|

|

|

|

|||||

|

|

Palo Alto Networks PANW and Qualys QLYS are both at the forefront of the cybersecurity space, playing key roles in guarding organizations from extensive cyberattacks. While Palo Alto Networks focuses broadly on next-generation firewalls, cloud security and AI-driven threat detection, Qualys serves a niche space involving vulnerability management and compliance monitoring. Both players are taking active roles in enabling enterprises against cloud and endpoint security.

Palo Alto Networks and Qualys are riding the key industry trends, driven by the mounting incidents of credential theft, remote desktop protocol breaches and social engineering-based strikes by malicious actors. Per a Mordor Intelligence report, the cybersecurity space is expected to witness a CAGR of 12.45% from 2025 to 2030.

With this strong growth forecast for the cybersecurity market, the question remains: Which stock has more upside potential? Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which offers a more compelling investment case.

Palo Alto Networks remains a cybersecurity leader, offering solutions for network security, cloud security and endpoint solutions for customers who need full enterprise security support. Its next-generation firewalls and advanced threat detection technologies are widely recognized and adopted globally.

Palo Alto Networks’ wide range of innovative products, strong customer base and growing opportunities in areas like Zero Trust, Secure Access Service Edge (SASE) and private 5G security continue to support its long-term growth potential. Palo Alto Networks’ ongoing technology advancements make it a compelling long-term investment.

For example, in the fourth quarter of fiscal 2025, SASE was Palo Alto Networks’ fastest-growing segment, with SASE Annual recurring revenues increasing 35% year over year. Palo Alto Networks also won its largest SASE contract ever with a global professional services firm, worth $60 million, spanning 200,000 users. Its Prisma Access Browser also gained adoption, adding more than three million licenses in the fourth quarter, which grew twofold on a sequential basis, pushing the total above six million.

However, Palo Alto Networks is encountering some near-term challenges. The company is experiencing shortened contract durations and a slowdown in the transition to Palo Alto Networks’ cloud-based AI-powered platforms from its legacy platforms. Moreover, PANW’s $1 million-plus deals are shifting from multi-year payments to annual payments, resulting in a shorter sales cycle and affecting top-line stability.

This can cause a deceleration in Palo Alto Networks’ top-line growth. Notably, the company’s revenue growth rate has been in the mid-teen percentage range over the past year, a sharp contrast from the mid-20s percentage in fiscal 2023. In the financial results for the fourth quarter of fiscal 2025, its sales and non-GAAP EPS grew 16% and 27%, respectively, year over year. The Zacks Consensus Estimate for both fiscal 2026 and 2027 revenues indicates a year-over-year increase of approximately 13.1%. The consensus mark for fiscal 2026 and 2027 EPS indicates year-over-year growth of mid-teens percentage.

Palo Alto Networks, Inc. price-consensus-eps-surprise-chart | Palo Alto Networks, Inc. Quote

Qualys is the leading provider of Vulnerability Management, Detection and Response (VMDR) solutions, and has been witnessing increased VMDR customer penetration for the past several quarters. Qualys continues to expand its customer base, with customers spending more than $500,000 annually, increasing 7% year over year to 212 in the second quarter of 2025. Also, its net dollar retention rate improved to 104% from 103% in the previous quarter.

Qualys has increased the depth of its portfolio with multiple product launches and enhancements, including the industry’s first Risk Operations Center with Enterprise TruRisk Management. Qualys also expanded its TotalAI solution with advanced AI security capabilities to extend threat coverage, provide multi-modal protections, and enable internal Large Language Model scanning, helping organizations secure their Machine Learning Operations pipeline.

Qualys’ channel partner program, which involves expanding its cloud-based security solutions through a network of partners, including Managed Service Provider , Managed Security Service Provider and Value-Added Resellers, has been able to increase its revenues much faster than direct customers. In the second quarter of 2025, channel revenues grew 17% year over year compared with 4% growth from direct customers.

Qualys is expanding globally with an international revenue growth rate of 15% year over year, representing 43% of total revenues in the latest quarter. This organic expansion is enabling it to gain more customers and market share without acquisition costs.

These factors are driving growth in Qualys’ top and bottom lines. In the second quarter, Qualys’ sales and non-GAAP EPS grew 10% and 11%, respectively, year over year. The Zacks Consensus Estimate for 2025 and 2026 revenues indicates a year-over-year increase of approximately 8.1% and 6.5%, respectively. The consensus mark for 2025 and 2026 EPS indicates year-over-year growth of 4.4% and 5.1%, respectively.

Qualys, Inc. price-consensus-eps-surprise-chart | Qualys, Inc. Quote

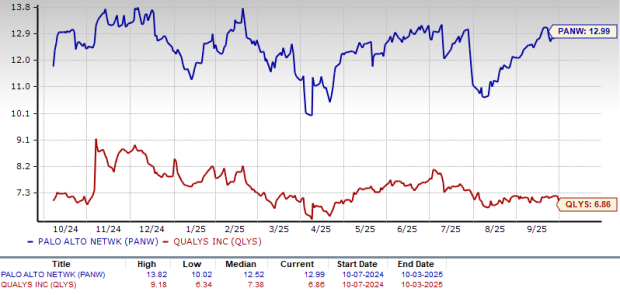

Year to date, Palo Alto Networks shares have appreciated 13.9%, while Qualys shares have lost 6.5%.

However, on the valuation front, Qualys looks more attractive than Palo Alto Networks. Currently, QLYS trades at a forward 12-month sales multiple of 6.86X, significantly below PANW’s 12.99X.

Both Palo Alto Networks and Qualys are key players in the cybersecurity space, but Palo Alto Networks is facing near-term challenges, including shortened contract durations and slowing sales growth. Additionally, Qualys is trading at a discount in comparison to Palo Alto Networks, making the stock more attractive at present.

Currently, Qualys flaunts a Zacks Rank #1 (Strong Buy), making the stock a must-pick compared to Palo Alto Networks, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Palo Alto Networks Stock Drops After Earnings; CEO Questions AI Fears

PANW -6.82%

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite