|

|

|

|

|||||

|

|

Investors, especially traders, are familiar with Reddit RDDT and have helped increase the social media company’s popularity by engaging in its infamous community-led platforms, such as WallStreetBets, which has been instrumental in creating the meme stock phenomenon.

We can all recount some of the most famous meme stocks that often surge due to heightened popularity on Reddit, with GameStop GME and AMC Entertainment AMC coming to mind.

Over the years, this attention has made Reddit one of the fastest-growing media outlets, given its niche as a destination for meaningful social news aggregation.

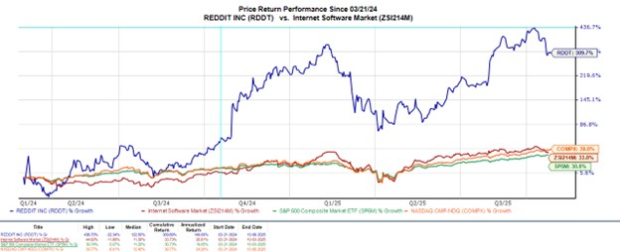

Known as the “front page of the internet”, it’s no surprise that Reddit stock has been one of the hottest IPO’s since going public in March of last year, with RDDT now up an exhilarating +300%.

Better still, the call for more upside is starting to be justified as Reddit’s strong user engagement and explosive advertising growth are starting to magnify its future earnings potential.

Like most social media companies, including giants like Meta Platforms META, Reddit derives the majority of its revenue from advertising, and most recently reported an 84% increase in ad revenue of $465 million during Q2. This was attributed to a 50% increase in active advertisers, with Reddit also posting a 47% spike in average revenue per user (ARPU) at $4.53.

Lifting advertiser interest and its internal operations has been Reddit Pixel, CAPI, and Smarty.io (AI-Powered Automation), which are ad tools that are boosting and integrating user conversion and tracking data. Overall, Reddit’s Q2 sales soared over 77% to $499.63 million.

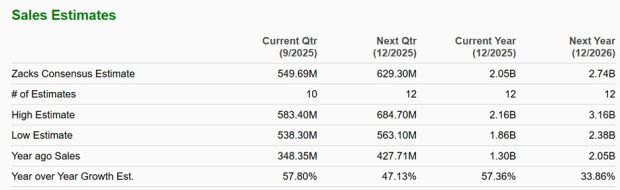

Notably, Reddit is scheduled to release Q3 results on Tuesday, November 4th, with Zacks projections calling for its top line to expand nearly 58% to $549.69 million compared to $348.35 million in the prior year quarter (Current Qtr below).

More intriguing, Reddit’s annual sales are now expected to climb over 57% in fiscal 2025 and are projected to soar another 34% in FY26 to $2.74 billion.

Most compelling about Reddit’s strong user engagement metrics is an expanding global base, as international daily active users (DAU) increased 32% during Q2 to 60.1 million. It’s noteworthy that this drove a more than 70% surge in global revenue, with total DAUs increasing 21% to 110.4 million.

It’s also important to point out that Reddit’s log-out users were at 61.1 million, and are growing faster than its log-in users, suggesting its reach is expanding beyond its core community.

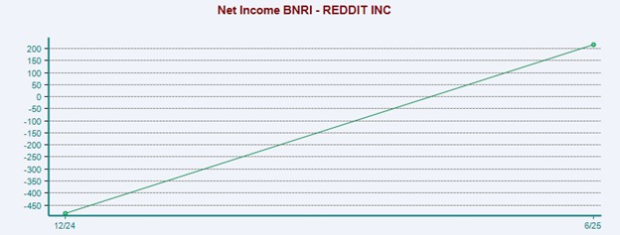

Getting to Reddit’s earnings potential, Q2 2025 marked the company’s first profitable quarter despite previously reporting positive earnings per share (EPS) in other quarters. However, in terms of a dollar amount, Reddit’s adjusted net income swung into the black for the first time at $89 million from a loss of $10 million in Q2 2024.

Gross margins also hit a new peak of 90.8%, with Reddit launching a high-margin data licensing business to complement its ad revenue model in which it sells access to vast troves of user-generated content for AI training and analytics.

Furthermore, many analysts predict Reddit will turn an annual net profit of over $150 million this year, compared to a net loss of $484 million in 2024.

Reddit is projected to post high-double-digit EPS growth for the foreseeable future, with Q2 earnings of $0.45 a share crushing expectations of $0.20 and skyrocketing from an adjusted loss of -$0.06 per share a year ago. Even better is that FY25 and FY26 EPS revisions have trended noticeably higher over the last 90 days.

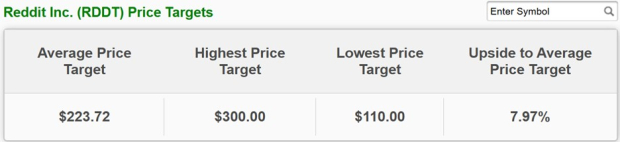

Based on short-term price targets offered by 25 analysts, the current Average Zacks Price Target of $223.72 a share suggests 8% upside for Reddit stock.

That said, RDDT is starting to receive more bullish forecasts based on Reddit's growth trajectory, with JMP Securities and Piper Sandler recently lifting their price targets to street-highs of $300 and $290, respectively.

Having an expansive user base, Reddit’s platform is capable of generating lucrative advertising revenue, which is being glorified by better monetization per user. Keeping this in mind, RDDT could have more room to run as Reddit looks poised to grow into its valuation.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min | |

| 2 hours | |

| 2 hours | |

| 4 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

This Viral AI Project Went From Side Hustle to Coveted Prize in Three Months

META

The Wall Street Journal

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite