|

|

|

|

|||||

|

|

Assurant, Inc. AIZ has acquired the portfolio of mobile device test automation technology from OptoFidelity. The move is in tandem with Assurant’s focus on investing in technologies that boost efficiency, expedite delivery and create greater value for its partners.

OptoFidelity produces advanced mobile device testing systems that are known for precision, repeatability and traceability. Since its founding in 2005, the company has delivered more than 9,000 test systems to mobile carriers, manufacturers and retailers globally. For nearly 20 years, OptoFidelity has maintained its leading position in innovation. With this acquisition, OptoFidelity will leverage Assurant’s Global Connected Living business strategy, which will provide it with better growth opportunities.

This acquisition of OptoFidelity enables AIZ to meet the growing demand, uphold high-quality standards and drive greater circularity by reusing devices from trade-in and other sources for the partners. With the smooth alliance of OptoFidelity’s mobile device test automation technology, AIZ can repurpose a greater volume of devices with enhanced precision and efficiency.

OptoFidelity’s technology improves operational efficiency and further strengthens Assurant’s ability to scale, optimize resources and easily integrate with existing processes to support future innovation. The modular technology is equipped to changing production volumes and testing needs, along with delivering high-quality results at any scale across both iOS and Android devices.

The businesses of AIZ represent a group of leading, protection and service-oriented offerings focused on compelling growth opportunities. The company intends to grow businesses by strengthening partnerships globally while continuing to invest in technology, including digital and AI. Its approach to mergers, acquisitions and other growth opportunities reflects a strategic and disciplined approach to capital management.

In October 2024, AIZ opened the Innovation and Device Care Center, which supports mobile device lifecycle solutions in Global Lifestyle and the development of new and innovative ways to leverage automation, robotics and AI. This acquisition of OptoFidelity marks a significant step in Assurant’s journey for automation and robotics across its Device Care Centers by expanding Assurant’s ability to deliver rigorously tested Certified Pre-Owned devices to the market at a high Units Per Hour rate.

Assurant will further collaborate with FutureDial, the leading customer of the technology acquired from OptoFidelity, to ensure continued support and exceptional service for existing and new clients as well.

Through its Global Lifestyle segment, the multi-line insurer provides mobile device solutions, extended service contracts and related services for consumer electronics and appliances, and credit and other insurance products, which are referred to as Connected Living. This segment derives revenues from service contracts and sales of products primarily from AIZ’s Connected Living business. Therefore, this buyout is likely to bolster and expand the insurer’s Connected Living business, which in turn contributes to the top-line growth of the company.

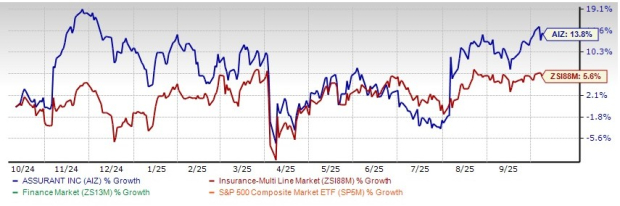

Shares of this Zacks Rank #2 (Buy) multi-line insurer have gained 13.8% in the past year, outperforming the industry’s growth of 5.6%.

Some other top-ranked stocks from the multi-line insurance industry are MGIC Investment Corporation MTG, Horace Mann Educators Corporation HMN and EverQuote, Inc. EVER, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MGIC Investment has a solid track record of beating earnings estimates in each of the trailing four quarters, with an average being 2.52%. In the past year, shares of MTG have risen 4.7%.

The Zacks Consensus Estimate for MTG’s 2025 and 2026 earnings implies year-over-year growth of 3.4% and 1.9%, respectively, from the consensus estimate of the corresponding years.

Horace Mann Educators has a solid track record of beating earnings estimates in each of the trailing four quarters, with an average being 39.75%. In the past year, shares of HMN have gained 28.9%.

The Zacks Consensus Estimate for HMN’s 2025 and 2026 earnings implies year-over-year growth of 34.5% and 6.3%, respectively, from the consensus estimate of the corresponding years.

EverQuote has a solid track record of beating earnings estimates in each of the trailing four quarters, with an average being 44.17%. In the past year, shares of EVER have climbed 9.7%.

The Zacks Consensus Estimate for EVER’s 2025 and 2026 earnings implies year-over-year growth of 48.8% and 18.3%, respectively, from the consensus estimate of the corresponding years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 11 hours | |

| 18 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite