|

|

|

|

|||||

|

|

Shares of Ovid Therapeutics OVID rallied 39.2% primarily driven by the encouraging top-line data readout from an early-stage study of the company’s lead investigational candidate, OV329.

The candidate is a next-generation GABA-AT inhibitor being developed to treat rare and drug-resistant epilepsies. By blocking GABA-AT to boost brain GABA levels, the therapy aims to reduce neuronal hyperexcitability (known to cause seizures) and could emerge as a potential best-in-class seizure treatment.

Ovid Therapeutics’ phase I study of OV329 enrolled 68 healthy volunteers across single and multiple-ascending dose cohorts (1–5 mg) to evaluate its safety, tolerability, pharmacokinetics, and pharmacodynamics. Patients received once-daily oral doses, with detailed safety and ophthalmic assessments conducted throughout the study duration. Exploratory biomarker analyses in the 3 mg and 5 mg cohorts used transcranial magnetic stimulation (TMS) as measured with electromyography to assess inhibitory effects.

All TMS biomarkers were studied across two muscle groups, including the first dorsal interosseous (FDI) and the abductor pollicis brevis (APB). Additional evaluations using magnetic resonance spectroscopy (MRS) and electroencephalography (EEG) explored changes in brain GABA levels and neural activity, comparing pre- and post-treatment results to placebo and historical data.

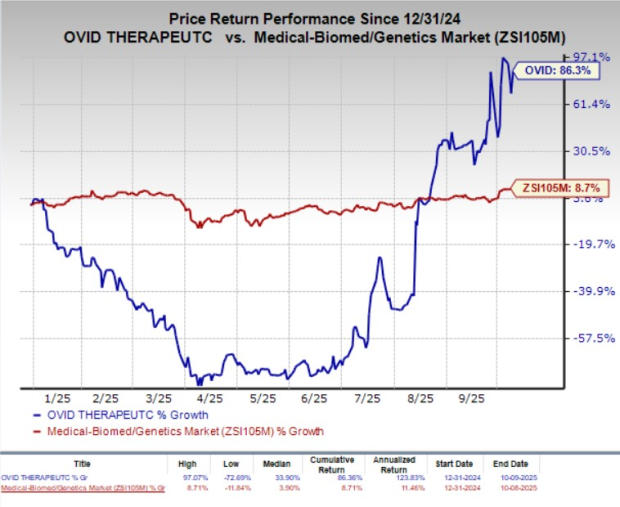

Year to date, shares of Ovid Therapeutics have surged 86.3% compared with the industry’s 8.7% growth.

In the phase I study, Ovid Therapeutics’ OV329 demonstrated strong GABAergic activity, reinforcing its potential as a novel treatment for refractory epilepsy. At the 5 mg dose, OV329 increased inhibition by 53% on the APB muscle and 44% on the FDI muscle, as measured by TMS, while the placebo showed no meaningful change. These results exceeded or matched the inhibitory effects seen with therapeutic doses of vigabatrin (VGB), a benchmark GABA-AT inhibitor.

Further supporting its mechanism, OV329 significantly prolonged the cortical silent period (CSP), another marker of neural inhibition, in both muscle groups tested. The 5 mg dose extended CSP duration by up to 13 milliseconds, compared to minimal changes with placebo. These findings align with previously reported inhibitory effects achieved with therapeutic doses of VGB, underscoring OV329’s potential best-in-class profile.

Ovid Therapeutics also reported that MRS showed a 7.13% rise in brain GABA levels after seven days of treatment compared to a negligible increase with placebo, consistent with OV329’s mechanism of boosting inhibitory neurotransmission. Though not statistically significant due to baseline variability, the trend, alongside exploratory EEG data showing increased inhibitory brainwave activity, further validates OV329’s targeted GABA-enhancing effect.

Additionally, OVID reported that the candidate demonstrated a favorable safety and tolerability profile in the phase I study. Treatment-related adverse events were mostly mild to moderate in severity.

Following the encouraging phase I data readout, Ovid Therapeutics is currently engaging with study sites and regulatory authorities. The company plans to launch a phase IIa study of OV329 in adults with drug-resistant focal onset seizures in the second quarter of 2026, with completion expected by mid-2027. The company also aims to further define OV329’s anti-convulsant profile through an open-label seizure study.

Ovid Therapeutics’ clinical pipeline includes another investigational candidate, OV350, which is currently being developed in a separate early-stage study for brain diseases.

Ovid Therapeutics price-consensus-chart | Ovid Therapeutics Quote

Ovid Therapeutics currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the biotech sector are Akero Therapeutics AKRO, Allogene Therapeutics ALLO and Chemomab Therapeutics CMMB, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Akero Therapeutics’ 2025 loss per share have narrowed from $3.92 to $3.74. Loss per share estimates for 2026 have narrowed from $4.38 to $4.13 during the same period. AKRO stock has surged 94.3% year to date.

Akero Therapeutics’ earnings beat estimates in three of the trailing four quarters while missing the same on the remaining occasion, the average surprise being 49.24%.

In the past 60 days, estimates for Allogene Therapeutics’ 2025 loss per share have narrowed from $1.02 to 96 cents. Loss per share estimates for 2026 have narrowed from 98 cents to 86 cents during the same period. ALLO stock has lost 29.1% year to date.

Allogene Therapeutics’ earnings beat estimates in three of the trailing four quarters, while meeting the same on the remaining occasion, with an average surprise of 14.03%.

In the past 60 days, estimates for Chemomab Therapeutics’ 2025 loss per share have narrowed from $2.40 to 60 cents. Loss per share estimates for 2026 have narrowed from $2.80 to $1.00 during the same period. CMMB stock has plunged 53.5% year to date.

Chemomab Therapeutics’ earnings beat estimates in three of the trailing four quarters, while meeting the same on the remaining occasion, with an average surprise of 26.25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-17 | |

| Feb-13 | |

| Feb-11 | |

| Feb-05 | |

| Feb-05 | |

| Jan-30 | |

| Jan-26 | |

| Jan-09 | |

| Jan-08 | |

| Dec-18 | |

| Dec-15 | |

| Dec-02 | |

| Dec-02 | |

| Nov-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite