|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

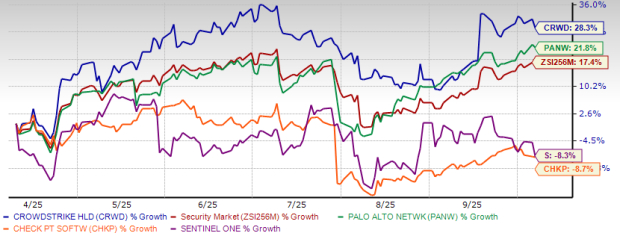

CrowdStrike Holdings CRWD shares have soared 28.3% in six months, outperforming the Zacks Security industry’s 17.4% growth. The stock has also outperformed the returns of other industry peers, including SentinelOne S, Palo Alto Networks PANW and Check Point Software CHKP. In the past six months, shares of Palo Alto Networks have gained 21.8%, while Check Point Software and SentinelOne shares have lost 8.7% and 8.3%, respectively.

CrowdStrike has been riding on strong enterprise demand for artificial intelligence (AI)-native cybersecurity solutions. But with the stock outperforming the industry and peers, the question arises: Does it still have room to run, or is it time for investors to consider taking profits? Let’s find out.

CrowdStrike’s subscription business model is driving its overall top-line performance. The company’s revenues crossed the $1 billion mark for the fourth consecutive time during the second quarter of fiscal 2026 and marked a year-over-year improvement of nearly 20.1%. This was partly achieved due to the strong adoption of the Falcon Flex Subscription Model, which allows customers to commit upfront and later choose modules, eliminating procurement friction.

CrowdStrike’s subscription customers, who adopted six or more cloud modules, represented 48% of the total subscription customers at the end of the second quarter. Those with seven or more cloud modules accounted for 33%, and those with eight or more cloud modules represented 23% as of July 31, 2025.

Falcon Flex makes it easier for customers to adopt multiple modules across CrowdStrike’s platform. Many are also using Flex to replace several legacy tools, choosing to consolidate around CrowdStrike. One such example is a Fortune 500 software firm that signed an eight-figure re-Flex deal to modernize its security operations center, renewing its contract 18 months before the expiration of the initial Falcon Flex subscription.

The company added $221 million in net new annual recurring revenue (ARR). This pushed up CrowdStrike’s total ARR to $4.66 billion, representing an increase of 20% from last year. A big part of this growth came from Falcon Flex, CrowdStrike’s subscription model. The company now has over 1,000 Falcon Flex customers, and more than 100 have already signed follow-on “re-Flex” deals before their contracts ended. These re-Flex deals are important because they show customers are expanding faster than expected, often boosting ARR by nearly 50%.

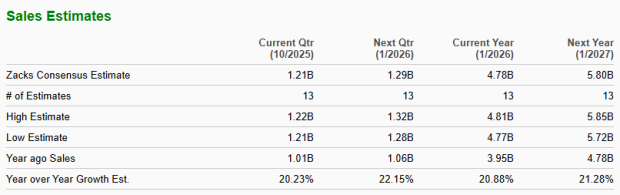

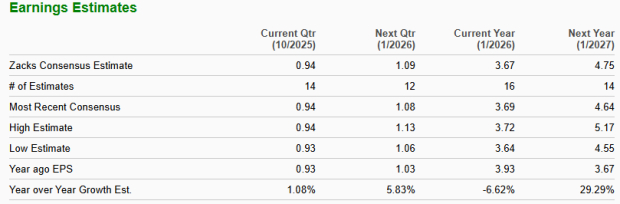

In the second quarter, CrowdStrike’s sales and non-GAAP EPS grew 21% and 5.7%, respectively, year over year. Looking ahead, management expects at least 40% year-over-year growth in net new ARR in the second half of fiscal 2026, where Falcon Flex can play a key role in helping the company reach its long-term goal of $10 billion ARR. The Zacks Consensus Estimate for both fiscal 2026 and 2027 revenues indicates a year-over-year increase of around 21%.

CrowdStrike’s Falcon platform is gaining popularity as an “AI-native SOC,” with strong adoption in Charlotte AI Agentic Detection Triage, Workflows and Response. CrowdStrike is partnering with other AI companies to expand its capabilities. CrowdStrike integrated its Falcon cybersecurity platform into NVIDIA's Enterprise AI Factory to enable enterprises to secure their AI systems across data ingestion, model training, and deployment.

In the second quarter, CrowdStrike expanded on its partnership with NVIDIA to secure the entire AI life cycle. Falcon Cloud Security is now integrated with NVIDIA’s large language models (LLMs) NIM microservices and NeMo Safety, protecting more than 100,000 large language models. Additionally, CrowdStrike introduced Charlotte AI AgentWorks integrated with NVIDIA’s Nemotron models. This platform lets analysts build custom, no-code AI agents while the Falcon platform secures those agents at every stage, from development to deployment. It helps organizations safely use and manage agentic AI in security operations.

In addition to NVIDIA, CrowdStrike strengthened its partner ecosystem during the second quarter. Amazon Business Prime added Falcon Go to their Business Prime membership for millions of small businesses, opening new opportunities in the Small and Medium Business market. In August 2025, it partnered with Zscaler and Red Canary (now owned by Zscaler) to offer customers comprehensive defense solutions. The partnership integrates CrowdStrike’s endpoint security platform, Zscaler’s Zero Trust Exchange platform, and Red Canary's AI-driven managed detection and response capabilities.

In September, CrowdStrike announced collaborations with KPMG, Salesforce, and Meta. Each focuses on a different part of security operations and AI use. With KPMG, CrowdStrike is helping organizations upgrade from older security systems to faster, AI-powered operations. KPMG will use CrowdStrike’s Falcon Next-Gen SIEM to deliver new advisory and managed services. This partnership will make it easier for companies to modernize their security centers and reduce costs while improving detection speed.

With Salesforce, CrowdStrike is securing AI-powered business tools. The integration connects Falcon Shield with Salesforce Security Center and brings Charlotte AI into Agentforce. This gives companies better visibility into AI agents and stronger protection for sensitive business data. With Meta, CrowdStrike launched CyberSOCEval, a set of open benchmarks to test how LLMs perform in real-world cybersecurity tasks. This helps organizations understand which AI tools work best for defending against real attacks.

These strategic partnerships, which contributed to more than 60% of new business during the second quarter, are expected to help CrowdStrike attract more customers and strengthen its position in the cybersecurity market. Though the consensus mark for fiscal 2026 EPS suggests a decline of 6.6%, it is forecasted to mark a strong recovery in fiscal 2027 with a jump of 29.3%.

As businesses continue to prioritize AI-driven cybersecurity solutions, CrowdStrike’s leadership in threat prevention, response and recovery will only strengthen. The company’s subscription-based model and recurring revenue streams, along with its strong partner base, should provide stability and gradual growth, even amid ongoing macroeconomic challenges and geopolitical issues, making the stock an attractive investment option at present.

CrowdStrike currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Cybersecurity Stocks Hit By Anthropic 'Claude Code Security.' JFrog Plunges.

PANW

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Stock Market Mixed With Walmart, Iran, Trump Tariff Ruling In Focus: Weekly Review

PANW

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite