|

|

|

|

|||||

|

|

DaVita Inc. DVA is scheduled to report third-quarter 2025 results on Oct. 29, after the closing bell.

In the last reported quarter, the company’s earnings per share (EPS) of $2.95 beat the Zacks Consensus Estimate by 9.3%. Over the trailing four quarters, its earnings outperformed the Zacks Consensus Estimate on three occasions and missed once, delivering an earnings surprise of 4.7%, on average.

Let’s check out the factors that have shaped DVA’s performance prior to this announcement.

DaVita is likely to continue benefiting in the third quarter of 2025 from its disciplined cost management, operational efficiency and progress in patient care optimization. The company’s sustained investments in advanced IT systems and data infrastructure are expected to support productivity gains and offset pressure from modest volume growth. Additionally, management’s initiatives in integrated kidney care (IKC) and value-based contracts should help drive steady performance, supported by ongoing clinical innovation, such as high-volume hemodiafiltration and advanced dialyzers, which aim to improve patient outcomes. These factors are positioned to sustain underlying earnings strength despite a challenging operating environment.

However, DaVita is likely to remain weighed down by persistent headwinds related to elevated mortality rates and higher missed treatment frequencies, which have yet to return to pre-pandemic levels. While management is working to mitigate these issues through new clinical protocols and pharmaceutical adoption, the improvement is expected to be gradual. Continued reimbursement constraints from the Centers for Medicare & Medicaid Services (CMS) end-stage renal disease rate update, which lags actual cost inflation, may also pressure margins. These challenges could temper the positive impacts of cost control and innovation in the upcoming quarter.

For third-quarter 2025, the Zacks Consensus Estimate for revenues is pegged at $3.40 billion, implying an improvement of 4.3% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at $3.29, indicating an uptick of 27% from the prior-year period’s reported number.

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold), along with a positive Earnings ESP, has higher chances of beating estimates. This is not the case here, as you can see below.

Earnings ESP: DVA has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita Inc. price-eps-surprise | DaVita Inc. Quote

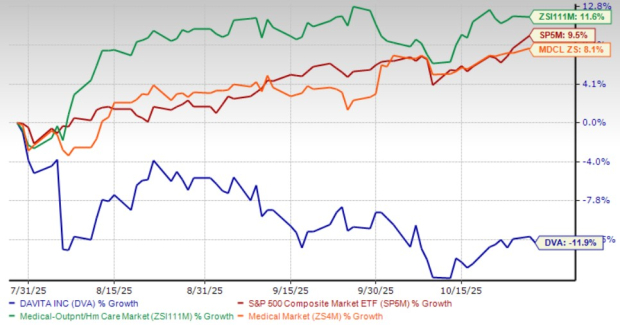

Over the past three months, DaVita’s shares have lost 11.9%, underperforming Medical - Outpatient and Home Healthcare’s 11.6% gain. DVA’s shares also underperformed the Zacks Medical sector’s increase of 8.1% and the S&P 500’s growth of 9.5%.

DaVita’s peers like Aveanna Healthcare Holdings Inc. AVAH, Encompass Health Corporation EHC and Elanco Animal Health Incorporated ELAN have outperformed it. AVAH, EHC and ELAN’s shares have rallied 140.6%, 16.9% and 52.5%, respectively, in the same time frame.

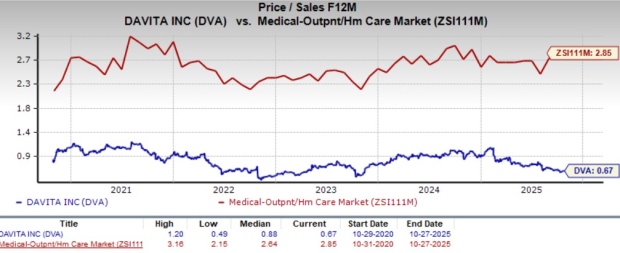

From a valuation standpoint, DVA’s forward 12-month price-to-sales (P/S) is 0.7X, a discount to the industry's average of 2.9X.

The company is trading at a discount to its peers, Aveanna Healthcare, Encompass Health and Elanco Animal Health. Aveanna Healthcare, Encompass Health and Elanco Animal Health’s P/S currently stand at 0.8X, 2X and 2.3X, respectively.

This suggests that investors may be paying a lower price relative to the company's expected sales growth.

DaVita’s management provided constructive long-term visibility centered on clinical innovation, technology integration, and disciplined execution. On the second quarter of 2025 earnings call in August, DaVita’s management highlighted that emerging advancements in artificial intelligence, new dialysis technologies and drug classes, such as GLP-1s and SGLT2 inhibitors, are expected to drive a new phase of progress in patient care. These advancements are expected to enhance personalization of care, improve patient outcomes and reduce mortality over time, supporting sustainable volume recovery. Additionally, DVA’s continued expansion of its IKC and value-based care programs provides a recurring revenue base with growing risk-based contracts, offering structural earnings visibility.

DaVita’s cost discipline and efficient capital management reinforce financial flexibility and margin stability over the long term. Although some headwinds, such as elevated mortality and reimbursement pressures, persist, management’s focus on innovation, efficiency and diversified care models lay a clear foundation for durable long-term performance visibility.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite