|

|

|

|

|||||

|

|

Centrus Energy LEU and Cameco CCJ are both well-positioned to benefit from the accelerating global shift toward nuclear energy. Centrus Energy supplies nuclear fuel and services for the nuclear power industry, and is pioneering the production of High-Assay, Low-Enriched Uranium (HALEU). Cameco is one of the largest global providers of uranium fuel, with controlling ownership of the world’s largest high-grade reserves and low-cost operations.

Momentum for nuclear expansion continues to build worldwide. India aims to raise nuclear capacity to 100 GW by 2047, while the US plans to quadruple its capacity to 400 GW by 2050. The US and UK recently signed the Technology Prosperity Deal to fast-track reactor approvals and reduce dependence on Russian nuclear fuel by 2028.

For investors considering capitalizing on this growth, we analyze and compare the fundamentals, growth prospects and risks of LEU and CCJ to determine which stock offers the stronger investment case.

The company, through its Low-Enriched Uranium segment, supplies components of nuclear fuel to commercial customers. This includes the supply of the enrichment component of Low-Enriched Uranium to utilities that operate commercial nuclear power plants. The enrichment component of LEU is measured in Separative Work Units (SWU). Centrus Energy also sells natural uranium hexafluoride.

The Technical Solutions segment provides advanced uranium enrichment services to the nuclear industry and the U.S. government, as well as advanced manufacturing and other technical services to government and private sector customers.

In the second quarter of 2025, Centrus Energy reported total revenues of $155 million, down 18% year over year. LEU segment’s revenues fell 26% year over year to $125.7 million, mainly owing to the absence of uranium sales due to low prices. The segment also reported a 27% decline in sales volumes of SWU, which was somewhat offset by 24% SWU higher prices. Technical Solutions revenues jumped 48% to $28.8 million, driven by a $9.1 million boost from the HALEU Operation Contract.

Earnings per share were $1.59, which came in 16% lower than the year-ago quarter on lower revenues and higher selling, general and administrative expenses and interest expenses.

Centrus Energy currently has a $3.6 billion revenue backlog, which includes long-term sales contracts with major utilities through 2040.

The company recently unveiled ambitious plans to significantly expand its uranium enrichment plant in Piketon, OH, to boost the production of Low-Enriched Uranium and HALEU. This project will mark a significant step in restoring America’s ability to enrich uranium at scale. The scope of the expansion depends on Centrus Energy securing funding from the U.S. Department of Energy (DOE). Centrus Energy’s multi-billion-dollar plan requires public and private investment and involves adding thousands of additional centrifuges at the plant to enable large-scale production. LEU has already raised more than $1.2 billion through two convertible note offerings over the past 12 months and has secured contingent purchase commitments of more than $2 billion from utility customers. The company also signed a Memorandum of Understanding (MOU) with Korea Hydro & Nuclear Power (“KHNP”) and POSCO International to bring private capital into the Piketon expansion.

Centrus Energy is the only company with a license for HALEU production to supply commercial and national security needs. Under its HALEU Operation Contract with the DOE, it has already delivered 920 kilograms of HALEU and has moved into Phase III.

HALEU is expected to be needed in the next few years to power both existing reactors and a new generation of advanced reactors to meet the world’s growing need for carbon-free electricity. While low-enriched uranium contains uranium concentration below 5%, HALEU offers concentration in the range of 5-20% with advantages such as improved efficiency, extended fuel cycles and lower waste.

Cameco's tier-one mining and milling operations have the licensed capacity to produce more than 30 million pounds (its share) of uranium concentrates annually. It holds some of the world's most promising uranium projects and continues to invest in ongoing exploration activities. Cameco accounted for 16% of global uranium production in 2024.

CCJ is also a leading supplier of uranium refining, conversion and fuel manufacturing services. Its ownership stakes in Westinghouse and Global Laser Enrichment (GLE) further strengthen opportunities across the nuclear fuel cycle.

Cameco’s revenues climbed 47% year over year to CAD 877 million ($634 million) and adjusted earnings per share surged 373% to CAD 0.71 ($0.51).

Cameco’s uranium revenues increased 47% to CAD 705 million ($510 million). The company sold 8.7 million pounds of uranium, 40% higher than in the second quarter of 2024. Despite a 17% decline in the average U.S. dollar spot price for uranium, the Canadian dollar average realized price increased 5% to CAD 81.03 per pound due to the impact of fixed price contracts.

In Fuel Services, production volume moved up 10% year over year to 3.2 million kgUs and sales volume surged 52% to 4.4 million kgUs. The segment witnessed a 37% rise in revenues to CAD 162 million ($117 million), with higher volumes being offset by lower average realized prices.

The earnings improvement in the quarter was mainly attributed to stronger equity earnings reflecting Cameco’s 49% investment in Westinghouse Electric Company.

Cameco recently lowered its share of production expectation at 9.8-10.5 million pounds from the McArthur River mine due to development delays in transitioning the mine to new mining areas, as well as slower-than-anticipated ground freezing. However, the expected share from the Cigar Lake mine is maintained at 9.8 million pounds. Backed by Cigar Lake’s upbeat performance in the first half and expecting the momentum to continue, Cameco expects it will likely help set off up to 1 million pounds (100% basis) of the production shortfall at the McArthur River.

Cameco has delivered 15.6 million pounds of uranium so far in 2025, reaching the halfway mark of its full-year target of 31–34 million pounds. The company also plans to make market purchases of up to 3 million pounds and committed purchases (including Inkai) at 9 million pounds. Prior to lowering the outlook for the McArthur River mine, the company had provided a uranium revenue projection for 2025 at CAD 2.8–3.0 billion, with average prices at $87 per pound. Fuel services revenues are projected at CAD 500-550 million for 2025. This takes the total revenue guidance for 2025 to CAD 3.3-3.550 billion. The company had reported CAD 3.136 billion in revenues in 2024.

Cameco expects its share of adjusted EBITDA from Westinghouse to be higher, at $525-$580 million, for 2025. The improvement stems from Westinghouse’s participation in the construction project for two nuclear reactors at the Dukovany power plant in the Czech Republic. Over the next five years, Cameco’s share of adjusted EBITDA is projected to witness a compound annual growth rate of 6-10%.

CCJ continues to invest in increasing production and capitalizing on market opportunities. Work is underway to extend the mine life at Cigar Lake to 2036. Cameco is also increasing production at McArthur River and Key Lake from 18 million pounds to its licensed annual capacity of 25 million pounds (100% basis).

Cameco recently inked a long-term agreement to supply natural uranium hexafluoride (UF6) to Slovenské elektrárne, Slovakia’s largest electricity producer. This agreement, running through 2036, marks Cameco’s entry into the Slovakia market and underscores its strategy of expanding its global commercial footprint in nuclear fuel.

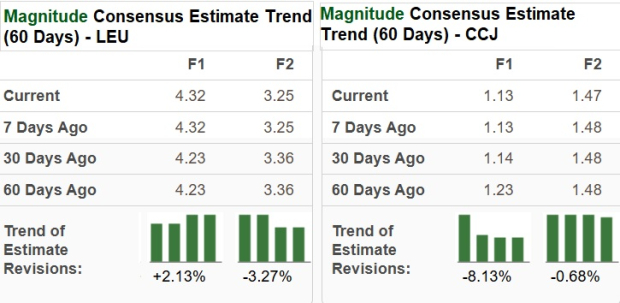

The Zacks Consensus Estimate for Centrus Energy’s 2025 revenues is $454.1 million, implying 2.7% growth from the year-ago quarter’s actual. The consensus mark for 2025 earnings is pegged at $4.32 per share, which indicates a year-over-year decline of 3.4%.

The consensus estimate for Centrus Energy’s 2026 revenues of $505.2 million indicates year-over-year growth of 11.2%. The estimate for earnings is pinned at $3.25 per share, indicating a year-over-year decline of 24.7%.

The Zacks Consensus Estimate for Cameco’s fiscal 2025 revenues is $2.54 billion, implying a 11.3% improvement from the prior year. The estimate for earnings is at $1.13 per share, indicating 130.6% year-over-year growth.

The consensus estimate for Cameco’s 2026 revenues is $2.52 billion, which indicates a year-over-year dip of 0.95%. The consensus mark from earnings per share is $1.47 per share, projecting 30.2% year-over-year growth.

In the past 60 days, the earnings estimate for Centrus Energy has moved up for 2025 but moved down for 2026. Meanwhile, Cameco has experienced downward revisions, as shown in the chart below.

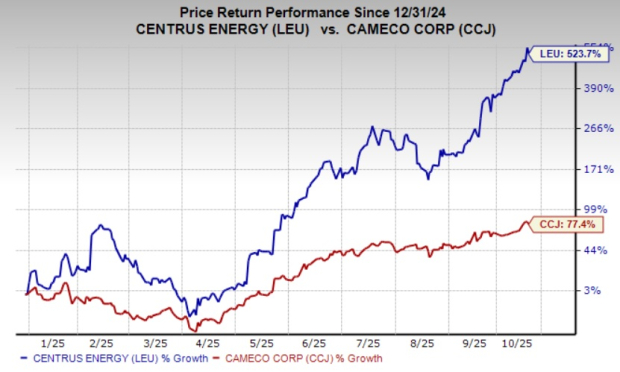

LEU shares have surged 523.7% year to date, while CCJ shares have gained 77.4%.

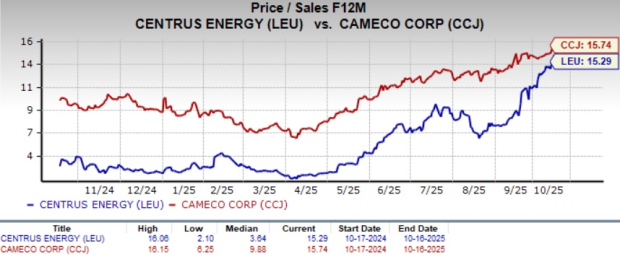

Centrus Energy is trading at a forward price-to-sales multiple of 15.29X. Cameco is trading higher, at a forward price-to-sales multiple of 15.74X.

Both Centrus Energy and Cameco are poised to thrive as nuclear energy gains global traction. Cameco offers scale, diversification and steady earnings visibility through its integrated fuel cycle and Westinghouse investment. However, Centrus Energy is uniquely positioned to drive the next phase of nuclear innovation through HALEU production.

Both stocks currently have a Zacks Rank #3 (Hold) each, which makes choosing one a difficult task. LEU currently looks more attractive from a valuation and price performance standpoint. Meanwhile, Cameco is seeing downward estimate revisions due to its revised production guidance. Given these factors, Centrus Energy is the more appealing option at the moment.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite