally, the company continues to develop its investment banking capabilities, building a base of consistent and repeatable revenues that differentiates it in the marketplace and contributes meaningfully to future earnings. It is also implementing technology-enabled process innovations designed to enhance customer experiences, mitigate operational risk and achieve structural efficiencies.

Furthermore, expansion efforts include the establishment of Texas Capital Securities Energy Equity Research and the launch of Texas Capital Direct Lending, which broadens service offerings and strengthens revenue potential. Collectively, these initiatives are expected to reduce non-interest expenses in the coming period, positioning TCBI for sustained long-term growth.

Steady Loan Growth: The company’s loan balance reflected the strength of its relationship-based business model in recent years. Over the past three years (2021–2024), TCBI’s average loan portfolio has increased at a CAGR of 4%. As of June 30, 2025, total average loans for investment increased 6.9% sequentially to $23.6 billion. The company’s focus on middle-market business clients and high-net-worth individuals across major Texas metropolitan areas is expected to support further expansion in both commercial and real estate lending, providing a solid foundation for future growth.

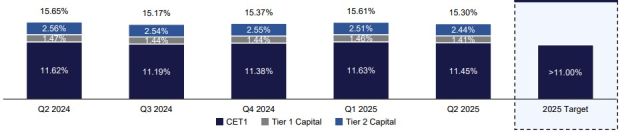

Strong Liquidity and Capital Position: TCBI continues to demonstrate financial resilience, underpinned by ample liquidity and manageable debt levels. As of June 30, 2025, the company held $2.69 billion in liquid assets. Its total debt stood at $1.87 billion during the same time frame.

The company’s capital ratios further underscore its resilience, with a total capital ratio of 15.3% and a common equity tier 1 (CET1) ratio of 11.4%, both of which are comfortably above regulatory requirements. Management expects CET1 to increase by more than 11% by the end of 2025, providing additional flexibility for growth and shareholder returns. With a robust liquidity position and a strong capital base, Texas Capital is well-positioned to sustain its operations, pursue growth initiatives and navigate potential economic challenges.

Robust Capital Distribution: The company’s focus on maintaining strong capital levels supports its share repurchase program. On Jan. 22, 2025, the company’s board of directors authorized a share repurchase program allowing the buyback of up to $200 million of outstanding common stock through Jan. 31, 2026. As of June 30, 2025, approximately $148 million remained available under this plan. Supported by strong capital levels and ample liquidity, Texas Capital’s share repurchase program is sustainable and underscores the company’s commitment to delivering shareholder value.

Rising Non-Interest Expenses: Texas Capital has experienced a persistent increase in non-interest expenses over the past few years, with a CAGR of 42.2% from 2020 to 2024, driven primarily by investments in technology and process improvements aimed at enhancing efficiency and customer experience. The rising trend of expenses continues in the first half of 2025. While these initiatives are likely to support long-term growth, the rising expense levels are expected to constrain near-term bottom-line expansion, particularly in the second half of 2025.

Credit Quality Concerns: Deterioration in credit quality continues to pose a challenge for Texas Capital. The non-performing assets and net charge-offs (NCOs) recorded a three-year CAGR of 15.3% and 46.8%, respectively, during 2021-2024. Further, both the metrics continue to increase in the first half of 2025. Rising criticized assets, especially in multi-family and office real estate loans, are likely to keep asset quality pressures elevated in the near term, potentially impacting financial performance.

The company faces near-term headwinds from rising non-interest expenses, increasingly criticized assets and elevated NCOs, which could pressure margins and asset quality in the short term.

From a valuation perspective, TCBI shares are trading at a forward price-to-earnings (P/E) ratio of 12.9X, which is below the industry average of 13.37X.

On the other hand, BOK Financial and Cullen/Frost are trading at 12.86X and 13.54X, respectively.

Nevertheless, TCBI is likely to benefit from steady NII growth, strategic expansion across corporate banking, investment banking and treasury solutions and the ongoing impact of Fed rate cuts. Strong liquidity, robust capital ratios and a sustainable share repurchase program further position the bank for long-term growth.

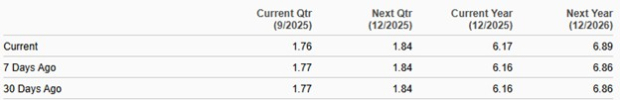

Over the past month, the Zacks Consensus Estimate for 2025 earnings has been revised upward.

The expected estimates imply growth of 39.3% and 11.8% for 2025 and 2026, respectively.

Hence, investors can consider TCBI stock at its current level, given its potential upside to generate healthy long-term returns.

The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 10 hours | |

| 13 hours | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite