|

|

|

|

|||||

|

|

Healthcare plan provider Centene Corporation CNC is set to report third-quarter 2025 results on Oct. 29, 2025, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is currently pegged at a loss of 21 cents per shareon revenues of $47.62 billion.

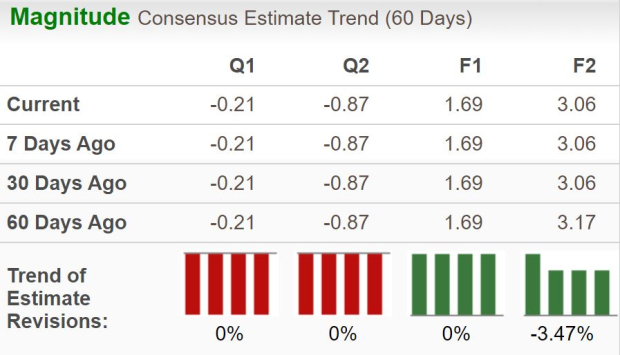

The third-quarter earnings estimate remained stable over the past 60 days. The bottom-line projection indicates a year-over-year plunge of 113%. However, the Zacks Consensus Estimate for quarterly revenues suggests a year-over-year growth of 13.3%.

For 2025, the Zacks Consensus Estimate for Centene’s revenues is pegged at $190.45 billion, implying a rise of 16.8% year over year. The consensus mark for 2025 EPS is pegged at $1.69, implying a decrease of 76.4%, year over year.

Centenebeat the earnings estimates in three of the last four quarters and missed once, with the average surprise being negative 5.2%. This is depicted in the figure below.

Centene Corporation price-eps-surprise | Centene Corporation Quote

Our proven model does not conclusively predict an earnings beat for the company this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat. That’s not the case here.

CNC has an Earnings ESP of 0.00% and a Zacks Rank #5 (Strong Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Zacks Consensus Estimate for the company’s total commercial memberships indicates a 26.6% year-over-year increase, whereas our model estimate predicts a 23.1% growth, primarily due to growth in the commercial marketplace. Both the consensus estimate and our model estimate for Medicare PDP memberships signal nearly 17% growth from the year-ago quarter.

The Zacks Consensus Estimate projects the company’s premium growth at about 19% year over year, in line with our model forecasts. This is likely to have supported top-line growth in the to-be-reported quarter.

However, the Zacks Consensus Estimate for total membership indicates a 2.2% year-over-year decline, due to decreases in Medicaid and Medicare memberships. Both the consensus estimate and our model estimate for the company’s total Medicaid memberships indicate a nearly 2% decline from a year ago.

The consensus estimate for service revenues indicates a 7.2% fall from the year-ago quarter’s $784 million. Also, the Zacks Consensus Estimate for the company’s investment and other income indicates an 11.7% year-over-year decline from $432 million.

Moreover, following the industry trend, CNC’s medical costs are expected to have remained elevated in the third quarter. The Zacks Consensus Estimate for the total health benefits ratio is pegged at 93%, up from 89.2% in the year-ago period, meaning a reduced portion of premiums remaining in hand after paying claims. Our model estimate for total operating expenses indicates more than a 15% increase in the third quarter. These are expected to have affected the bottom line, making an earnings beat uncertain.

While an earnings beat looks uncertain for Centene, here are some companies from the broader Medical space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

Select Medical Holdings Corporation SEM has an Earnings ESP of +8.58% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Select Medical’s bottom line for the to-be-reported quarter of 18 cents per share has witnessed one upward revision against no downward movement over the past month. The consensus mark for Select Medical’s revenues is pegged at $1.32 billion.

Erasca, Inc. ERAS has an Earnings ESP of +5.66% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Erasca’s bottom line for the to-be-reported quarter remained stable over the past week. Erasca’s earnings beat estimates in three of the past four quarters and met once, with an average surprise of 13%.

Humana Inc. HUM has an Earnings ESP of +4.29% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Humana’s bottom line for the to-be-reported quarter is pegged at $2.91 per share, which remained stable over the past week. Humana beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 9.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 min | |

| 7 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite