|

|

|

|

|||||

|

|

NextEra Energy NEE and Dominion Energy D are two of the most prominent utility companies in the United States. Both companies continue to invest millions of dollars in strengthening their infrastructure and adding more renewable energy assets to their generation portfolio. NextEra Energy and Dominion Energy’s focus on strengthening infrastructure is enhancing grid resilience, ensuring the stability of power supply even during extreme weather events. These companies also make strategic acquisitions to expand their renewable portfolio and market reach. NEE and D are committed to lowering emissions in electricity generation and are playing vital roles in the evolving U.S. energy landscape.

Per the latest release of the U.S. Energy Information Administration, demand for electricity is rising in the United States, and a clear transition towards clean energy sources is evident in the Utilities space. Amid such an industry backdrop, let’s delve deep and closely look at the fundamentals of these stocks.

NextEra Energy is the world’s largest producer of wind and solar energy and continues to make significant investments in clean energy solutions, reducing reliance on fossil fuels and promoting sustainability.

The company expects to witness a compound annual growth rate for earnings in the range of 6% to 8% through 2027 from the base of 2024 adjusted EPS. It aims to achieve this target through persistent renewable asset additions to the generation portfolio and execution of plans across all business segments.

Through its subsidiary, Florida Power & Light (FPL), NextEra Energy serves millions of customers with reliable electricity, while its Energy Resources business focuses on expanding renewable projects across North America.

FPL’s focus is on clean, efficient, modernized generation and a stronger and smarter grid. Florida Power & Light Company has been making smart investments to provide high-quality services to its customers and plans to invest more than $49.6 billion in the 2025-2029 time period. The company is efficiently providing quality services to its rising customer base in Florida. The improvement in the Florida economy is going to create fresh demand from commercial customers and drive its performance.

Energy Resources continues to work on its strategy of making a long-term investment in clean energy assets. The company expects to be able to add 36.5-46.5 GW of new renewables in the 2024-2027 time frame to the generation portfolio via clean energy investments. Energy Resources has more than 25 GW in the backlog of signed contracts, which provides clear visibility into the ongoing expansion of clean power generation. The company plans to invest more than $25 billion in the 2025-2029 time period to further strengthen its renewable operations.

NextEra Energy’s stable performance and earnings allow it to increase shareholders’ value through dividends and share repurchases. The current buyback authorization will enable the company to buy back 180 million shares. The company expects to increase its dividend rate by nearly 10% annually through at least 2026, subject to the approval of its board of directors. NextEra Energy’s current dividend yield of 3.48% is better than the Zacks S&P 500 composite’s yield of 1.76%.

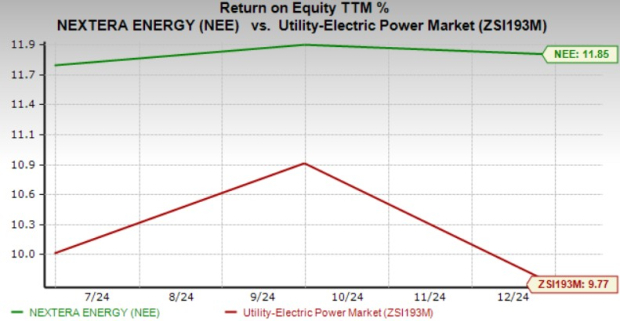

Return on Equity (ROE) measures how efficiently a company is using shareholder investments to generate profits. The current ROE of NextEra Energy is 11.85% compared with the Zacks Utility Electric Power industry's average of 9.77%.

Utility operation is capital-intensive and the companies operating in the sector needs to borrow funds to efficiently manage the operation as funds generated internally are always not sufficient to meet the long-term capital expenditure plan. NextEra Energy’s debt to capital is 54.63% a tad higher compared with its industry average of 54.23%.

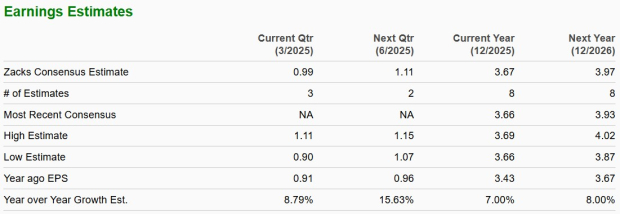

NextEra Energy has been a consistent performer and has surpassed expectations in each of the last four reported quarters, resulting in an average surprise of 6.5%. The Zacks Consensus Estimate for earnings per share for 2025 and 2026 indicates a year-over-year increase of 7% and 8%, respectively.

Dominion Energy is another formidable operator in the U.S. utility space, providing electricity and natural gas to millions of customers. It has made significant strides toward a cleaner energy future. The company continues to invest in renewable energy, particularly offshore wind, solar, and battery storage projects, as part of its long-term sustainability goals.

Dominion Energy is also focused on modernizing and strengthening its infrastructure to enhance grid reliability and efficiency. Through strategic acquisitions and divestitures, it has streamlined its operations, prioritizing clean energy initiatives and improving its service capabilities.

Dominion Energy has a well-chalked-out long-term capital expenditure plan to strengthen and expand its infrastructure and plans to invest $12.1 billion in 2025 and $52.3 billion in the 2025-2029 period to further strengthen its operation. The company’s long-term objective is to add more battery storage, solar, hydro and wind (offshore as well as onshore) projects by 2036 and increase the renewable energy capacity by more than 15% per year, on average, over the next few years.

Dominion Energy has plans to upgrade electric infrastructure by installing smart meters and grid devices, as well as enhance services to customers through the customer information platform. The company is also working on a project of strategic undergrounding of 4,000 miles of most outage-prone overhead distribution lines.

Dominion Energy divested some of its merchant generation facilities and electric retail energy marketing business to focus on core regulated operations. The sale of its gas transmission and storage assets to an affiliate of Berkshire has supported D’s transition toward regulated and sustainable operations.

The stable performance of Dominion Energy has allowed management to declare a regular dividend for its shareholders. The company has been paying dividends to its shareholders for a very long time. The first quarter dividend of 66.75 cents per share will mark the 389th consecutive dividend payout for Dominion Energy. The current dividend yield is 5.25%, which is better than the industry’s yield of 3.23%.

ROE measures how efficiently a company is using shareholder investments to generate profits. The current ROE of Dominion Energy is 8.71% compared with its industry average of 9.77%.

Dominion Energy’s debt to capital stands at 55.41% compared with its industry average of 54.23%. It indicates this company is utilizing slightly more debt than its peers in the industry.

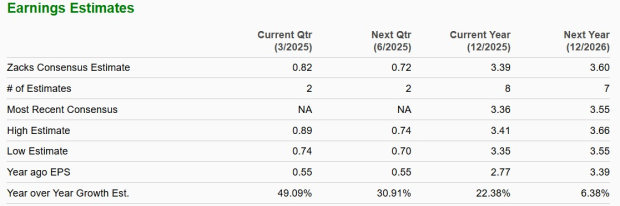

Dominion Energy has surpassed expectations in three out of the last four reported quarters, resulting in an average surprise of 4.15%. The Zacks Consensus Estimate for earnings per share for 2025 and 2026 indicates a year-over-year increase of 22.38% and 6.38%, respectively.

NextEra Energy is trading at a forward 12 months earnings multiple of 17.08X, below its median of 25.54X over the last five years. Dominion Energy’s forward earnings multiple sits at 14.42X, below its last five years’ median of 17.86X. Both stocks appear expensive when compared with industry average of 13.42X.

Both NEE and D are efficiently serving millions of customers in their service territories. The drop in interest rates will assist both of these capital-intensive utilities. These companies are working to reduce carbon emissions generated from electricity production.

These consistent performers are regularly distributing dividends to their shareholders and are evenly matched for most of the parameters. Both companies currently carry a Zacks Rank #3 (Hold) each, but Dominion Energy currently has a VGM score of C and NextEra Energy has a VGM score of F. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Over the past year, Dominion Energy’s shares have returned 1.7% compared with NextEra Energy’s 0.1% rally. Based on the aforesaid parameters, D appears to be a better choice in the utility space compared with NEE at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 9 hours | |

| 16 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite