|

|

|

|

|||||

|

|

The robotaxi market has huge potential. The global robotaxi market is projected to reach $45.7 billion by 2030, at a CAGR of 91.8% from 2023 to 2030, according to MarketsandMarkets’ forecast. This highly lucrative space attracts both WeRide WRD, based in China, and ride-hailing company Uber Technologies UBER, headquartered in San Francisco. Let us delve into the autonomous vehicle (“AV”)-related details of the two companies.

Uber is working to establish a strong presence in the robotaxi market through strategic partnerships. This approach allows the company to bypass the significant research and development expenses involved in building autonomous driving systems on its own. Although Uber sold the self-driving division in 2020, it has continued to pursue the vision of becoming a comprehensive ride-hailing super app.

As part of its partnership-driven strategy, in July, Uber inked a partnership with China’s tech giant Baidu BIDU to expand in the rapidly growing autonomous delivery and ride-hailing market. Under this agreement, Baidu plans to deploy its driverless vehicles on the Uber platform in Asia and the Middle East this year.

The partnership combines Baidu’s advanced artificial intelligence capabilities with Uber’s extensive global network. Over the course of the multi-year deal, thousands of Baidu’s Apollo Go autonomous vehicles are expected to be integrated into the Uber platform across several international markets outside the United States and mainland China. By incorporating Baidu’s AV technology, Uber aims to increase access to dependable and cost-effective ridesharing services. Following the rollout, riders requesting eligible Uber trips may be offered the option of a fully driverless ride via an Apollo Go autonomous vehicle.

Also in July, Uber entered into an agreement with Lucid Group LCID and autonomous vehicle startup Nuro. Under this partnership, at least 20,000 self-driving Lucid vehicles equipped with Nuro’s autonomous driving technology will be added to Uber’s network over the next six years, supported by a significant investment from the latter in both companies. Uber is investing $300 million into Lucid to support the robotaxi program.

These agreements underscore Uber’s asset-light strategy of using strategic alliances to strengthen its foothold in the emerging robotaxi market. Rather than investing heavily in independent autonomous vehicle R&D, Uber is leveraging its platform and distribution reach to integrate advanced AV technologies from industry leaders.

WeRide is rapidly establishing itself on the global stage through aggressive international expansion. In August 2025, Southeast Asia’s leading superapp Grab GRAB revealed its plans to invest in WeRide to accelerate the rollout and commercialization of Level 4 autonomous robotaxis and shuttles across the region. The investment is expected to be completed by mid-2026.

Additionally, WeRide announced that it will introduce its GXR and Robobus autonomous vehicles in Singapore through Ai.R, Grab’s first autonomous ride service for consumers, which is operated in collaboration with the former. The initial rollout includes an 11-vehicle fleet operating across two routes in Punggol, marking Singapore’s first autonomous shuttle deployment in a residential neighborhood.

WeRide’s expansion extends well beyond Asia. In the Middle East, its partnership with Uber in Abu Dhabi has already resulted in a growing fleet operating across highways, islands and airport routes. Earlier this month, the companies launched autonomous robotaxi passenger services in Riyadh.

In China, WeRide runs Level 4 robotaxis in Shanghai through alliances with Chery Group and Jinjiang Taxi, connecting major transportation hubs and cultural destinations. WeRide is also deploying its autonomous shuttle services in multiple international markets. Its Robobus is already operational at Resorts World Sentosa in Singapore, the Roland-Garros stadium in Paris and various sites across Riyadh, serving as an efficient last-mile transportation solution. With regulatory approvals across six countries — Singapore, Saudi Arabia, the UAE, China, France and the United States — WeRide is emerging as a frontrunner in the global autonomous mobility space.

By expanding its fleets, forming strategic partnerships and introducing innovative service models, WeRide is rapidly scaling commercial operations and playing a transformative role in shaping the future of autonomous transportation.

Shares of UBER have gained in excess of 59% this year. WRD’s shares have declined in double digits in the same time frame.

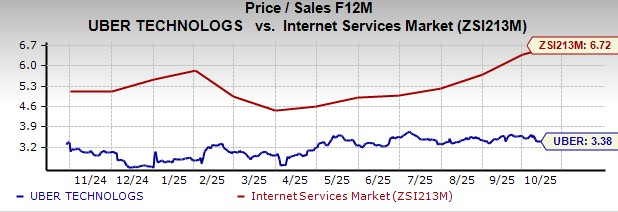

WeRide, which began trading on the Nasdaq a year back, appears to be pricier than Uber. WRD has a Value Score of F, while Uber has a Value Score of D.

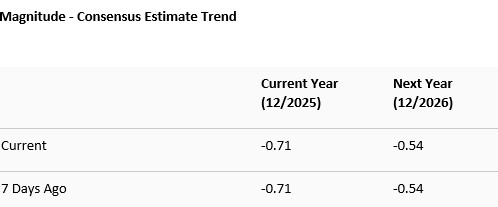

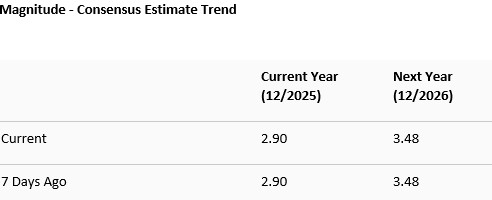

The bottom-line estimates for both WRD and Uber have remained stable over the past seven days.

Uber’s dominant market position in ride-hailing gives it a distinct advantage. With a vast base of active users and driver-partners, Uber is well-positioned to rapidly scale autonomous services once the technology receives broader regulatory approval. Its app is designed to integrate AV fleets from multiple partners, offering flexibility and user choice.

As Uber pursues growth in suburban and low-density areas, its focus on scalable autonomous deployments signals strong long-term potential. While regulatory and macroeconomic risks persist, Uber’s ability to simultaneously scale its core mobility and delivery businesses — alongside emerging AV initiatives — positions it favorably for the future of transportation.

While there is little scope for doubt that WeRide is a strong innovator in autonomous technology, Uber’s platform-driven strategy, global and much bigger scale, apart from the ability to commercialize AV services across the vast customer base, firmly positions it favorably in the robotaxi race. Uber’s better price performance and valuation picture compared with WeRide also works in its favor.

While Uber currently has a Zacks Rank #3 (Hold), WeRide carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite