|

|

|

|

|||||

|

|

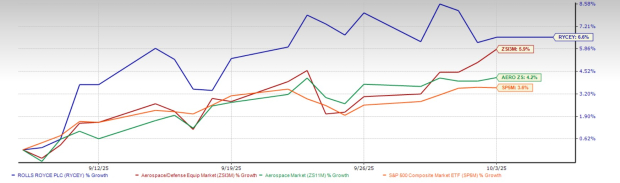

Shares of Rolls-Royce Holdings plc RYCEY have surged 6.6% in the past month, outperforming both the Zacks Aerospace-Defense Equipment industry’s growth of 5.9% and the broader Zacks Aerospace sector’s gain of 4.2%. It also came above the S&P 500’s return of 3.6% in the same time frame.

Other industry players, such as Rocket Lab USA, Inc. RKLB and Curtiss-Wright Corp. CW, have also delivered a similar stellar performance in the past month. Shares of RKLB and CW have risen 17.6% and 11.1%, respectively, in the said period.

With RYCEY’s strong outperformance, some investors may be eager to buy the stock right away. However, before making this decision, it is essential to verify whether the company’s fundamentals can sustain long-term growth or if the recent rise is merely temporary. Understanding RYCEY’s growth potential and related risks is essential for making a well-informed investment choice.

RYCEY’s latest robust performance on the bourses seems to have been influenced by the following developments:

In September 2025, Rolls-Royce, together with Landmark and ASCO, commissioned a 10-megawatt gas engine power plant with a carbon capture system in the East Midlands region of the United Kingdom. In the same month, Lithuanian energy supplier Ignitis Group chose Rolls-Royce to provide large-scale battery storage systems from its mtu EnergyPack brand. The order includes systems with a total storage capacity of 582 megawatt hours and an output of 291 megawatts. These developments should bolster RYCEY’s position as a technology company contributing to sustainable energy.

Additionally, the company introduced the mtu 12V2000Z engine with 2222 horsepower and launched the mtu NautIQ Bridge system for yachts between 30 and 40 metres in length. It also presented a new flexible exhaust aftertreatment system for its mtu 4000 series engines and a fuel-efficient POD drive. These additions are expected to strengthen Rolls-Royce’s position in the marine market and support future growth.

Looking ahead, Rolls-Royce seems well-placed to maintain its growth in the coming years, supported by strong demand across its key business areas, which include Civil Aerospace, Defence and Power Systems.

In the Civil Aerospace segment, the company continues to benefit from higher global air travel and the need for fuel-efficient aircraft. Its Trent XWB, Trent 1000 and Trent 7000 engines power major aircraft such as the Airbus A350, Boeing 787 and Airbus A330. The recent improvements made by Rolls-Royce to extend engine life by 30% are expected to increase its aftermarket revenues and support long-term cash generation. With an order backlog of more than 2,000 widebody engines (as of July 2025), Rolls-Royce has good visibility for future growth.

Its Defence business is also expected to perform well as global defense spending increases. Rolls-Royce engines, including the EJ200 for the Eurofighter Typhoon and the AE series for transport aircraft, continue to see strong demand.

In September 2025, Rolls-Royce strengthened its partnership with Avio Aero and IHI to develop the next-generation fighter engine under the Global Combat Air Programme. This initiative reinforces Rolls-Royce’s commitment to advancing future combat air propulsion technology.

In the Power Systems division, Rolls-Royce is expanding in clean energy and energy storage. Its focus on hydrogen-powered engines, sustainable aviation fuel and small modular reactors supports the global shift toward cleaner energy. The selection of its small modular reactor technology by Great British Nuclear and the large battery storage orders (in June 2025) show the growing strength of this segment.

Overall, steady orders, ongoing innovation and a strong presence across several growing industries are likely to help Rolls-Royce maintain its positive momentum and achieve sustainable growth in the long term.

Let’s check below how the company is expected to perform in the near term.

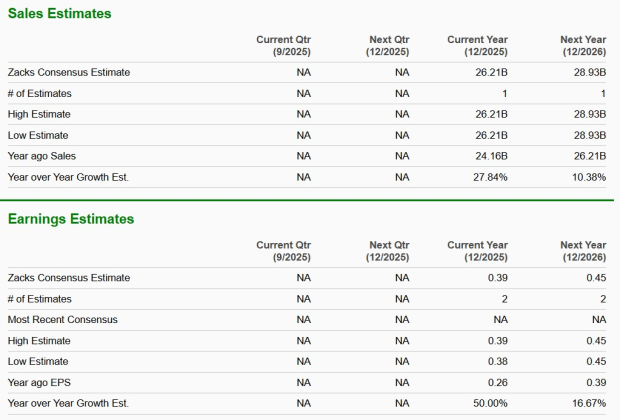

The Zacks Consensus Estimate for 2025 sales implies year-over-year growth of 27.8%, while that for 2026 sales indicates an improvement of 10.4%.

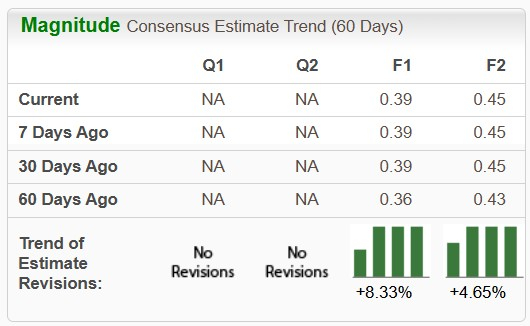

The Zacks Consensus Estimate for 2025 and 2026 earnings indicates year-over-year growth of 50% and 16.7%, respectively.

Further, the upward revision in its 2025 and 2026 earnings estimates over the past 60 days suggests investors’ increasing confidence in this stock’s earnings generation capabilities.

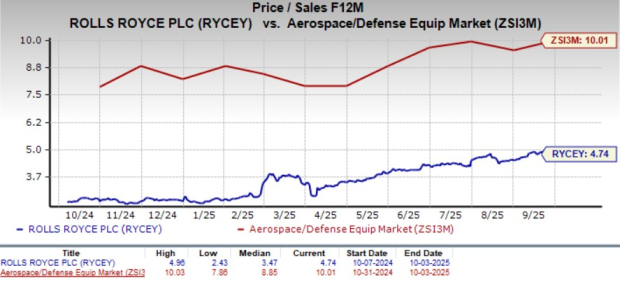

In terms of valuation, RYCEY’s forward 12-month price-to-sales (P/S) is 4.74X, a discount to the industry average of 10.01X. This suggests that investors will be paying a lower price than the company's expected sales growth compared with its industry average.

Other industry peers, on the contrary, are trading at a premium to RYCEY. While RKLB is trading at a forward 12-month P/S of 34.58X, CW is trading at 5.65X.

Aerospace and defense companies such as RYCEY, CW and RKLB continue to face several industry-specific challenges, including supply-chain pressures caused by shortages of raw materials, logistical difficulties and delays in the availability of engine parts and components. These ongoing issues have significantly affected Rolls-Royce’s engine production and maintenance schedules and are expected to remain a challenge for the company over the coming few months.

Another near-term challenge for Rolls-Royce is the recent implementation of tariffs by the U.S. administration on imported goods. Although Rolls-Royce engines are currently exempt, any sudden policy change by President Trump could have an impact on the company. Additionally, the automotive division, particularly the Rolls-Royce Motor Cars plant in Goodwood, which produces luxury vehicles mainly for export, could face difficulties if new U.S. tariffs are imposed on imported vehicles.

To conclude, investors considering RYCEY stock may want to include it in their portfolio, given its attractive valuation, strong market performance, promising long-term growth prospects, upward earnings revisions and positive near-term sales outlook.

RYCEY currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Howmet Aerospace Pops. Earnings, Upgrade Fuel Bullish Defense Surge.

CW +5.80%

Investor's Business Daily

|

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite