|

|

|

|

|||||

|

|

Circle Internet Group CRCL offers USDC stablecoin, which is redeemable on a one-for-one basis for U.S. dollars and is backed by reserves consisting of highly liquid, price-stable cash and cash equivalents. As of Oct. 16, $75.86 billion USDCs were in circulation, rising from $72.36 billion as of Sept. 11, $65.2 billion as of Aug. 10, 2025, and $61.3 billion at the end of the second quarter of 2025. An expanding partner base, which includes the likes of Kraken, Binance, Corpay, FIS, Fiserv, OKX, Finastra and Fireblocks, is noteworthy.

These factors have helped CRCL shares jump 56% since its initial public offering on June 5, outperforming both the Zacks Financial-Miscellaneous Services industry and the Zacks Finance sector. While the industry has appreciated 6.4%, the broader sector has risen 1.3% over the same time frame.

However, are these factors enough for investors to jump into CRCL stock? Let us dig deep to find out.

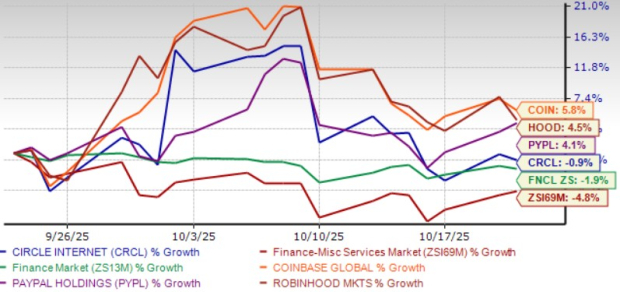

CRCL shares have underperformed peers, including Coinbase COIN, PayPal PYPL and Robinhood HOOD, in the past month. While Circle shares have dropped 0.9% in the past month, Coinbase, Robinhood and PayPal shares have appreciated 5.8%, 4.1% and 4.5%, respectively.

The underperformance in CRCL shares can be attributed to increasing concern over its prospects amid rising competition from Coinbase, PayPal and Robinhood. Coinbase has inked a deal with Shopify, which will allow consumers to pay with USDC on Base (Coinbase’s Ethereum layer-2 network) through Shopify Payments, bringing onchain payments to millions of storefronts. PayPal offers PayPal USD (PYUSD) while Robinhood is part of a coalition that has launched a stablecoin called USDG.

Circle shares are overvalued, as suggested by the Value Score of F.

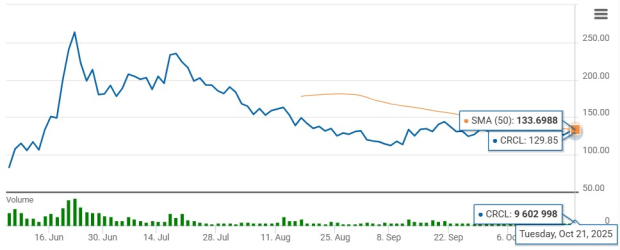

CRCL shares are also trading below the 50-day moving average, indicating a bearish trend.

An improving regulatory environment, including the passage of the GENIUS Act, provides a legal background to stablecoins like USDC, paving the way for more enterprise adoption. This bodes well for Circle, which has minted USDC worth $42.2 billion, up 21% year over year, in the second quarter of 2025. Meaningful wallets, defined as wallets holding more than $10 of USDC, surged 68% year over year as USDC adoption continues to expand globally.

The company launched Circle Payments Network in May, a platform for financial institutions to use stablecoins for payments, with more than 100 institutions in the pipeline. Currently, Hong Kong, Brazil, Nigeria and Mexico are the active payment corridors. Circle Gateway, introduced in July, enables seamless cross-chain USDC usage and is currently supported by eight new blockchain partners. Circle also introduced Arc, an open Layer-1 blockchain purpose-built for stablecoin finance and compatible with Ethereum infrastructure.

Circle has inked a partnership with Fireblocks under which the former’s stablecoin network will complement Fireblocks’ custody and payments infrastructure tools to provide cross-border treasury and tokenization asset settlement. The partnership with Finastra now enables banks to integrate USDC settlement into cross-border payment flows. FIS and Circle are enabling U.S. financial institutions to offer their customers the option to make domestic and cross-border stablecoin payments using USDC. The Kraken and Circle partnership will expand access to and the utility of USDC and EURC on the former’s platform.

Circle now offers a yield token, USYC, which can be used in both digital assets and traditional capital markets as collateral with anytime liquidity between USYC and USDC. The company’s expanded partnership with Binance now makes USYC available as collateral, thereby accelerating adoption.

For third-quarter 2025, the Zacks Consensus Estimate for Circle’s earnings has been unchanged at 16 cents per share over the past seven days. The consensus mark for revenues is pegged at $695.7 million.

Circle Internet Group, Inc. price-consensus-chart | Circle Internet Group, Inc. Quote

For 2025, the Zacks Consensus Estimate for CRCL’s loss has been unchanged at $1.97 per share over the past seven days. The consensus mark for 2025 revenues is pegged at $2.66 billion.

Improving regulatory environment and growing demand for stablecoins like USDC bode well for Circle’s long-term prospects. Hence, investors currently holding a long position should continue to stay put.

However, a stretched valuation and stiff competition make the CRCL stock a risky bet in the near term. Circle’s investments in building platform, capabilities and partnerships are expected to hike operating expenses, currently expected between $475 million and $490 million for 2025, implying a 20-24% growth rate. This is expected to keep margins under pressure in the near term.

Circle currently has a Zacks Rank #3 (Hold), which implies that investors should wait for a better entry point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 45 min | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite