|

|

|

|

|||||

|

|

The Zacks Utility - Electric Power industry presents a compelling case for stable, long-term income due to its regulated framework. This structure allows companies to recover costs and earn steady returns, reducing earnings volatility. With electricity demand remaining consistent across economic cycles and typically attractive dividend yields, utilities serve as a reliable, defensive option for income-oriented investors. Given the sector’s capital-intensive nature, the recent decline in interest rates is especially beneficial, lowering financing costs for long-term infrastructure projects.

The U.S. electric utilities industry is moving beyond its traditional image as a steady income provider, propelled by the accelerating shift toward clean energy. Significant investments in grid modernization, renewable integration and electrification are backed by federal incentives and climate-oriented policies, which are transforming the sector. Amid such a backdrop, let us focus on NextEra Energy NEE and American Electric Power AEP, which are leading U.S. electric utilities with major investments in renewable generation, grid modernization and stable dividend income, making them directly comparable for investors seeking steady returns and clean energy growth exposure.

NextEra Energy is recognized for its focus on renewable energy and sustainable growth. Through significant investments in wind, solar, battery storage and grid modernization, the company is spearheading the clean energy transition. As the parent of Florida Power & Light and NextEra Energy Resources, it manages one of the world’s largest portfolios of wind and solar projects. Backed by solid financials and a proven record of innovation, NEE offers investors a compelling mix of stability and long-term growth aligned with the green energy movement.

American Electric Power benefits from its robust regulated operations and strategic commitment to the clean energy transition. The company is channeling significant capital into renewable and nuclear generation, as well as grid modernization and transmission upgrades, to drive sustainable long-term growth. Backed by steady cash flows, reliable dividend payments and favorable regulatory support, AEP stands to gain from increasing power demand and ongoing decarbonization efforts. The company’s balanced focus on modernization and reliability reinforces its position as a stable, income-oriented utility leader.

NextEra Energy and American Electric Power are among the most influential players in the utility sector. A closer comparison of their fundamentals can help identify which stock offers the stronger investment opportunity.

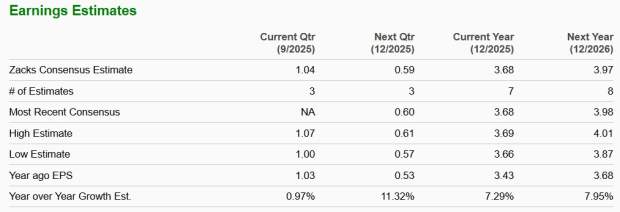

The Zacks Consensus Estimate for NextEra Energy’s earnings per share in 2025 and 2026 has increased year over year by 7.29% and 7.95%, respectively. Long-term (three to five years) earnings growth per share is pegged at 8.04%.

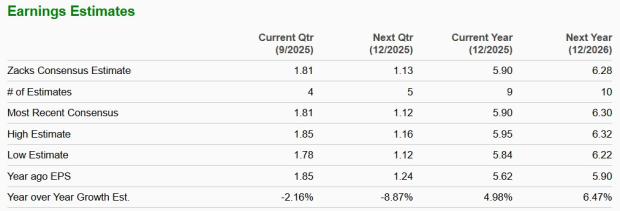

The Zacks Consensus Estimate for American Electric Power’s earnings per share in 2025 and 2026 has increased year over year by 4.98% and 6.47%, respectively. Long-term (three to five years) earnings growth per share is pegged at 6.43%.

The Zacks Utilities sector is a capital-intensive one and huge investments are required at regular intervals to upgrade, maintain and expand operations. The usage of new evolving technology also requires investments. So, the utilities borrow from the market and add it to their internal cash generation to fund the long-term investments. The decline in interest rates from historic highs is going to be beneficial for the capital-intensive utilities.

NextEra Energy’s debt-to-capital currently stands at 60.48% compared with American Electric Power’s 59.78%. Both companies are using debt to fund their business. Both NEE and AEP’s debt levels are marginally lower than the industry’s 61.16%.

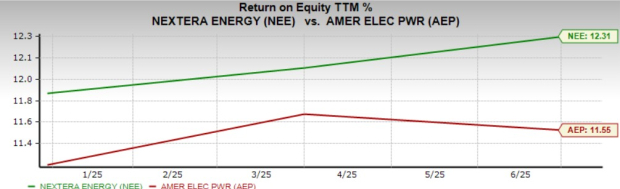

Return on Equity (“ROE”) is an important measure of financial performance that indicates how efficiently a company converts shareholder equity into profits. It highlights management’s effectiveness in utilizing invested capital to grow earnings and enhance shareholder value.

NEE’s current ROE is 12.31% compared with AEP’s 11.55%. Both companies also outperform the industry’s ROE of 10.35%.

Capital expenditure is critical in the sector, as it drives infrastructure development, system reliability and long-term growth. Utilities must consistently invest in power generation, transmission and distribution networks to meet rising demand, integrate renewable energy sources and comply with evolving regulatory standards.

NextEra Energy plans to invest nearly $74.6 billion in the 2025-2029 period to strengthen its infrastructure and add more clean electricity generation assets. American Electric Power plans to invest $54 billion in the 2025-2029 period to strengthen its electric transmission, distribution and generation infrastructure.

Dividends are regular payments made by a company to its shareholders and represent a direct way for investors to earn a return on their investment. They are an important indicator of a company’s financial health and stability, often signaling strong cash flow and consistent earnings. Utilities are known for regular dividend payments to their shareholders.

Currently, the dividend yield for NextEra Energy is 2.68%, while that for American Electric Power’s is 3.21%. The dividend yields of both companies are higher than the S&P 500’s yield of 1.49%.

NextEra Energy currently appears to trade at a premium compared with American Electric Power on a Price/Earnings Forward 12-month basis. (P/E- F12M).

NEE and AEP are currently trading at 21.53X and 18.67X, respectively, compared with the industry’s 15.45X.

NextEra Energy has gained 18.2% in the last three months compared with American Electric Power’s rally of 7.3% in the same time period.

NextEra Energy and American Electric Power are investing heavily in their infrastructure to serve millions of customers across the United States.

NEE’s better movement in earnings estimates, stronger ROE and wider capital expenditure plan make it a better choice in the utility space.

Based on the above discussion, NextEra Energy currently has an edge over American Electric Power, with both presently carrying a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 7 hours | |

| Feb-22 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite