|

|

|

|

|||||

|

|

Lam Research Corporation LRCX recently posted robust first-quarter fiscal 2026 results, helping its shares rise 11% since the Oct. 22 release. LRCX’s first-quarter top and bottom lines surpassed the Zacks Consensus Estimate and marked a significant year-over-year improvement.

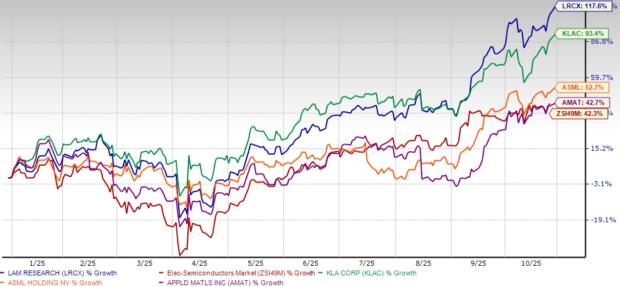

The latest quarterly performance is likely to push its share prices further, which have already witnessed a remarkable run this year so far. The stock has soared 117.6% year to date (YTD), outperforming the Zacks Electronics - Semiconductors industry’s gain of 42.3%.

Lam Research has also outpaced the gains of other semiconductor peers, including KLA Corporation KLAC, ASML Holding ASML and Applied Materials AMAT. YTD, shares of KLA Corporation, ASML Holding and Applied Materials have surged 93.4%, 52.7% and 42.7%, respectively.

For investors considering their next move, here’s why buying Lam Research stock might be the most prudent approach now.

Lam Research’s first-quarter earnings surpassed expectations, showcasing the company’s solid financial foundation. Total revenues rose 28% year over year to $5.32 billion and beat the Zacks Consensus Estimate by 2%, primarily driven by continued demand across the Systems and Customer Support Business Group segments.

Lam Research reported first-quarter non-GAAP earnings of $1.26 per share, which beat the consensus mark by 4.1%. The bottom line also increased 46.5% on a year-over-year basis.

Lam Research Corporation price-consensus-eps-surprise-chart | Lam Research Corporation Quote

Expanding its manufacturing operations in Asia has also helped the company lower costs and improve margins. In the first quarter, Lam Research’s non-GAAP operating margin rose to 35%, up 410 basis points from the year-ago quarter, which is impressive, considering the challenging macroeconomic environment.

This strong financial performance reinforces Lam Research’s resilience in navigating an evolving semiconductor cycle. As demand grows for advanced nodes, LRCX’s specialized technology in etch and deposition tools for high-aspect-ratio structures positions it well to capitalize on this trend. The company’s first-quarter results also highlight its effective cost management, which has enabled sustained profitability even amid fluctuating end-market demand.

Lam Research is benefiting from the booming demand for artificial intelligence (AI) and datacenter chips, which require advanced fabrication technologies. The company’s deposition and etch solutions are critical for producing high-bandwidth memory (HBM) and advanced packaging technologies, which are essential for AI workloads.

In 2024, Lam Research’s shipments for gate-all-around nodes and advanced packaging exceeded $1 billion, and management expects this figure to triple to more than $3 billion by 2025. Additionally, the industry’s migration to backside power distribution and dry-resist processing presents further growth opportunities for Lam’s cutting-edge fabrication solutions.

With AI-driven investments accelerating, Lam Research’s leading position in etch and deposition makes it a key beneficiary of the ongoing semiconductor spending cycle.

Analysts’ expectations for top and bottom lines indicate continued growth momentum for Lam Research in the years ahead. The Zacks Consensus Estimate for fiscal 2026 and 2027 revenues signifies a year-over-year increase of 11.9% and 11.7%, respectively. The consensus mark for fiscal 2026 and 2027 earnings per share indicates growth of 13% and 16.1%, respectively.

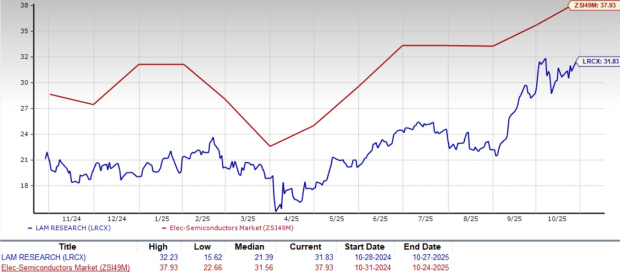

Even after the robust YTD rally, Lam Research stock doesn’t look expensive. LRCX currently trades at a forward price-to-earnings (P/E) multiple of 31.83, which is significantly lower than the industry’s 37.93. The company’s discounted valuation multiple aligns with its long-term growth potential.

Compared with major semiconductor stocks, LRCX trades at a lower P/E multiple than ASML and KLA Corporation, while at a premium to AMAT. At present, ASML Holding, KLA Corporation and Applied Materials have forward 12-month P/E multiples of 35.39, 33.46 and 24.56, respectively.

Lam Research’s discounted valuation, solid financial performance and strategic focus on AI-driven growth make it a compelling investment option right now. The company’s expanding market share in AI and datacenter fabrication, coupled with innovative product launches, strengthens its competitive positioning.

LRCX sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 29 min | |

| 2 hours | |

| 4 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite