|

|

|

|

|||||

|

|

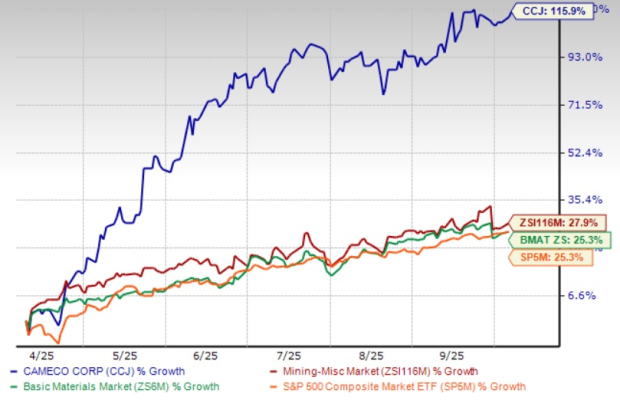

Cameco CCJ has surged 115.9% in the past six months, outpacing the industry’s 27.9% growth, the Zacks Basic Materials sector’s 25.3% gain and the S&P 500’s 25.3% rise.

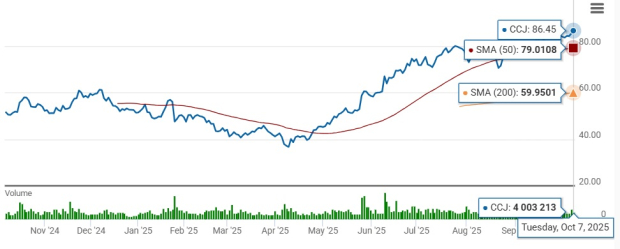

Cameco has been trading above the 200-day simple moving average (SMA) and the 50-day SMA, indicating a bullish trend.

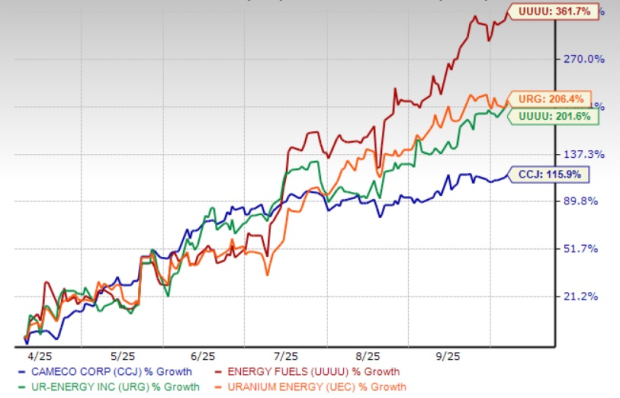

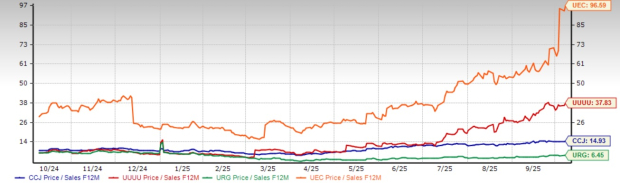

However, other uranium peers Energy Fuels Inc. UUUU, Ur-Energy Inc. URG and Uranium Energy Corp. UEC have delivered even stronger returns in this timeframe, as shown in this chart below.

Investors may be eager to join the rally, but it’s essential to first understand what’s fueling the surge, assess Cameco’s growth prospects and weigh the possible risks.

Cameco’s total revenues in the first half of 2025 increased 35% year over year to CAD 1,666 million ($1,184 million). Uranium revenues were up 27% to CAD 1,324 million ($941 million), aided by a 16% higher sales volume and an increase of 10% in the Canadian dollar average realized price, benefiting from fixed-price contracts, even though U.S. dollar spot prices fell 24%.

Fuel services’ revenues surged 56% year over year to CAD297 million ($211 million) due to a 2% increase in average realized price and a 55% increase in sales volume.

Cameco’s adjusted earnings per share soared 248% year over year to CAD 0.87 ($0.62) in the first half of 2025. The earnings improvement was also attributed to stronger equity earnings reflecting Cameco’s 49% investment in Westinghouse Electric Company in the second quarter.

In September, Cameco signed a long-term agreement to supply natural uranium hexafluoride (UF6) to Slovenské elektrárne (“SE”), Slovakia’s largest electricity producer. This agreement, running through 2036, marks Cameco’s entry into the Slovakia market.

Cameco will provide both uranium and conversion services to SE. The material will support operations at SE’s Bohunice and Mochovce nuclear facilities, starting in 2028.

Cameco has two operating mines, Cigar Lake (in which it holds a 54.547% stake) and McArthur River (69.805%), along with a mill at Key Lake (83.33%).

Cameco recently revised its share of production expectation for 2025 at 9.8-10.5 million pounds from the McArthur River mine, from the 12.6 million pounds expected earlier. This reflects development delays in transitioning the mine to new mining areas, as well as slower-than-anticipated ground freezing. The expected share from the Cigar Lake mine is maintained at 9.8 million pounds. Backed by Cigar Lake’s upbeat performance in the first half, Cameco expects it will likely help set off up to 1 million pounds (100% basis) of the production shortfall at the McArthur River.

Cameco’s share of production (Cigar Lake and McArthur River) was at 10.6 million pounds of uranium in the first half of 2025, reflecting an 18% drop from the year-ago quarter. The company has to produce 9-9.7 million pounds from both operations in the second half to meet its revised guidance of 19.6-20.3 million pounds in 2025.

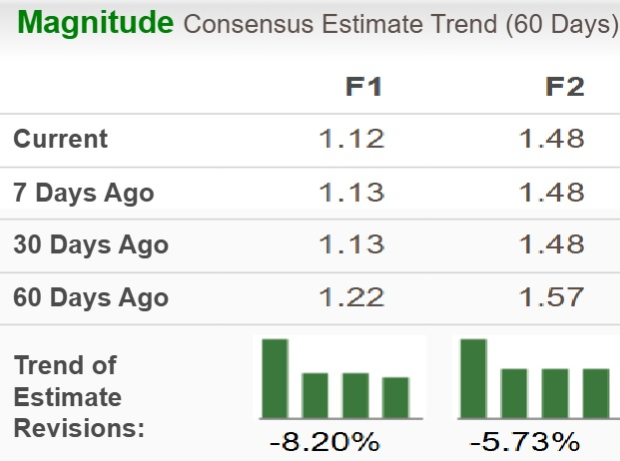

The Zacks Consensus Estimate for CCJ’s 2025 earnings is pegged at $1.12 per share, indicating 128.6% year-over-year growth. The same for 2026 is $1.48, implying 31.7% growth.

However, both the estimates for fiscal 2025 and 2026 have moved down, as shown in the chart below.

Cameco’s stock is trading at a forward price-to-sales ratio of 14.93 compared with the industry’s 1.46. It is above its five-year median of 6.78. The company’s Value Score of F suggests that the stock is not so cheap and indicates a stretched valuation at this moment.

Ur-Energy is trading much lower than Cameco, at 4.66X. Meanwhile, Energy Fuels and Uranium Energy are currently trading higher at 37.83X and 96.59X, respectively.

CCJ had a total debt-to-total capital ratio of 0.13% as of June 30, 2025. Meanwhile, Energy Fuels and Uranium Energy have debt-free balance sheets. Ur-Energy’s total debt-to-total capital ratio is 0.01%.

The nuclear power sector is experiencing a strong upswing, driven by global events, the urgency of energy security and a surge in low-carbon energy demand resulting from the climate crisis. Cameco is uniquely positioned to capitalize on this boom, thanks to its high-quality, low-cost asset base and its strategic involvement across the entire nuclear fuel supply chain.

CCJ continues to invest in increasing production and capitalizing on market opportunities. Work is underway to extend the mine life at Cigar Lake to 2036. Cameco is also increasing production at McArthur River and Key Lake from 18 million pounds to its licensed annual capacity of 25 million pounds (100% basis).

Supported by a strong balance sheet, the company is making investments to boost its capacity to capitalize on the expected surge in uranium demand. However, new investors can wait for a better entry point, considering the premium valuation, lowered production outlook and the downward estimate revision activity. The stock currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite