|

|

|

|

|||||

|

|

Lamb Weston Holdings, Inc. (LW) reported solid first-quarter fiscal 2026 results, wherein both top and bottom lines beat the Zacks Consensus Estimate. While net sales increased, earnings decreased from the year-ago period’s actuals.

LW’s adjusted earnings were 74 cents per share, beating the Zacks Consensus Estimate of 54 cents. The decrease of 5% was due to elevated income tax expense and reduced equity method investment earnings, partially offset by increased adjusted income from operations.

Net sales amounted to $1,659.3 million, beating the Zacks Consensus Estimate of $1,616 million. The top line increased $5.2 million year over year.

Lamb Weston price-consensus-eps-surprise-chart | Lamb Weston Quote

On a constant-currency basis, sales dipped 1%, as solid 6% volume growth was outweighed by a 7% drop in price/mix. Volume growth was driven by customer wins and retention, particularly in North America and Asia, and the lapping of a $15 million charge in the last quarter related to a voluntary product withdrawal.

The decline in price/mix reflected the carryover impact of fiscal 2025 price and trade investments to support customers, ongoing price and trade support, and negative channel product mix across segments.

Adjusted gross profit fell $14.2 million from the prior year, landing at $338.9 million, with weaker price/mix serving as the main drag. This headwind was partially offset by elevated sales volumes, reduced manufacturing costs per pound resulting from cost savings initiatives, and the benefit of lapping a $39 million charge in the prior year related to a voluntary product withdrawal.

Adjusted selling, general and administrative (SG&A) expenses fell $24 million year over year, totaling $132.4 million, supported by cost-savings measures and $7.3 million in miscellaneous income, largely from an insurance recovery and property tax refunds.

Adjusted EBITDA rose $2.8 million year over year, reaching $302.2 million. This growth was driven by reduced adjusted SG&A expenses, partially offset by a decline in adjusted gross profit and equity method investment earnings (loss).

Net sales for the North America segment, which covers customers in the United States, Canada and Mexico, were down 2%, reaching $1,084.6 million compared with the prior-year quarter. Volume rose 5%, driven by recent customer contract wins and broad-based growth across channels.

The price/mix of the segment fell 7%, reflecting the carryover impact of fiscal 2025 price investments, ongoing customer support through price and trade, and negative channel mix. The North America segment’s adjusted EBITDA declined by $18 million to $260 million.

Net sales for the International segment, which includes all customers outside North America, grew 4% to $574.7 million, including a favorable $24.5 million from foreign currency translation. At constant currency, net sales were flat. Volume grew 6%, driven by strength in Asia and with multinational chain customers.

The price/mix of the segment declined 6% due to investments to support customers and ongoing price and trade support. International segment adjusted EBITDA rose by $5.8 million to $57.2 million.

The company ended the quarter with cash and cash equivalents of $98.6 million, long-term debt and financing obligations (excluding the current portion) of $3,670.9 million and total shareholders’ equity of $1,789.8 million.

The company generated $352 million as net cash from operating activities for the 13 weeks ending Aug. 24, 2025, wherein capital expenditures, net of proceeds from blue chip swap transactions, amounted to $79.2 million.

In the first quarter of fiscal 2026, Lamb Weston returned $51.7 million to its shareholders through cash dividends. The company repurchased 187,259 shares of its common stock for $10.4 million under its share repurchase program. Approximately $348 million remains authorized and available for future repurchases.

Lamb Weston also declared a quarterly dividend of 37 cents per share, payable on Nov. 28, 2025, to its stockholders of record as of Oct. 31.

The company expects net sales at constant currency in the range of $6.35 billion to $6.55 billion and adjusted EBITDA of $1.00 billion to $1.20 billion. Capital expenditures are expected to total approximately $500 million.

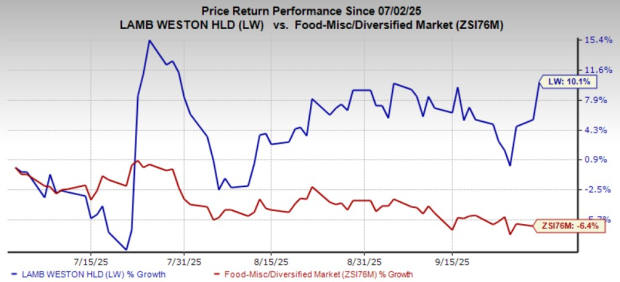

Shares of this Zacks Rank #3 (Hold) company have gained 10.1% in the past three months against the industry’s 6.4% decline.

Celsius Holdings, Inc. (CELH) develops, processes, manufactures, markets, sells and distributes functional energy drinks. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings indicates growth of 77.7% and 54.3%, respectively, from the prior-year levels. CELH delivered a trailing four-quarter earnings surprise of 5.4%, on average.

Laird Superfood, Inc. (LSF) manufactures and markets plant-based, natural and functional food in the United States. It has a Zacks Rank #2 (Buy) at present. LSF delivered a trailing four-quarter earnings surprise of 11.3%, on average.

The Zacks Consensus Estimate for Laird Superfood’s current fiscal-year sales and earnings indicates growth of 21% and 23.8%, respectively, from the prior-year levels.

Smithfield Foods, Inc. (SFD) produces packaged meats and fresh pork in the United States and internationally. It holds a Zacks Rank #2 at present. SFD delivered a trailing four-quarter earnings surprise of 6.6%, on average.

The Zacks Consensus Estimate for Smithfield Foods’ current fiscal-year sales and earnings indicates growth of 7.1% and 28.7%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite