|

|

|

|

|||||

|

|

Globalstar, Inc. GSAT and Viasat, Inc. VSAT operate in the satellite communications industry, which is undergoing a major transformation amid the convergence of mobile satellite services (“MSS”), direct-to-cell connectivity and expansion of Internet-of-Things (IoT) asset tracking and remote monitoring.

According to a Grand View Research report, the global satellite communication market is expected to witness a CAGR of 10.2% from 2025 to 2030, reaching $159.6 billion.

This uptrend in spending benefits both GSAT and VSAT. However, their strategies, partnerships and execution capabilities reveal key differences that are crucial for investors to understand. So, if an investor wants to make a smart buy in the satellite space, which stock stands out?

Given this backdrop, let us scrutinize closely to find out which of these two stocks currently holds the edge, and more importantly, which might be the smarter bet now.

Globalstar is expected to gain from innovations such as the RM200 two-way module and XCOM RAN, which could further drive the top line. The RM200 two-way module is witnessing growing traction across verticals such as oil & gas, defense and MVNOs and has been tested by more than 50 partners. It recently announced the commercial rollout of the RM200 two-way module. With XCOM RAN, GSAT is eyeing entry into terrestrial wireless markets, significantly broadening its total addressable market. Growing traction in the government vertical, especially U.S. federal agencies and defense markets, bodes well.

Strategic collaborations are also aiding in footprint expansion. It recently inked a new strategic collaboration with Conekt.ai, a connectivity management platform provider. As per the partnership, GSAT’s Band 53 spectrum and XCOM RAN private network technology solutions will be integrated with Conekt.ai’s orchestration platform, creating a unified solution for multi-network connectivity.

Globalstar is in the midst of a comprehensive infrastructure upgrade and recently launched its global ground infrastructure program for the next-generation Extended MSS Network, or the C-3 system. Under this program, it will add about 90 antennas across 35 ground stations in 25 countries, significantly boosting network capacity and resiliency. Globalstar recently deployed new ground station equipment in Talkeetna, AK, its first installation at this existing teleport. The site will host two new six-meter tracking antennas to support the third-generation C-3 mobile satellite system.

It is also working with SpaceX for the deployment of nine new satellites. These satellites, under construction by MDA, are scheduled for launch first in late 2025 and then in 2026 to replace the existing constellation and ensure service continuity. It expects 2025 revenues to be between $260 million and $285 million, with adjusted EBITDA margins around 50%.

Nonetheless, macro uncertainty and stiff competition from other players remain overhangs. Also, new product rollouts entail execution risks. Delays in client onboarding, technical troubles or slower commercialization could weigh on revenue growth.

Viasat is a global communications company that serves its high-bandwidth, high-performance communications solutions to the public as well as the military, enterprise and government sectors. With the Inmarsat acquisition, VSAT has expanded its global coverage (including increased oceanic coverage and polar reach). The Inmarsat buyout has brought a greater diversity of on-orbit technologies by expanding Viasat’s Ka-band fleet to 13 Ka-band satellites.

The impending launch of the ViaSat-3 Flight 2 satellite, which will double its bandwidth capacity, is a tailwind. On the last earnings call, management emphasized that each ViaSat-3 satellite “is designed to enable more bandwidth capacity than our entire existing fleet.” It is focused on getting Flights 2 and 3 of the ViaSat-3 series into service.

Momentum in the Defense and Advanced Technologies segment, buoyed by solid traction across information security and cyber defense, space and mission systems, bodes well. In the last reported quarter, the DAT segment revenues were $344 million, up 15% year over year and total segment awards were up 22% to $428 million. Infosec and cyber defense product lines are emerging as strong growth drivers with 84% revenue growth. In the last reported quarter, this sub-segment had a book-to-bill ratio of 2.2x, which indicates near-term revenue conversion and visibility into fiscal 2026 and beyond. DAT revenue growth for fiscal 2026 is anticipated to be in the mid-teens, primarily driven by strong double-digit growth in infosec and cyber defense, and space and mission systems.

The Aviation segment is also witnessing momentum driven by an increase in commercial aircraft in service and higher average revenue per aircraft. Backlog remains large at 1,580 aircraft (only slight sequential decline). Multi-band, multi-orbit solutions (which are displacing single-band L-band offerings) like NexusWave can re-accelerate maritime revenues. Government SATCOM business is another tailwind. It recently won an IDIQ contract by the U.S. Space Force Space Systems Command for the Protected Tactical SATCOM-Global program.

Nonetheless, it faces plenty of challenges. Macro uncertainty and stiff competition aside, a debt-heavy balance sheet is a concern. As of June 30, 2025, it had a net debt of $5.6 billion. Moreover, fiscal 2026 capital expenditure is forecasted to be approximately $1.2 billion (includes roughly $400 million for Inmarsat-related capital expenditures). Its largest segment, Communication Services, is expected to register flat revenues in fiscal 2026, due to a lower rate of declines in fixed services and others.

Over the past month, GSAT and VSAT have gained 20.5% and 37.7%, respectively.

In terms of the forward 12-month price/sales ratio, GSAT’s shares are trading at 17.62X, lower than VSAT’s 1.1X.

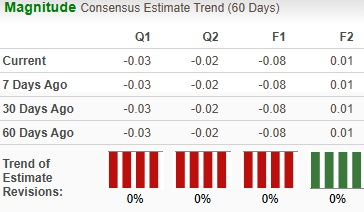

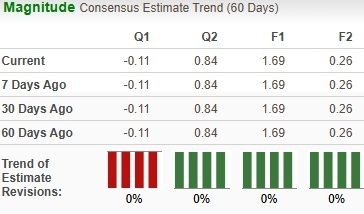

Analysts have kept their earnings estimates unchanged for both GSAT and VSAT’s bottom line for the current year.

Globalstar and Viasat carry a Zacks Rank #3 (Hold) each at present.

GSAT’s widening IoT runway accelerated by product innovations, C-3 network upgrades and improving government traction positions it for long-term growth. Meanwhile, VSAT must navigate a heavy debt load and capital-intensive satellite rollout. For investors seeking cleaner upside in a rapidly converging satellite market, GSAT currently looks like the smarter pick.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite