|

|

|

|

|||||

|

|

Pfizer PFE recently announced a landmark deal with the Trump administration. Per the deal, Pfizer committed to key measures aimed at lowering prescription drug costs while boosting investment in U.S.-based innovation and manufacturing.

As part of the deal, Pfizer will slash prices of some of its drugs to align their cost with those in comparable developed countries, supporting President Trump’s Most Favored Nation (MFN) pricing proposal. The company will also offer significant discounts—up to 85%, averaging 50%—on key treatments through the new direct purchasing platform, TrumpRx.gov.

In exchange, Pfizer will receive a three-year exemption from tariffs on pharmaceutical imports if it increases U.S. manufacturing investment. To that end, Pfizer has committed an additional $70 billion over the coming years to strengthen its U.S. research and production footprint.

Pfizer stock is up almost 14% as the drug pricing deal seems to have alleviated the two biggest concerns surrounding the drug and biotech industry this year – tariff and MFN pricing. Stocks of most other large drugmakers like Merck, AstraZeneca AZN, AbbVie ABBV and Eli Lilly LLY, among others, gained too as these drugmakers could be the next in line to sign similar deals with the Trump administration. Many of the large drugmakers have already committed to investing billions to boost domestic investments.

However, does the latest price increase make Pfizer’s stock a buy? It is important to understand Pfizer’s strengths and weaknesses to better analyze how to play the stock rather than decide the investment approach on the basis of one significant deal.

Pfizer is one of the largest and most successful drugmakers in oncology. The addition of Seagen strengthened its position in oncology.

Its oncology revenues are rising, driven by drugs like Xtandi, Lorbrena, the Braftovi-Mektovi combination and Padcev. Its oncology revenues grew 9% in the first half of 2025.

Pfizer has ventured into the oncology biosimilars space and markets six biosimilars for cancer. Pfizer also advanced its oncology clinical pipeline with several candidates entering late-stage development, like sasanlimab, vepdegestrant and sigvotatug vedotin. By 2030, it expects to have eight or more blockbuster oncology medicines in its portfolio.

Pfizer is also working on expanding the labels of its approved products (oncology as well as non-oncology) like Padcev, Adcetris, Litfulo, Nurtec, Velsipity and Elrexfio, among others.

Pfizer’s non-COVID operational revenues are improving, driven by its key in-line products like Vyndaqel, Padcev and Eliquis, new launches and newly acquired products like Nurtec and those from Seagen (December 2023). Pfizer's recently launched and acquired products delivered $4.7 billion in revenues in the first half of 2025, up approximately 15% operationally versus last year.

Continued growth of Pfizer’s diversified portfolio of drugs, particularly oncology, should support top-line growth in 2025.

Pfizer’s new products/late-stage pipeline candidates and newly acquired products, including those acquired from Seagen, position it strongly for operational growth in 2025 and beyond. Pfizer expects the 2025 to 2030 revenue CAGR to be approximately 6%.

Pfizer expects the acquisition of Seagen to contribute more than $10 billion in 2030 risk-adjusted revenues with potential significant growth beyond 2030.

With the end of the pandemic, sales of Pfizer’s COVID products, Comirnaty and Paxlovid, came down to around $11 billion in 2024 from $56.7 billion in 2022. Though sales of Paxlovid and Comirnaty have stabilized in 2025 after declining significantly in the past two years, their sales are usually weighted toward the second half of the year and are difficult to estimate as they depend on infection rates. There is an element of uncertainty related to COVID sales, and they may decline further in future years.

Though Pfizer expects a moderate negative impact on revenues from the loss of exclusivity (“LOE”) in 2025, the impact is expected to be significant in the 2026-2030 period as several of its key products, including Eliquis, Vyndaqel, Ibrance, Xeljanz and Xtandi, will face patent expirations.

Pfizer expects an unfavorable impact of approximately $1 billion from the Medicare Part D redesign under the IRA, which took effect in the first quarter of 2025. Higher-priced drugs, including Vyndaqel, Ibrance, Xtandi and Xeljanz, are most affected by the IRA.

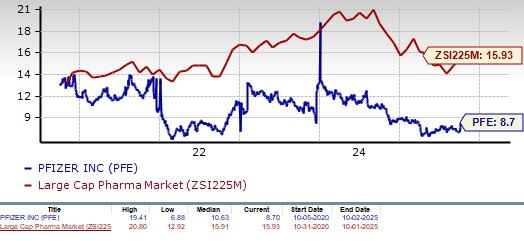

Pfizer’s stock has risen 2.1% so far this year compared with an increase of 8.3% for the industry.

From a valuation standpoint, Pfizer appears attractive relative to the industry and is trading below its 5-year mean. Going by the price/earnings ratio, Pfizer’s shares currently trade at 8.70 forward earnings, significantly lower than 15.93 for the industry as well as the stock’s 5-year mean of 10.63. The stock is also much cheaper than other large drugmakers like AbbVie, Novo Nordisk, Eli Lilly, AstraZeneca, J&J and others.

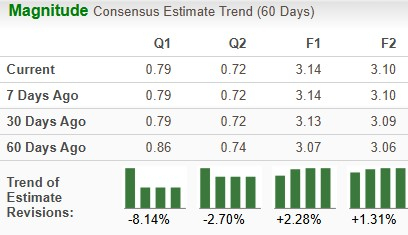

The Zacks Consensus Estimate for earnings has risen from $3.07 per share to $3.14 per share for 2025, while that for 2026 has increased from $3.06 per share to $3.10 per share over the past 60 days.

Pfizer faces its share of challenges, including COVID-19 product-related uncertainty, U.S. Medicare Part D headwinds and the upcoming LOE cliff in the 2026-2030 period. However, with COVID-related uncertainties diminishing, its revenue volatility is declining. Pfizer’s key drugs like Vyndaqel, Padcev and its recently launched and acquired products should help the company largely offset its LOEs over the next several years.

Pfizer expects cost cuts and internal restructuring to deliver savings of $7.7 billion by the end of 2027. Though Pfizer does not expect strong top-line growth over the next three years due to the LOEs, it expects EPS growth. Pfizer’s dividend yield stands at around 7%, which is impressive.

Last month, Pfizer also announced a definitive agreement to acquire obesity drug developer, Metsera, to re-enter the lucrative obesity space after it scrapped the development of danuglipron, a weight-loss pill, earlier this year.

Investors should continue to retain this Zacks Rank #3 (Hold) stock in their portfolio as it appears to have significant upside potential. The latest drug pricing deal somewhat removes a significant overhang facing Pfizer and the pharma industry at large. Investors with a long-term horizon may consider investing in this stock due to its cheap valuation, high dividend yield, rising estimates, recent stock price appreciation and significant growth prospects.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite