|

|

|

|

|||||

|

|

Swiss pharma giant Roche Holding AG RHHBY reported sales of CHF 14.9 billion for the third quarter of 2025, up 6% year over year at constant exchange rates (CER), driven by the strong demand for its drugs.

The company reports under two divisions — Pharmaceuticals and Diagnostics. All growth rates mentioned below are on a year-over-year basis and at CER.

For the first nine months of 2025, sales totaled CHF 45.9 billion, up 7% at CER. Sales in the Pharmaceuticals Division grew 9% to CHF 35.5 billion, driven by strong growth in demand for its key drugs — Phesgo (breast cancer), Xolair (food allergies), Hemlibra (hemophilia A), Vabysmo (severe eye diseases) and Ocrevus (multiple sclerosis or MS).

The Diagnostics division’s sales totaled CHF 10.3 billion, up 1% as demand for pathology solutions and molecular diagnostics more than offset the impact of healthcare pricing reforms in China.

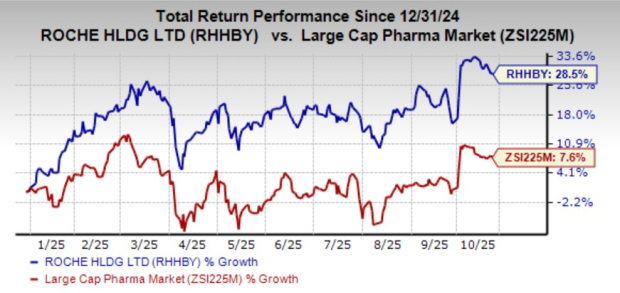

Roche’s shares have risen 28.5% year to date compared with the industry’s growth of 7.6%.

The top five growth drivers — Phesgo, Xolair, Hemlibra, Vabysmo and Ocrevus — generated total sales of CHF 15.8 billion, reflecting an increase of CHF 2.4 billion at CER compared to the first nine months of 2024.

The increase in the sales of these drugs offset the decline in sales of Avastin (various types of cancer), Herceptin (breast and gastric cancer), MabThera/Rituxan (blood cancer, rheumatoid arthritis), Lucentis (severe eye diseases) and Esbriet (lung disease) due to loss of exclusivity.

MS Ocrevus generated sales of $5.2 billion, up 7%.

Sales of hemophilia A drug Hemlibra surged 12% year over year to CHF 3.5 billion.

Vabysmo sales grew 13% to CHF 3 billion on strong demand in all regions.

Immuno-oncology drug Tecentriq’s (for advanced lung cancer, urothelial cancer and breast cancer) sales were up 1% to CHF 2.6 billion.

Perjeta’s sales were down 13% year over year to CHF 2.3 billion.

Xolair sales surged 34% to CHF 2.2 billion.

Actemra/RoActemra’s (rheumatoid arthritis and COVID-19) sales improved 2% year over year to CHF 1.9 billion.

Breast cancer drug Phesgo’s (a fixed-dose combination of Perjeta and Herceptin for subcutaneous injection) sales skyrocketed 54% year over year to CHF 1.8 billion.

Breast cancer drug Kadcyla generated sales of CHF 1.5 billion, up 8% during the said time frame.

Evrysdi generated sales of CHF 1.3 billion, up 8% year over year.

Sales of the lung cancer drug Alecensa rose 8% to CHF 1.2 billion.

Sales of blood cancer drug Polivy surged 40% to CHF 1.1 billion.

Sales of Rituxan/MabThera declined 4% to CHF 933 million due to biosimilar erosion.

Activase/TNKase sales totaled CHF 833 million, down 2%.

Herceptin sales plunged 19% on a year-over-year basis to CHF 817 million due to biosimilar competition in various countries.

Sales of Avastin, approved for multiple oncology indications, were down 15% to CHF 763 million due to biosimilar competition.

Blood cancer drug Gazyva/Gazyvaro’s sales totaled CHF 728 million, up 13% year over year.

Pulmozyme (cystic fibrosis) sales rose 16% year over year to CHF 361 million.

Roche continues to expect total sales to grow in the mid-single-digit range (at CER) in 2025. Core earnings per share are expected to grow in the high single-digit to low double-digit range (previous guidance: high single digit range). Roche expects to increase its dividend in Swiss francs further.

The FDA approved label expansion of Gazyva/Gazyvaro for the treatment of lupus nephritis.

The regulatory body also approved Tecentriq plus lurbinectedin as first-line maintenance therapy for extensive-stage small cell lung cancer (ES-SCLC).

Roche recently announced positive results from the phase III evERA study on giredestrant for breast cancer. Data showed that giredestrant in combination with everolimus significantly reduced the risk of disease progression or death by 44% and 62% in the intention-to-treat (ITT) and ESR1-mutated populations, respectively, compared with standard-of-care endocrine therapy plus everolimus.

Roche is all set to acquire 89bio, Inc. ETNB for $3.5 billion in a bid to augment its portfolio in cardiovascular, renal, and metabolic diseases (CVRM).

The acquisition will add 89bio’s pegozafermin to RHHBY’s pipeline. Pegozafermin is a glycoPEGylated analog of fibroblast growth factor 21 (FGF21), currently in late-stage development for metabolic dysfunction-associated steatohepatitis (MASH) in moderate and severe fibrotic patients (F2 and F3 stages) as well as cirrhotic patients (F4 stage).

Roche and partner Alnylam ALNY advanced zilebesiran into a global phase III cardiovascular outcomes trial for people with uncontrolled hypertension.

The decision was based on encouraging data from the phase II KARDIA program.

Alnylam entered into a strategic collaboration with Roche to co-develop and co-commercialize zilebesiran for the treatment of hypertension in 2023.

Roche’s performance in the first nine months of 2025 was good, as high demand for key drugs offset the decline in sales of legacy drugs. MS drug Ocrevus and ophthalmology drug Vabysmo continued their stellar performances.

Vabysmo's performance has been phenomenal in the past couple of years, and the drug has given stiff competition to Regeneron’s REGN ophthalmology drug Eylea, which was one of the leading ophthalmology drugs.

Regeneron co-developed Eylea with Bayer.

Growth in hemophilia treatment Hemlibra and breast cancer drug Phesgo also boosted RHHBY’s top line.

However, loss of exclusivity for key drugs continues to adversely impact top-line growth in 2025.

Roche currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 6 hours | |

| 12 hours | |

| 13 hours | |

| Feb-26 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite