|

|

|

|

|||||

|

|

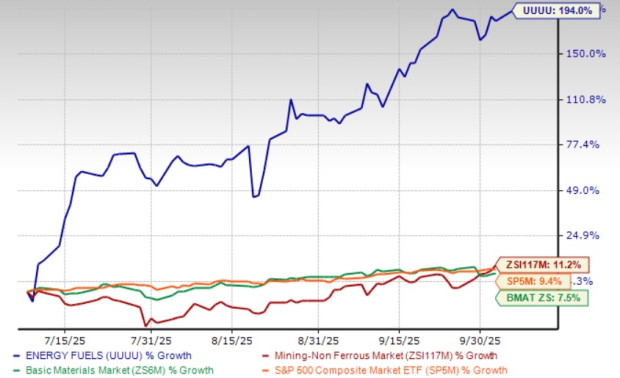

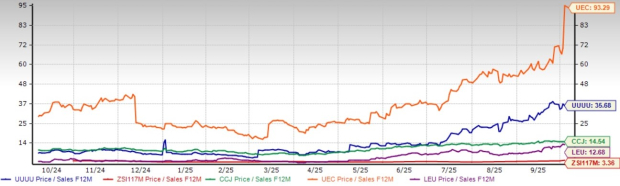

Energy Fuels UUUU has soared 194% in the past three months, far outpacing the non-ferrous mining industry’s 11.2% growth, Zacks Basic Materials sector’s 7.5% gain and the S&P 500’s 9.4% climb.

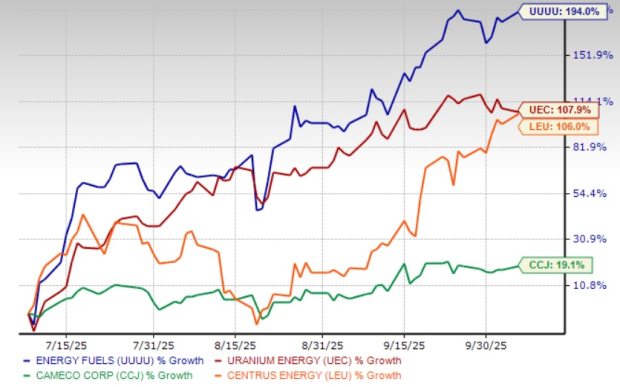

The stock has also outperformed peers like Centrus Energy LEU, Uranium Energy UEC and Cameco CCJ, as shown in the chart below.

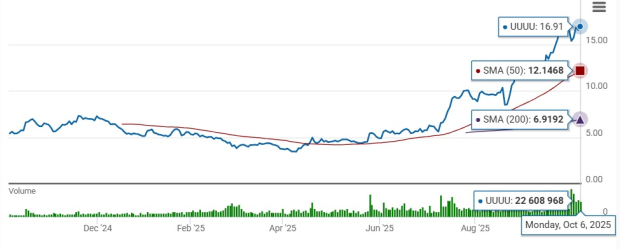

Energy Fuels has been trading above the 200-day simple moving average (SMA) and the 50-day SMA, indicating a bullish trend.

Before chasing the rally, investors should assess the factors driving UUUU’s surge, its growth prospects and potential risks.

In September, UUUU achieved a major milestone with its high-purity neodymium-praseodymium (NdPr) oxide produced being converted into commercial-scale rare earth permanent magnets (REPMs) by South Korea’s POSCO International Corporation.

It has met the stringent quality requirements for use in high-temperature drive unit motors that are installed in EVs and hybrid vehicles. The market rollout of vehicles powered by drive units using Energy Fuels' NdPr oxide is expected soon. This achievement marks a step in building a "mine-to-magnet" supply chain independent of China using rare earth oxides produced in the United States.

In August, Energy Fuels produced its first kilogram of dysprosium (Dy) oxide at 99.9% purity, surpassing commercial benchmarks. UUUU is targeting to deliver the first samples of high purity terbium (Tb) oxide in the fourth quarter of 2025. UUUU plans to construct and commission commercial-scale Dy, Tb and other "heavy" REE separation capacity at its White Mesa Mill, which could start producing in the fourth quarter of 2026.

Energy Fuels is also progressing the Donald Project in Australia, which could start production by the end of 2027. It is one of the richest deposits of HREEs in the world. Also, its Toliara Project in Madagascar and the Bahia Project in Brazil contain significant quantities of light and heavy REE oxides.

In second-quarter 2025, the company mined ore containing approximately 665,000 pounds of uranium from the Pinyon Plain, La Sal and Pandora mines. The Pinyon Plain mine has been performing exceptionally well and produced 635,000 pounds of uranium during the quarter, attributed to its exceptional ore grades.

The mine’s production and drill results to date indicate that it is set to be the highest-grade uranium deposit mined in U.S. history. It holds considerable exploration upside, with Energy Fuels currently extracting ore from only about 25% of the vertical extent of the target zone.

During the second quarter, Energy Fuels sold 50,000 pounds of uranium on the spot market for an average price of $77 per pound. The uranium revenues of $3.85 million marked a 55% year-over-year decline, due to lower sales volumes resulting from contract timing and the decision to retain inventory amid lower uranium prices.

The company expects higher uranium sales over the remaining quarters of 2025 targeting full-year sales at 350,000 pounds. With uranium prices regaining ground recently, the company may make higher sales or revisit the guidance.

In 2026, Energy Fuel expects to sell between 620,000 and 880,000 pounds of uranium under its existing long-term contracts. It is planning opportunistic sales of uranium in 2025 and 2026 and intends to enter into new long-term sales contracts.

As of June 30, 2025, Energy Fuels had $253.23 million of working capital, comprising $71.5 million of cash, $126.4 million of marketable securities and $7.8 million in trade and other receivables, as well as $76.50 million of inventory.

The company, like it’s peer Uranium Energy, has no debt on its balance sheet. Meanwhile Cameco’s debt-to-capital ratio is at 0.13 and Centrus Energy is at 0.55.

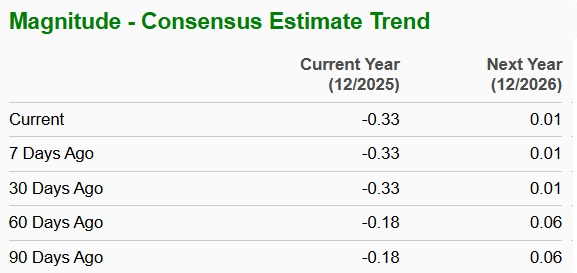

The Zacks Consensus Estimate for Energy Fuels’ 2025 earnings is currently pegged at a loss of 33 cents per share. The bottom-line estimate for 2026 is pegged at earnings of one cent per share.

Image Source: Zacks Investment Research

Both the estimates have undergone negative revisions as shown in the chart below.

Uranium prices have been under pressure earlier this year due to oversupply and uncertain demand. Uranium prices have, however, recently surged to around $82 per pound, fueled by growing expectations of expanded nuclear power capacity, fresh purchases by physical uranium funds and policy initiatives. Additionally, with Cameco lowering its 2025 guidance and Kazatomprom reducing its output by 10% for next year, supply concerns have been triggered.

Energy Fuels’ revenues fluctuate, as it typically avoids selling uranium or makes lower sales during price downturns, adding uncertainty to quarterly performance.

Energy Fuels is trading at a forward price/sales of 35.68X, well above the industry average of 3.36X. The company’s Value Score of F suggests that the stock is not so cheap and has a stretched valuation at this moment.

Meanwhile, Centrus Energy and Cameco are cheaper alternatives than UUUU, with price/sales of 12.68X and 14.54X, respectively. Uranium Energy is trading at a loftier P/S of 93.29.

The increasing demand for uranium and REEs in clean energy technologies and the push for supply chains independent of China are a growth opportunity for UUUU. The White Mesa Mill in Utah, being the only U.S. facility able to process monazite and produce separated REE materials, gives the company an edge.

Backed by its debt-free balance sheet, Energy Fuels is ramping up uranium production while developing significant REE capabilities. With expansion plans and a target capacity of 4–6 million pounds of uranium per year, UUUU is well-positioned for future growth.

Energy Fuels’ debt-free position, growing REE production and strong uranium portfolio support a compelling long-term case. Those who already own the stock may stay invested. However, given its premium valuation, expected 2025 loss and the downward estimate revisions, new investors can consider waiting for a better entry point.

UUUU currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 5 hours | |

| 9 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite