|

|

|

|

|||||

|

|

Biotech giant Bristol-Myers Squibb Company BMY is scheduled to report third-quarter 2025 results on Oct. 30, before market open. The Zacks Consensus Estimate for sales and earnings is pegged at $11.83 billion and $1.51 per share, respectively.

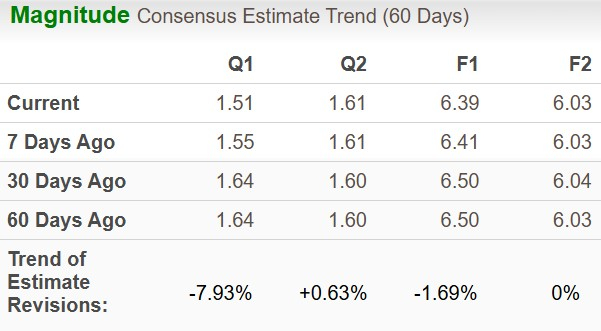

Earnings estimate for 2025 has decreased to $6.39 from $6.50 per share over the past 30 days, while that for 2026 has declined to $6.03 from $6.04.

BMY has an excellent track record. Its earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 22.71%. In the previously reported quarter, the company’s earnings beat estimates by 36.45%.

Per our proven model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Earnings ESP for BMY is -1.03%. The company currently carries a Zacks Rank #3. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

BMY’s top line has likely gained from an increase in growth portfolio sales. The growth portfolio primarily comprises Opdivo, Orencia, Yervoy, Reblozyl, Opdualag, Abecma, Zeposia, Breyanzi, Camzyos, Sotyku, Krazati and others.

Consistent label expansions in newer metastatic and adjuvant indications (MSI-high colorectal cancer and first-line non-small cell lung cancer) have likely maintained momentum for immuno-oncology drug Opdivo in the third quarter. The Zacks Consensus Estimate and our model estimate for Opdivo sales are pegged at $2.43 billion and $2.37 billion, respectively.

The FDA had earlier granted approval to Opdivo Qvantig (nivolumab and hyaluronidase-nvhy) injection for subcutaneous use. The initial uptake has been strong and sales have likely seen good momentum in the third quarter as well.

The Zacks Consensus Estimate and our model estimate for Orencia sales are pegged at $937 million and $947.3 million, respectively.

The Zacks Consensus Estimate and our model estimate for Yervoy sales are pegged at $687 million and $658.5 million, respectively.

Reblozyl posted solid growth in both the U.S. and international markets in the last reported quarter. Sales in the United States are being driven by strong demand in first-line ring sideroblasts (RS) positive and RS-negative myelodysplastic syndromes-associated anemia. International sales growth, driven by strong launches in new markets, has also likely boosted sales of this drug in the third quarter.

The Zacks Consensus Estimate and our model estimate for Reblozyl sales are pegged at $583 million and $598 million, respectively.

The Zacks Consensus Estimate and our model estimate for Opdualag sales are pegged at $292 million and $294.8 million, respectively.

Breyanzi sales have likely benefited from strong demand growth across all its approved indications. BMY expects strong growth in the second half of 2025 as well but sales will be skewed more toward the fourth quarter as the third quarter normalizes.

The Zacks Consensus Estimate and our model estimate for Breyanzi sales are pegged at $329 million and $352.5 million, respectively.

Camzyos sales have likely seen strong growth, driven by increased demand in the United States on the back of new patient starts and higher demand in newly launched markets outside the country. The drug is expected to record steady growth in 2025 due to its compelling efficacy and safety profile in obstructive HCM.

The newly launched schizophrenia drug Cobenfy, too, is off to a solid start, and sales have likely grown sequentially in the third quarter.

Increase in demand for psoriasis drug Sotyktu has likely been partially offset by higher rebates.

However, total quarterly revenues in the third quarter have likely been adversely impacted by a decline in sales from the legacy portfolio, which includes Eliquis, Revlimid, Pomalyst, Sprycel and Abraxane, among others.

Generic competition for Sprycel, Revlimid, Abraxane and Pomalyst has likely pulled down revenues from this portfolio.

The Zacks Consensus Estimate for Pomalyst’s third-quarter sales is pegged at $659 million and our model estimate for the same is pinned at $657 million.

Strong demand in international markets boosted Eliquis sales in the second quarter and the trend has likely prevailed in the third quarter. The Zacks Consensus Estimate and our model estimate for Eliquis’ third-quarter sales are pegged at $3.6 billion and $3.5 billion, respectively.

Bristol-Myers collaborated with Pfizer PFE for Eliquis in 2007. Profits and losses are shared equally worldwide, except in certain countries where Pfizer commercializes Eliquis and pays BMY a sales-based fee.

BMY expects operating expenses to be higher in the second half of the year compared to the first half, reflecting timing of investments, including the recently signed business development deals.

Consequently, operating expenses are likely to have increased in the to-be-reported quarter.

Shares of BMY have lost 18.7% year to date against the industry’s growth of 11.1%. The stock has also underperformed the sector and the S&P 500 in this timeframe.

Going by the price/earnings ratio, BMY’s shares currently trade at 7.19x forward earnings, lower than its mean of 8.43x and 15.59x for the large-cap pharma industry.

Legacy portfolio sales accounted for 48% of total sales in the first half of 2025 and a continued decline in its sales might have adversely impacted top-line growth.

While drugs like Reblozyl, Breyanzi, Camzyos and Opdualag have enabled BMY to somewhat stabilize its revenue base, these drugs will take some time to fully offset the decline in legacy drug sales.

Nonetheless, approval of additional new drugs and label expansion of top drugs should further diversify its pipeline.

The approval of Cobenfy for schizophrenia broadens BMY’s portfolio and validates the acquisition of Karuna Therapeutics. Cobenfy represents the first new pharmacological approach to treating schizophrenia in decades.

BMY made strategic acquisitions to augment its product portfolio, and these seem to be paying off now. However, there is a long way to go. On the other hand, the company has taken on colossal debt to finance these acquisitions.

BMY has recently collaborated with BioNTech BNTX for the global co-development and co-commercialization of the latter’s investigational bispecific antibody BNT327 across numerous solid tumor types.

BNT327, a next-generation bispecific antibody candidate, targets PD-L1 and VEGF-A. BMY and BNTX will jointly share development and manufacturing costs along with profits on an equal basis.

While BMY’s efforts to revive the top line in the face of generic challenges for key drugs are commendable, the company still has a few challenges to navigate.

Irrespective of how the third-quarter results play out, we recommend prospective investors to wait and watch how BMY wades through these challenges before turning positive.

For investors already owning the stock, staying invested would be a prudent move. The company’s attractive dividend yield is a strong positive.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite