|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

West Pharmaceutical Services, Inc. WST delivered adjusted third-quarter 2025 earnings per share (EPS) of $1.96, which moved up 5.9% year over year. The figure topped the Zacks Consensus Estimate by 17.4%.

The adjustments include expenses related to the amortization of acquisition-related intangible assets, among others.

GAAP EPS for the quarter was $1.92, reflecting an improvement of 3.8% from the year-ago figure.

Quarterly revenues of $804.6 million were up 7.7% year over year and surpassed the Zacks Consensus Estimate by 2.4%.

Organic net sales, which exclude the impact of acquisitions and/or divestitures, were up 5% year over year.

Robustperformances by the Proprietary Products and Contract-Manufactured Products segments drove thetop-line improvement.

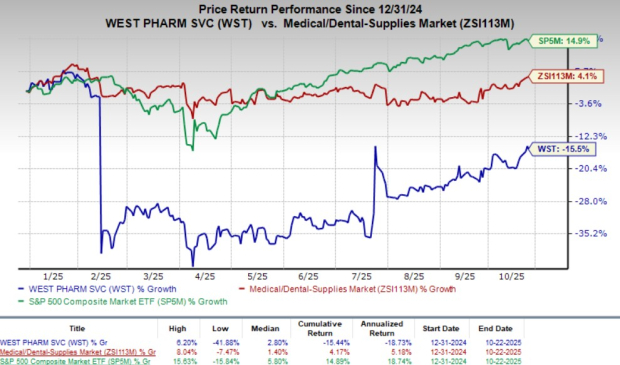

Shares of WST were up nearly 6.7% in today’s pre-market trading. The company’s shares have lost 15.5% so far this year against the industry’s growth of 4.1%. The S&P 500 Index has increased 14.9% in the said period.

WST operates under two segments — Proprietary Products and Contract-Manufactured Products.

In the quarter under review, Proprietary Products reported worldwide revenues of $647.5 million, up 7.7% year over year on a reported basis. Our estimate for the segment’s revenues was pinned at $638 million.

On an organic basis, revenues were up 5.1% year over year.

Thesegment’s high-value product (HVP) accounted for 48% of its net sales during the period.Sales of HVP components were up 16.3%, driven by strength in Westar and Envision products. HVP Delivery Devices, which represented 12% of total company net sales, decreased 15.7%. The decline was primarily due to the absence of a one-time fee of $19 million recorded in the year-ago quarter. Standard Products, 20% of total company net sales, increased 6.7%.

Revenues in the Contract-Manufactured Products segment totaled $157.1 million, up 8% year over year on a reported basis. This growth was driven by an increase in sales of self-injection devices for obesity and diabetes, partially offset by a decrease in sales of healthcare diagnostic devices. Our estimate for this segment’s third-quarter revenues was pegged at $148.8 million.

Organically, revenues were up 4.9% year over year.

In the quarter under review, West Pharmaceutical’s gross profit increased 11.2% year over year to $294.3 million. The gross margin expanded 120 basis points (bps) to 36.6%. We had projected 33.6% of gross margin for the third quarter of 2025.

Selling, general and administrative expenses increased 23% year over year to $102.7 million. Research and development expenses increased 10.3% to $17.1 million.

Adjusted operating profit totaled $170.1 million, reflecting a 5.9% improvement from the year-ago quarter’s level. The adjusted operating margin contracted 40 bps to 21.1%. We had projected 18.2% of operating margin for the quarter.

WST exited the third quarter with cash and cash equivalents of $628.5 million compared with $509.7 million as of June-end. Total debt at the end of the reported quarter was $202.7 million, which remained almost flat sequentially.

Cumulative net cash provided by continuing operating activities at the end of the third quarter was $503.7 million compared with $463.3 million a year ago.

West Pharmaceutical has a consistent dividend-paying history, with a five-year annualized dividend growth rate of 5.21%.

West Pharmaceutical has issued fourth-quarter guidance and updated its financial outlook for 2025.

WST expects its fourth-quarter sales to lie between $790 million and $800 million, implying organic growth of 1-2.3%. The company expects EPS to be in the range of $1.81-$1.86, which assumes a 14 cents benefit based on current foreign exchange rates. The Zacks Consensus Estimate for fourth-quarter sales and EPS is pegged at $792.7 million and $1.77, respectively.

WST now projects full-year revenues to be between $3.06 billion and $3.07 billion (up from its previous guidance of $3.04-$3.06 billion). The Zacks Consensus Estimate is pegged at $3.04 billion.

For 2025, organic net sales are expected to grow 3.75-4% from the prior-year level.

For the full year, adjusted EPS is now anticipated to be in the range of $7.06-$7.11 (up from the previous guidance of $6.65-$6.85). Full-year EPS guidance now reflects a 27 cents tailwind from currency movement against previous guidance of no impact. The Zacks Consensus Estimate is pegged at $6.74.

West Pharmaceutical Services, Inc. price-consensus-eps-surprise-chart | West Pharmaceutical Services, Inc. Quote

West Pharmaceutical exited the third quarter of 2025 with better-than-expected results. Solid top-line results, along with improvements in organic revenues, were impressive. Robust performance by the Proprietary Products segment was encouraging. Strength in HVP and robust growth in the Biologics and Pharma market units during the reported quarter were also promising.

West Pharmaceutical Services strong quarterly performance underscores the resilience of its diversified portfolio and continued execution across both Proprietary and Contract Manufacturing segments. Growth in High-Value Product components remains a key driver, supported by rising demand for GLP-1 related products and Annex 1 conversions.

The company’s operational discipline and strategic focus on innovation, quality, and customer partnerships continue to strengthen its competitive position in the injectable solutions market. Leadership enhancements, including the appointment of a new CFO, further reinforce West Pharmaceutical’s focus on long-term growth and operational excellence. With improving market conditions and strong momentum in its core businesses, West Pharmaceutical has raised its full-year outlook, reflecting confidence in sustained performance through the remainder of the year.

WST currently carries a Zacks Rank #3 (Sell).

Some better-ranked stocks in the broader medical space are Boston Scientific Corporation BSX, Merit Medical Systems MMSI and Masimo Corporation MASI.

Boston Scientific, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 8.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Boston Scientific’s shares have gained 14.2% against the industry’s 0.4% decline in the past year.

Merit Medical, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.8%. MMSI’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 12.92%.

Merit Medical has declined 11.8% against the industry’s 4.6% gain in the past year.

Masimo, carrying a Zacks Rank of 2 at present, has an estimated growth rate of 20.5% for 2025. MASI’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 13.8%.

Masimo’s shares have gained 2.3% against the industry’s 12.1% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite