|

|

|

|

|||||

|

|

Amazon is one of the world's most diverse technology companies, with dominant positions in e-commerce, cloud computing, streaming, digital advertising, and more.

Amazon is weaving artificial intelligence (AI) into all of its businesses, and it's driving a surge in the company's earnings.

Amazon is scheduled to report its third-quarter operating results on Oct. 30, and recent history suggests it could beat Wall Street's expectations.

Throughout October and November, many of America's largest companies will report their results for the quarter that ended Sept. 30. Folks on Wall Street will be particularly focused on the leaders of the artificial intelligence (AI) boom, because those businesses have the potential to generate faster revenue and earnings growth than most of the rest of the market.

Amazon (NASDAQ: AMZN) is one of them, and it's scheduled to report its third-quarter results on Oct. 30. The company has taken a diversified approach to AI, deploying more than 1,000 applications across its e-commerce, cloud computing, streaming, and digital advertising businesses to boost its efficiency and create new opportunities to generate revenue.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Amazon has made a habit of beating Wall Street's expectations, which is why I think its stock could soar after the Q3 report arrives.

Image source: Amazon.

Amazon Web Services (AWS) is the largest cloud infrastructure provider in the world, with a 30% market share according to Statista's last report. It offers hundreds of services to help businesses thrive in the digital age, but it's also at the heart of Amazon's AI strategy. Through AWS, the company wants to dominate the three core layers of AI: infrastructure (data centers and chips), large language models (LLMs), and software.

The central role of AWS was felt on Monday, as a routine technical update went wrong and took down dozens of services for several hours. It's never good to see customers suffer cascading issues, but the event still underscored just how wide Amazon's online service reach is. The outage will not affect Amazon's third-quarter results, falling firmly in the fourth quarter, but management will surely discuss it.

Like most cloud providers, AWS fills many of its data centers with advanced chips from suppliers like Nvidia, However, the company also designed its own AI accelerator chips, the Inferentia and Trainium lines. Servers featuring Trainium2 chips, for example, can deliver up to 40% better price performance than GPU-based servers.

Through the AWS Bedrock platform, businesses can also access ready-made LLMs from top AI companies like Anthropic and Meta Platforms, which they can use to accelerate their own AI development. Amazon developed its own foundational LLM, Nova, which is more customizable than most third-party models, and it has become the second-most popular model on Bedrock.

Data centers and LLMs are the two key ingredients required for creating AI software, so AWS has to lead the pack on both fronts if it wants to remain the preferred cloud destination for businesses.

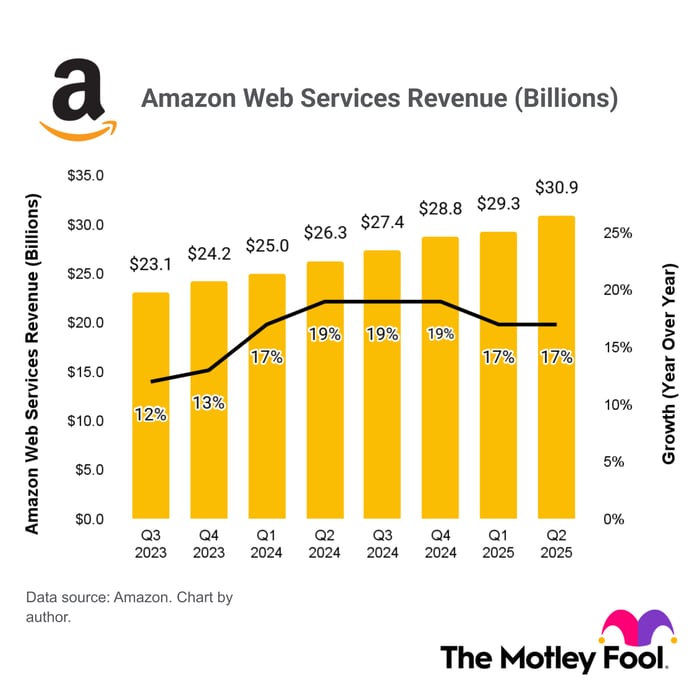

AWS generated $30.9 billion in revenue during the second quarter, which was up 17% year over year. However, Amazon CEO Andy Jassy said there continues to be more demand for the cloud provider's data center capacity than it can possibly supply, which is constraining its ability to generate even faster revenue growth.

However, Jassy said the supply-demand imbalance should improve with each passing quarter, so investors might see an acceleration in revenue growth for AWS when Amazon releases its third-quarter results.

AWS accounted for just 18% of Amazon's total revenue in the second quarter, but it contributed a whopping 57% of the company's operating income, so it's the profitability engine behind the entire organization. E-commerce -- which was Amazon's original business -- remains its single largest source of revenue, but it runs on razor-thin profit margins because it focuses on providing customers with the lowest possible prices.

Back in 2023, Amazon split its U.S. logistics network into eight regions, and the products stored in its fulfillment centers are now more specifically customized to their geographic locations. Goods now travel shorter distances to reach customers, which boosts profit margins by reducing costs. During the second quarter, the distance the average package traveled fell 12% year over year, and the number of touches per package declined by 15%.

This, combined with the continued strength in AWS, is driving a surge in Amazon's profits. The company's second-quarter earnings per share (EPS) jumped by 33% to $1.68, crushing Wall Street's estimate of $1.33. That followed 62% earnings growth in the first quarter, which also beat analysts' consensus forecast.

Topping Wall Street's estimates has become a habit for Amazon; it also delivered an average beat of 23% in each quarter of 2024. Wall Street will be looking for EPS of $1.56 when Amazon reports its third-quarter results, but an even better result seems likely.

One single quarter is unlikely to change Amazon's positive trajectory, especially considering the incredible amount of demand there is for AI services on AWS. Therefore, the stock could be a great addition to any diversified portfolio, especially considering its attractive valuation.

Based on Amazon's trailing 12-month EPS of $6.55, its stock is trading at a price-to-earnings (P/E) ratio of 32.5. That's a slight discount to the technology-heavy Nasdaq-100 index, which trades at a P/E ratio of 33.1. But it gets better, because Wall Street expects Amazon to generate $7.59 in EPS in 2026, placing its stock at a forward P/E ratio of just 27.9.

AMZN PE Ratio data by YCharts.

Since we know Amazon routinely beats Wall Street's estimates, its stock might be even cheaper right now than it appears.

Investors who are willing to own this stock for three to five years or more could do especially well if they buy it today, because that time frame will give the company sufficient time to create meaningful value from its AI initiatives.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 20, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

| 10 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

Marketplaces Are the Next Frontier in Publisher Deals With AI Companies

AMZN

The Wall Street Journal

|

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite