|

|

|

|

|||||

|

|

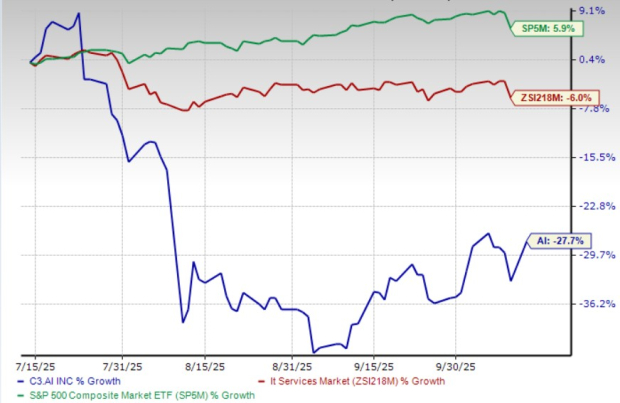

C3.ai, Inc. AI shares have tumbled 27.7% over the past three months, while the industry slipped 6% during the same period. By contrast, the S&P 500 advanced 5.9% in that timeframe.

However, C3.ai’s shares climbed 8.2% yesterday as optimism returned to the tech sector, boosted by a broader rebound after Friday’s sell-off, and by renewed hopes that escalating U.S.-China trade tensions may ease. Many tech and AI companies were buoyed by investor relief after President Trump adopted a more conciliatory tone toward China.

In effect, the rally reflects a combination of technical relief (short covering, oversold conditions), speculative positioning in beaten-down AI stocks, and the view that trade risk may be moderating.

AI’s recent struggles stem largely from weak financial execution. In the latest quarter, revenues dropped nearly 20% year over year, missing expectations, while losses widened significantly. A sharp fall in demonstration license sales and a greater mix of costly initial production deployments pressured margins. These dynamics left the company with a negative free cash flow, raising investor concerns about its ability to achieve scale and profitability in the near term.

Another setback has been the disruption in the sales process. Leadership changes within the global sales and services organization caused confusion, slowing contract closures and impacting quarterly results. Compounding the issue, founder Tom Siebel admitted that his reduced involvement due to health challenges left a gap in sales coordination. The results were what management itself described as “unacceptable” performance, with missed guidance and poor resource alignment.

Beyond internal execution, C3.ai also faces external pressures. The enterprise AI market is expanding, but intense competition and customer hesitation in adopting large-scale AI projects create headwinds. While the company touts strong partnerships with major cloud providers and defense clients, investors remain skeptical until consistent growth and profitability appear. Until C3.ai can convert its pipeline into reliable revenue streams and prove its business model can scale efficiently, its stock may remain under pressure despite occasional rebounds.

C3.ai is looking to regain momentum by leaning on strong partnerships and a large addressable market. Management emphasized that the demand for enterprise AI applications continues to expand across industries such as manufacturing, defense and government. With more than 131 ready-to-deploy AI applications and a platform designed to overcome common challenges in generative AI projects, the company believes it has a competitive edge.

These capabilities are helping customers transition from pilot programs into large-scale rollouts, which may support revenue stability over time.

Another growth driver is the company’s expanding customer base and contract wins. Recent deals with firms like Nucor and Qemetica, as well as extensions with Huntington Ingalls Industries and the U.S. Army, highlight how existing clients are broadening their use of C3.ai’s solutions.

These expansions not only deepen relationships but also demonstrate the company’s ability to scale AI programs across multiple plants, assets and operational workflows. Such momentum in long-term partnerships can provide recurring revenue visibility.

C3.ai is also investing in new go-to-market strategies, particularly through its Strategic Integrator Program. This initiative allows system integrators and OEMs to build specialized applications on the C3 Agentic AI platform, effectively multiplying the company’s reach into different industries without shouldering all the direct sales burden.

Combined with deeper alliances with major cloud providers like Microsoft Azure, AWS and Google Cloud, C3.ai expects to accelerate adoption globally. With nearly 90% of new business in the last quarter flowing through partners, this ecosystem approach is positioned to amplify growth.

Lastly, leadership changes are intended to sharpen execution. The appointment of a CEO, and the reorganization of the sales and services divisions are expected to improve coordination and customer outcomes. Management is optimistic that the refreshed structure, along with a substantial cash balance to support operations, provides a foundation for long-term expansion.

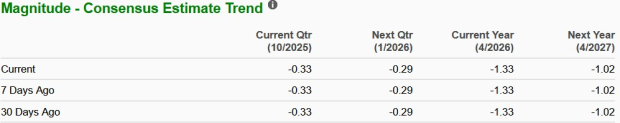

The Zacks Consensus Estimate for fiscal 2026 and 2027 loss per share has been unchanged in the past 30 days, as shown in the chart.

The Zacks Consensus Estimate for fiscal 2026 and 2027 sales implies a year-over-year decline of 23.1% and growth of 12.6%, respectively. Meanwhile, Palantir Technologies Inc. PLTR sales in 2025 are likely to increase 45.6% year over year, whereas SoundHound AI, Inc. SOUN sales in fiscal 2026 are likely to grow 29.4%.

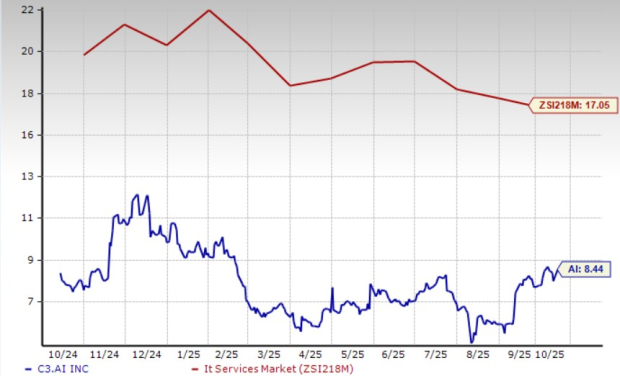

AI is priced at a discount relative to its industry. It has a forward 12-month price-to-sales ratio of 8.44, which is well below the industry average. Meanwhile, Palantir Technologies and Snowflake’s forward 12-month price-to-sales ratios are 79.1 and 15.75, respectively.

C3.ai’s recent rebound shows that investor enthusiasm for AI remains intact, but the company’s uneven execution and competitive challenges suggest caution. While its strong partnerships, expanding customer base and revamped leadership structure provide a foundation for long-term growth, the lack of consistent profitability and execution risks make it premature for fresh investments.

Current shareholders may consider holding their positions, given the potential upside if execution improves, but new investors will be better served waiting until the company demonstrates more reliable growth and operational stability. AI currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 19 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 8 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite