|

|

|

|

|||||

|

|

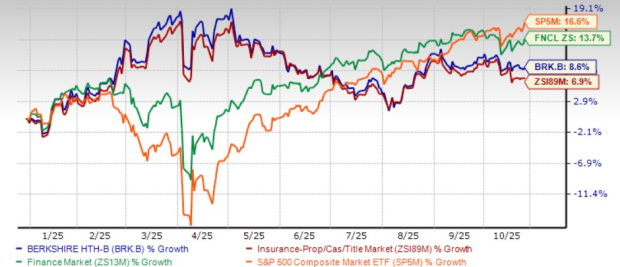

Shares of Berkshire Hathaway Inc. (BRK.B) closed at $492.10 on Friday, a 9.2% discount to its 52-week high of $542.07, after having gained 8.6% year to date. Shares outperformed the industry but underperformed the Finance sector as well as the Zacks S&P 500 composite index in the same time frame.

Berkshire Hathaway is a conglomerate with more than 90 subsidiaries engaged in diverse business activities. This provides it stability in various economic cycles.

BRK.B is now trending below its 50-day simple moving average (SMA), indicating the possibility of a downside ahead.

Shares of BRK.B’s peers, Chubb Limited CB and The Progressive Corporation PGR, have gained 1.6% each year to date.

Chubb, a premier global provider of property and casualty insurance and reinsurance, is targeting growth in the middle-market segment across both domestic and international markets. Chubb is enhancing its core package solutions and expanding its specialty insurance portfolio. With focused strategic initiatives, Chubb seeks sustainable growth and stronger competitive positioning.

Progressive, one of the top auto insurers in the United States, is well-positioned to sustain profitability through its strong market presence, broad product offerings and disciplined underwriting. Progressive is advancing its strategy by promoting bundled auto insurance, limiting exposure to high-risk properties, and enhancing segmentation with targeted, innovative solutions. With this approach, Progressive continues to strengthen its competitive edge.

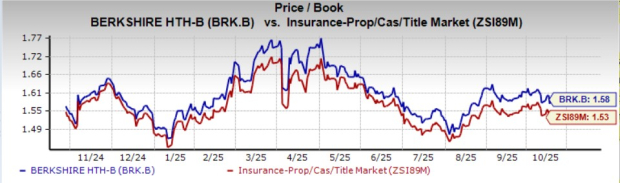

The stock is overvalued compared with its industry. It is currently trading at a price-to-book multiple of 1.58, higher than the industry average of 1.53.

Berkshire is relatively cheap compared to Progressive but expensive compared to Chubb.

Based on short-term price targets offered by four analysts, the Zacks average price target is $536.75 per share. The average suggests a potential 9.5% upside from the last closing price.

Berkshire Hathaway’s insurance operations, which contribute roughly a quarter of total revenues, continue to lead its business model. This segment remains a key driver of long-term growth, supported by disciplined underwriting practices, an extensive market presence, and a demonstrated ability to perform well even under challenging economic conditions.

A solid insurance operation is complemented by its other divisions. Berkshire Hathaway Energy (BHE), the company’s regulated utility arm, delivers steady cash flows and continues to expand its renewable energy portfolio—aligning with global electrification and sustainability goals. Within the same division, Burlington Northern Santa Fe (BNSF), Berkshire’s rail subsidiary, plays a critical strategic role in U.S. freight transportation. Although BNSF currently faces headwinds from an unfavorable freight mix and lower fuel surcharge revenues, the business remains a strong long-term asset supported by consistent utility demand and infrastructure importance.

The Manufacturing, Service, and Retail segment adds cyclical upside potential. It is positioned to benefit from a stronger economic backdrop and rising consumer spending, which together support higher sales and profit margins.

Financially, Berkshire maintains one of the most conservative capital allocations. It holds over $100 billion—about 90% of its cash equivalents—in short-term U.S. Treasuries and other government-backed securities. At a time of elevated interest rate, while its investment income has strengthened, the Federal Reserve’s shift toward rate cuts should sustain liquidity and returns. This prudent stance enables Berkshire to act swiftly on acquisition opportunities while maintaining a stable yield profile.

Berkshire has also been actively reshaping its equity portfolio—exiting BYD, trimming Apple and Bank of America holdings and increasing investments in Japanese trading houses like Mitsubishi and Mitsui. These moves emphasize management’s focus on stable, cash-generating assets that support future share buybacks and reinvestment.

Finally, Berkshire’s expanding insurance float—rising from $114 billion in 2017 to $174 billion by mid-2025—continues to provide low-cost capital, fueling investments in durable, high-return assets and reinforcing its strong balance sheet and shareholder value creation.

Return on equity (“ROE”) in the trailing 12 months was 7%, underperforming the industry average of 7.7%. Return on equity, a key profitability measure, reflects how effectively a company utilizes its shareholders’ funds. It is noteworthy that though BRK.B’s ROE lags the industry average, the metric has been improving consistently.

The same holds true for return on invested capital (ROIC), which has increased every year since 2020. This reflects BRK.B’s efficiency in utilizing funds to generate income. However, ROIC in the trailing 12 months was 5.6%, lower than the industry average of 5.9%.

The Zacks Consensus Estimate for 2025 earnings implies a 7.7% year-over-year decrease, while the same for 2026 suggests a 1.9% increase. The expected long-term earnings growth rate is pegged at 7%, in line with the industry average.

The consensus estimate for 2025 earnings has moved up 0.3% in the past 30 days, while that for 2026 witnessed no movement in the same time.

Berkshire Hathaway has long added strength and stability to investors’ portfolios, delivering consistent shareholder value for nearly six decades under Warren Buffett’s leadership.

The attention now turns to the company’s future as Greg Abel prepares to step in as CEO on Jan. 1, 2026, with Buffett continuing as executive chairman.

However, with Berkshire trading at a premium valuation, witnessing modest returns on capital, facing near-term earnings headwinds, and having a cautious analyst outlook, a wait-and-see approach seems prudent for this Zacks Rank #3 (Hold) stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite