|

|

|

|

|||||

|

|

Palantir and Snowflake have benefited from the growing adoption of generative AI software services.

The solid revenue pipelines of both companies should translate into healthy long-term growth.

The adoption of artificial intelligence (AI) software solutions has been a solid tailwind for companies that had been struggling for growth. Palantir Technologies (NASDAQ: PLTR) and Snowflake (NYSE: SNOW) are two such examples that have received a nice shot in the arm thanks to the growing demand for generative AI software solutions.

Palantir's growth trajectory has improved following the launch of its Artificial Intelligence Platform (AIP) in April 2023. Similarly, Snowflake's strategy of integrating AI-focused tools into its data cloud platform has helped it attract more customers, while enabling it to win more business from its existing customers.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

But if you have to pick up one of these two AI stocks for your portfolio, which one should it be? Let's find out.

Image source: Snowflake.

Palantir's generative AI software platform has been helping customers in various ways, such as reducing downtimes, improving operational efficiency, and automating workflows. Not surprisingly, there has been robust demand for this platform since it was launched two-and-a-half years ago. This explains why Palantir is now growing at a much faster pace than before AIP's launch.

The company's revenue in the first six months of 2025 increased by 44% from the same period last year to $1.89 billion. Its net income has more than doubled during this period, rising by 125% to $541 million, owing to the positive unit economics of AIP. For comparison, Palantir's revenue in the first half of 2023 increased by just 15% year over year.

This impressive acceleration is a result of the rapid adoption of AIP. The company received $2.3 billion worth of new orders in the second quarter, an increase of 140% from the prior-year period. This figure was higher than the total revenue that Palantir generated in the first half. The company benefited from a combination of an increase in its customer count as well as an expansion in contracts with existing customers.

Specifically, its overall customer count in the second quarter was up by 43% from the year-ago period. Additionally, Palantir management pointed out on the earnings call that it continues to "see expansions with our existing customers." As a result, Palantir's top 20 customers contributed 30% more in trailing 12 month revenue in Q2.

Looking ahead, Palantir has the ability to sustain the acceleration in its growth rate. That's because the market for AI software platforms that it is operating in is growing at an annual rate of 40% and could hit $153 billion in revenue in 2028. Given that Palantir is considered to be a leader in this market, it is easy to see why it is now winning contracts at a faster pace than the market's growth.

This should help Palantir corner a bigger share of the AI software opportunity in the long run, paving the way for potentially more upside in the stock following the tremendous gains that it has clocked in the past couple of years.

Snowflake's data cloud offering enables customers to store and consolidate their data in a secure manner into a single platform. That data can be used to gain analytical insights, build applications, and other products.

The company is now infusing AI into its data cloud platform to help customers do more with their data. For instance, the Snowflake Cortex suite of AI features enables customers to apply large language models (LLMs) to their data so that they can build AI agents and conversational applications such as chatbots. Snowflake's AI offerings can help customers boost efficiency in different ways, such as by turning documents into searchable data to get insights from data with natural language prompts.

The productivity gains that customers are enjoying thanks to Snowflake's AI offerings explain why customers have been quick to adopt them. The company said that its AI solutions were being used by more than 6,100 customer accounts on a weekly basis in the fiscal second quarter. That means a nice chunk of its customers are yet to adopt its AI solutions considering that it had a total customer base of just over 12,000 at the end of the previous quarter, a metric that increased by 19% from the prior-year period.

What's worth noting is that AI is a key reason behind driving the growth in Snowflake's growth. Management remarked on the previous earnings call that "AI is a core reason why customers are choosing Snowflake, influencing nearly 50% of new logos won in Q2." As a result, the company was able to record a 33% year-over-year increase in its remaining performance obligations (RPO) to $6.9 billion.

That was slightly higher than the 32% increase in its product revenue, suggesting that it is winning new business at a faster pace than it can fulfill existing contracts. Moreover, the adoption of Snowflake's solutions by its existing customers explains why its non-GAAP earnings nearly doubled year over year in the previous fiscal quarter to $0.35 per share.

Throw in the fact that Snowflake has a massive addressable market that could hit $355 billion in 2029, and it is easy to see why analysts are forecasting healthier earnings growth for the company.

SNOW EPS Estimates for Current Fiscal Year data by YCharts

In all, just like Palantir, even Snowflake's growth rate is likely to get better in the long run owing to the adoption of its AI-focused offerings that are not only helping it win a bigger share of its existing customers' wallets, but also allowing it to bring more customers on board.

It is evident that both Snowflake and Palantir have been growing at an impressive pace on the back of AI-fueled demand. Both companies reported healthy revenue and earnings growth last quarter, a trend that's likely to continue thanks to their robust revenue pipelines. So, both Snowflake and Palantir look like AI stocks that are worth buying right now.

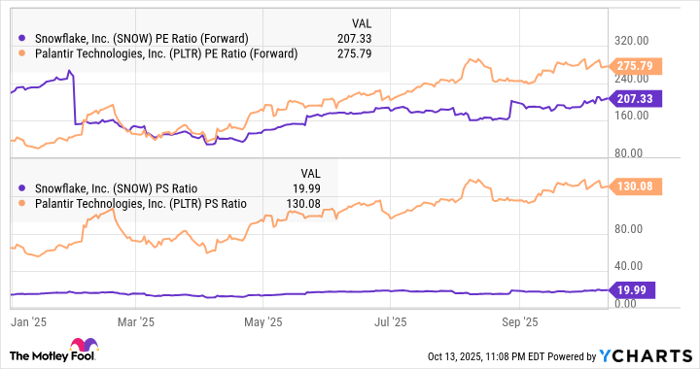

But if you look at their valuations, it becomes clear that one of them is the better bet than the other.

SNOW PE Ratio (Forward) data by YCharts

There's no doubt that both stocks are definitely expensive right now. But those premium valuations can be attributed to their ability to deliver stronger growth in the future. Snowflake's earnings, for instance, are expected to jump by 39% in the next fiscal year, followed by a stronger increase of 44% in fiscal 2028, as we saw in the chart in the previous section. A similar scenario is expected at Palantir, with its earnings expected to increase by 37% in 2027 following a 33% increase next year.

Importantly, both companies can grow at a faster pace than analysts' expectations thanks to their large addressable markets and favorable unit economics on account of stronger cross-selling opportunities. We have already seen that Snowflake's earnings almost doubled in the previous quarter, while Palantir's bottom line jumped 78% year over year. They can sustain such terrific growth rates in the future as well.

However, not everyone may be comfortable paying the sky-high valuation Palantir is trading at, even though it can justify its valuation. That's why Snowflake looks like the better bet for anyone looking to invest in one of these two AI stocks right now.

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $638,300!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,114,470!*

Now, it’s worth noting Stock Advisor’s total average return is 1,044% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 13, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies and Snowflake. The Motley Fool has a disclosure policy.

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite