|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Seagate Technology Holdings plc (STX) is scheduled to report first-quarter fiscal 2026 earnings on Oct. 28, after the closing bell.

The Zacks Consensus Estimate for earnings is pegged at $2.36 per share, suggesting a rise of 49.4% year over year. The Zacks Consensus Estimate for revenues is currently pegged at $2.53 billion, indicating a 16.7% uptick from the year-ago actual.

Management anticipates first-quarter revenues of $2.5 billion (+/- $150 million). At the midpoint, this indicates a 15% year-over-year improvement. Non-GAAP earnings are expected to be $2.3 per share (+/- 20 cents).

STX’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 7%.

Our proven model predicts an earnings beat for Seagate this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is exactly the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Seagate has an Earnings ESP of +2.54% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Higher demand for mass capacity storage solutions, owing to robust nearline cloud storage demand, is likely to have aided Seagate’s performance in the fiscal first quarter. In the last reported quarter, revenues from mass capacity devices jumped 40% year over year to $2 billion, driven by stronger nearline cloud demand and rising nearline enterprise sales. The increasing demand for mass-capacity storage continues to align with cloud investment cycles and the expansion of AI-ready data center infrastructure.

Cloud service providers (CSPs) are increasingly prioritizing AI application development and infrastructure buildout. Seagate considers HDDs essential for supporting these phases of AI adoption and expects HDD demand to have accelerated in the quarter under discussion. With about 50% of global data centers in just four countries, evolving data sovereignty rules are driving demand for local storage. In this environment, mass capacity hard drives offer the right mix of space, efficiency and cost, helping ensure data is secure and compliant. Seagate expects enterprise edge storage to follow the cloud trend, with AI investments fueling long-term demand.

Management anticipates strong performance driven by the adoption of HAMR, margin growth and a disciplined capital allocation strategy. The launch of the Mozaic 3+ hard drive platform in 2024 positions it well to gain market share in the mass capacity storage solutions sector. Mozaic 3+ incorporates HAMR technology, which enables denser data storage by applying heat to a small area of the drive. Since its HAMR-based Mozaic drives are the industry’s only products offering 3 terabytes per disk, cloud customers are eager to obtain them. Seagate is increasing volume production of Mozaic 3+ products by utilizing common features across its PMR and HAMR platforms.

We expect mass capacity revenues to be up 22.5% year over year to $2.1 billion in the fiscal first quarter. Our estimate for revenues from the HDD segment is pegged at $2.35 million, indicating an increase of 17.4% from the year-ago actual. The estimate for the non-HDD (which includes enterprise data solutions, cloud systems and solid-state drives) segment is pegged at $161.5 million, down 1.5% from the prior-year level.

STX’s margin performance continues to improve due to a favorable product mix driven by higher adoption of its latest-generation offerings and ongoing pricing optimization. We estimate gross margin to be 39.4% for the fiscal first quarter, significantly up from 33.3% recorded in the prior-year quarter. It achieved a record gross margin of 37.9%, up about 700 basis points in the last reported quarter. Moreover, its robust cash flow funds innovation and growth while supporting dividends and buybacks. Management expects higher free cash flow in the second half of 2025, with share repurchases set to resume. A strong product pipeline and shifts in the business model position STX for higher profitability and steady dividends in fiscal 2026.

However, Seagate generates a major chunk of its revenue internationally, exposing it to forex fluctuations. A weaker euro or pound against the dollar can negatively impact its performance and growth. Management also faces challenges from global macro factors, such as tariff uncertainty and rising debt levels.

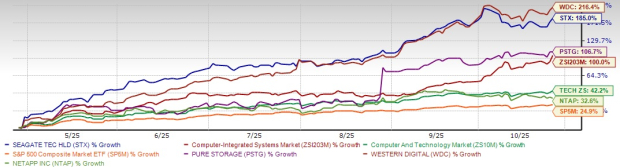

STX shares have gained 185% in the past six months, outperforming the Zacks Computer-Integrated Systems industry’s growth of 100%. The stock has also outperformed the Zacks Computer & Technology sector and the S&P 500’s growth of 42.2% and 24.9%, respectively.

The company has outpaced its competitors in the broader storage space, like Pure Storage (PSTG) and NetApp, Inc. (NTAP), while lagging behind its cut-throat rival in the HDD space, Western Digital Corporation (WDC). WDC has gained 216.4%, while PSTG and NTAP have gained 106.7% and 32.6%, respectively, during the same time frame.

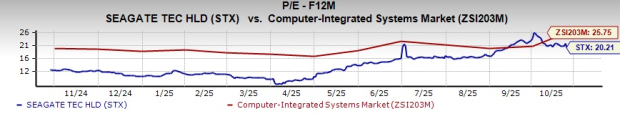

From a valuation standpoint, STX appears to be trading relatively cheaper compared to the industry but trading above its mean. Going by the price/earnings ratio, the company shares currently trade at 20.21 forward earnings, lower than 25.75 for the industry but above the stock’s mean of 11.84.

WDC, PSTG and NTAP are trading at multiples of 18.12X, 38.53X and 14.2X, respectively, compared with the Zacks Computer-Storage Devices industry’s multiple of 22X.

Strong demand for mass capacity storage and accelerating cloud and AI infrastructure investments drive STX’s growth. The company’s HAMR-based Mozaic 3+ platform strengthens its technology leadership and margin expansion, while a favorable product mix and disciplined capital allocation support rising profitability and cash returns. Despite currency and macro risks, Seagate’s structural business transformation, record margins and robust cash flow outlook position it well for continued shareholder value creation.

Investors should consider buying Seagate now because it is well-positioned to capitalize on surging AI and cloud-driven demand for mass-capacity storage.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite