|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Cadence Design Systems, Inc. CDNS will release results for the third quarter of 2025 on Oct. 27.

The Zacks Consensus Estimate for third-quarter 2025 earnings has been unchanged in the past 60 days at $1.79 per share. The consensus mark implies an increase of 9.2% from the year-ago actual. The Zacks Consensus Estimate for revenues is pegged at $1.32 billion, indicating a nearly 9% uptick from the year-ago actual.

Management expects revenues to be in the $1.305-$1.335 billion band for the third quarter. Revenues were $1.215 billion in the year-ago quarter. Non-GAAP EPS is anticipated to be between $1.75 and $1.81 compared with $1.64 in the year-ago quarter.

Cadence has an impressive earnings surprise history. The company’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 6.9%.

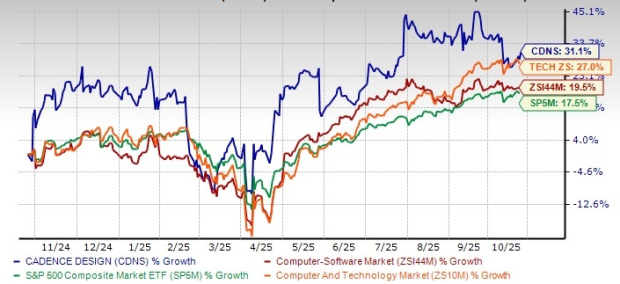

CDNS stock has gained 31.1% in the past year compared with its Computer-Software industry’s growth of 19.5%. The S&P 500 composite and the Zacks Computer and Technology sector have risen 17.5% and 27%, respectively, in the same time frame.

AI is driving a major transformation in semiconductor and system design and Cadence is deeply integrated into this shift. Design activity across several verticals, especially data centers and automotive, has been robust, due to AI, hyperscale computing and 5G. The focus on Generative AI, Agentic AI and Physical AI has been leading to an exponential increase in computing demand and semiconductor innovation.

Customers have been significantly increasing their R&D budgets in AI-driven automation. On the last earnings call, Cadence highlighted that its efforts to unify EDA, IP, 3D-IC, PCB and system analysis have been aiding in capitalizing on the opportunity presented by the AI super cycle.

These factors are likely to have driven demand for Cadence’s solutions, particularly its AI portfolio, in the to-be-reported quarter. Cadence.AI portfolio is powered by autonomous silicon agents and built the JedAI platform using NVIDIA accelerated compute capacity.

Cadence Design Systems, Inc. price-eps-surprise | Cadence Design Systems, Inc. Quote

Cadence’s ratable software model, strong backlog and high mix of recurring revenues are other positives. At the end of the second quarter, Cadence had a backlog of $6.4 billion and current-remaining performance obligations of $3.1 billion.

It has been collaborating with several tech giants, including Qualcomm and NVIDIA, on their next-generation AI designs across both training and inference. Expanding partnerships with its foundry partners like Taiwan Semiconductor Manufacturing, Intel and Arm Holdings bodes well.

Ongoing uncertainty prevailing over global macroeconomic conditions, especially U.S.-China tech tensions, along with stiff competition in the EDA space, and inflation, remain concerns.

Core electronic design automation (“EDA”) business (which constitutes Custom IC, Digital IC and Functional Verification businesses) is likely to have gained from demand for the new hardware systems, especially among AI, automotive and HPC clients, along with the rapid adoption of digital full-flow solutions and the Virtuoso and Spectre X circuit simulator.

In the second quarter, CDNS launched Cerebrus AI Studio (an agentic AI multi-block and multi-user SoC design platform) and Millennium M2000 AI Supercomputer, which are likely to have witnessed steady traction as companies continue to build their next-gen AI and agentic-AI products, amid increasing chip complexity. Momentum in the verification software suite (Verisium, Xcelium and Jasper) is expected to have acted as a tailwind. Our estimate for revenues from Core EDA is pegged at $962.4 million, indicating year-over-year growth of 13.1%.

The System Design and Analysis division is likely to have gained from the increasing demand for 3DIC technologies, Allegro X PCB and AI-powered Advanced Substrate Router, Clarity and Celsius solvers. CDNS’ digital twin Reality datacenter product is likely to have gained traction with large hyperscalers and cloud service providers.

In September, Cadence announced a major expansion of its Cadence Reality Digital Twin Platform with the addition of a digital twin of NVIDIA DGX SuperPOD with DGX GB200 systems. Our estimate for revenues from System Design and Analysis is pegged at $187.9 million, indicating a year-over-year decline of 3.4%.

Increasing demand for solutions (PCIe, UCIe, DDR and HBM) in AI, foundry ecosystem buildout and chiplet use cases is likely to have cushioned the performance of the IP business division. We expect revenues to be up 1.5% to $172.7 million on a year-over-year basis in the to-be-reported quarter.

On Sept. 4, 2025, Cadence signed a definitive agreement to acquire the Design & Engineering division of Hexagon AB, including its renowned MSC Software business, an industry pioneer in engineering simulation and analysis. The €2.7 billion deal, structured with 70% cash and 30% Cadence common stock, marks a significant step in advancing Cadence’s Intelligent System Design strategy. Pending regulatory approvals and customary closing conditions, the transaction is expected to be finalized in the first quarter of 2026.

On Aug. 27, 2025, Cadence completed its acquisition of Arm’s Artisan foundation IP business — covering standard cell libraries, memory compilers and GPIOs optimized for advanced process nodes. The deal strengthens Cadence’s design IP portfolio, adding to its leadership in protocol, memory interface and SerDes IP at advanced nodes.

Our proven model predicts an earnings beat for Cadence this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is exactly the case here.

CDNS currently has a Zacks Rank #2 and an Earnings ESP of +2.24%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Here are a few other stocks that you may want to consider, as our model shows that these, too, have the right combination of elements to post an earnings beat this season.

Western Digital Corporation WDC currently has an Earnings ESP of +1.11% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

WDC is scheduled to report quarterly earnings on Oct. 30. The Zacks Consensus Estimate for WDC’s to-be-reported quarter’s earnings and revenues is pegged at $1.58 per share and $2.7 billion, respectively. Shares of WDC have gained 81% in the past year.

Amazon.com, Inc. AMZN has an Earnings ESP of +16.76% and a Zacks Rank #1 at present. AMZN is scheduled to report quarterly figures on Oct. 30. The Zacks Consensus Estimate for AMZN’s to-be-reported quarter’s earnings and revenues is pegged at $1.60 per share and $177.99 billion, respectively. Shares of AMZN have gained 17.3% in the past year.

InterDigital, Inc. IDCC has an Earnings ESP of +17.32% and a Zacks Rank #1 at present. It is scheduled to report quarterly figures on Oct. 30. The Zacks Consensus Estimate for IDCC’s to-be-reported quarter’s earnings and revenues is pegged at $1.79 per share and $147.53 million, respectively. Shares of IDCC have gained 154.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite