|

|

|

|

|||||

|

|

Globalstar, Inc. GSAT is accelerating its transformation with an infrastructure upgrade aimed at strengthening its satellite and ground network capabilities for long-term growth. The company’s latest initiatives underscore a clear focus on scalability, reliability and diversification across commercial, industrial and government markets.

At the center of this transformation is the C-3 Extended MSS Network, supported by a global ground infrastructure program. A major milestone was achieved with the installation of a six-meter tracking antenna at Globalstar’s Texas ground station, marking the start of a global upgrade that will include approximately 90 antennas deployed across 35 ground stations in 25 countries. This expansion is designed to boost network capacity, resilience and service continuity, even during terrestrial network failures.

Globalstar recently announced the deployment of new ground station equipment in Talkeetna, AK, its first installation at this existing teleport. The site will host two new six-meter tracking antennas to support the third-generation C-3 mobile satellite system. The company is also expanding its existing Wasilla ground station with two additional antennas. Together, these four new antennas will ensure high service quality and redundancy, enabling next-generation mobile satellite connectivity, including IoT and device-to-device solutions, critical for Alaska’s rugged terrain. The company also announced plans to double the size of its existing ground station in Estonia to support the third generation of its C-3 constellation. Previously, Globalstar announced the construction of another gateway infrastructure at its current ground station at OTE S.A.’s commercial teleport in Nemea, Greece and an expansion to its Singapore ground station.

These upgrades support growing demand for IoT and asset-tracking services while enabling scalability for future applications, including 5G non-terrestrial networks. For 2025, the company reiterated its revenue outlook of $260-$285 million and expects adjusted EBITDA margins around 50%.

On the satellite front, Globalstar is reinforcing its constellation through a new launch agreement with SpaceX to deploy nine additional satellites. These satellites, under construction by MDA, are scheduled for launch first in late 2025 and then in 2026 to replace the existing constellation and ensure service continuity.

However, the company faces stiff competition driven by rapid technological innovation and an increasing wave of new players entering the market alongside established providers. Players like Iridium Communications IRDM and Viasat, Inc. VSAT, both of which are expanding their satellite capabilities and service offerings to capture market share.

Iridium’s mobile and satellite communication network leverages the advanced interlinked mesh architecture of 66 operational satellites to provide global reach of its services across numerous territories. The company plans to build its next-generation network in the 2030s, delivering standards-based 5G/6G services directly to consumer devices for enhanced connectivity beyond cell towers. The network will also host Aireon and introduce space-based VHF services, supporting the aviation industry’s shift from ground-based to satellite communications. The company will also strengthen its role as a global alternative for PNT while continuing to deliver meaningful shareholder returns, leveraging its spectrum assets, partner ecosystem and proven strategy to sustain long-term leadership.

Viasat is benefiting from solid momentum in information security and cyber defense, space and mission systems. Its strong bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models. Strategic acquisitions to expand its portfolio serve as a positive factor. The impending launch of the ViaSat-3 Flight 2 satellite, which will double its bandwidth capacity, is a tailwind. Viasat recently announced it has secured a prime contract from the U.S. Space Force Space Systems Command (USSF SSC) for the Protected Tactical SATCOM-Global (PTS-G) program. Per the contract, Viasat will develop a dual-band X/ X/Ka-band satellite and anchor station architecture for providing secure, reliable and cost-effective communication capabilities to support evolving USSF and U.S. Department of War (DoW) missions.

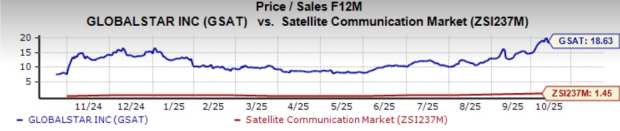

GSAT stock has gained 22.8% in the past month compared with the Zacks Satellite and Communication industry's 4.6% rise.

Globalstar stock is trading at a substantial premium, with a forward 12-month price/sales of 18.63X compared with the industry’s 1.45X.

GSAT’s estimates are on an upward trajectory at present. The consensus mark for 2025 earnings has been revised up 66.7% to a loss of 8 cents per share over the past 60 days and the same for 2026 has moved north 112.5% to 1 cent.

At present, GSAT carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Mar-01 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite