|

|

|

|

|||||

|

|

The artificial intelligence (AI)-driven astonishing bull run of 2023 and 2024 has continued in 2025 too. With just two months to close this year, the AI infrastructure developers are set to witness another fabulous year buoyed by the enormous growth of this space.

Despite these positives, several AI stocks provided negative returns this year. Here, we have identified five AI stocks with a favorable Zacks Rank that have significantly lagged in 2025. However, these stocks have room to grow in the near future.

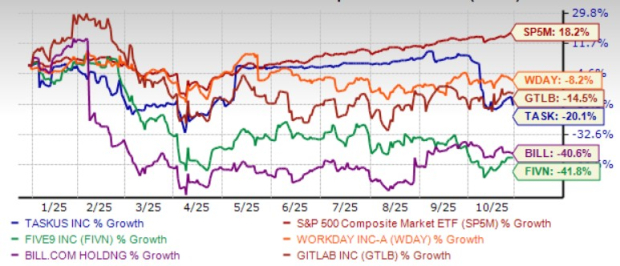

These stocks are: Five9 Inc. FIVN, TaskUs Inc. TASK, Workday Inc. WDAY, GitLab Inc. GTLB and BILL Holdings Inc. BILL. Each of our picks currently carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Zacks Rank #1 Contact center software solutions provider Five9 has been benefiting from FIVN’s strong performance driven by a rise in subscription revenues supported by traction in Enterprise AI revenues. FIVN provides intelligent cloud software for contact centers in the United States, India and internationally.

FIVN offers a virtual contact center cloud platform that delivers a suite of applications, enabling a broad range of contact center-related customer service, sales, and marketing functions.

FIVN’s platform comprises interactive virtual agents, agent assistance, workflow automation, workforce engagement management, AI insights, and AI summaries. It allows the management and optimization of customer interactions across voice, chat, email, web, social media, and mobile channels directly or through its application programming interfaces.

FIVN has been benefiting from the growing adoption of AI tools in its call center services, with personalized AI agents emerging as a major growth driver. Five9 introduced its Intelligent CX Platform powered by Five9 Genius AI on the Google Cloud space. FIVN also released new Five9 AI agents tailor-made for Google Cloud.

Ties with big names like Salesforce Inc. (CRM), Microsoft Corp. (MSFT), ServiceNow Inc. (NOW), Verint Systems Inc. (VRNT) and Alphabet Inc. (GOOGL) helped the company build more tailored AI tools and improve its integration across platforms. This is anticipated to have helped FIVN win new clients and hold on to the existing ones.

Five9 has an expected revenue and earnings growth rate of 10.6% and 16.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.3% over the last 90 days.

FIVN has an expected revenue and earnings growth rate of 9.6% each and 8.5%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 1.3% over the last 90 days.

Zacks Rank #1 TaskUs is a provider of outsourced digital services. TASK serves social media, e-commerce, gaming, streaming media, food delivery and ridesharing, HiTech, FinTech and HealthTech sectors. TASK operates principally in the United States, the Philippines, India, Mexico, Taiwan, Greece, Ireland and Colombia.

TaskUs Accelerates Agentic AI Services. In May 2025, TASK announced a strategic partnership with AI-driven customer support companies Decagon and Regal. The partnerships augment TASK’s agentic AI consulting practice, a set of business services and expertise that help companies seamlessly integrate advanced AI technologies into their customer experience operations.

To that point, agentic AI can accomplish complex tasks autonomously with minimal human interaction, unlike traditional AI models, as it builds on the rapid progress of generative AI by exhibiting goal-driven behavior, adaptability, and reasoning to solve problems dynamically.

TaskUs has an expected revenue and earnings growth rate of 17.8% and 16.3%, respectively, for the current year. The Zacks Consensus Estimate for 2025 earnings has improved 4.2% over the last 60 days.

TASK has an expected revenue and earnings growth rate of 12.9% and 10%, respectively, for next year. The Zacks Consensus Estimate for next-year 2025 earnings has improved 3.1% over the last 60 days.

Zacks Rank #2 Workday’s diversified product portfolio continues to yield a steady flow of customers. WDAY’s cloud-based business model and expanding product portfolio have been the primary growth drivers. The company is also gaining traction in the international market. WDAY has a strong balance sheet and ample liquidity. This allows the company to invest in portfolio expansion and strategic acquisitions.

Significant investment from Elliott Investment Management will likely drive innovation. Management is putting a strong focus on integrating advanced AI and ML capabilities. This will drive long-term benefits. WDAY’s solid customer wins in education, healthcare, financial Services, retail and hospitality verticals are driving the top line.

Workday has an expected revenue and earnings growth rate of 12.7% and 21.1%, respectively, for the current year (ending January 2026). The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 60 days.

WDAY has an expected revenue and earnings growth rate of 12.2% and 16.8%, respectively, for next year. The Zacks Consensus Estimate for next-year 2025 earnings has improved 2.2% over the last 60 days.

Zacks Rank #1 GitLab offers a DevOps platform, which is a single application that leads to faster cycle time and allows visibility throughout and control over various stages of the DevOps lifecycle.

GTLB’s expanding portfolio has been a major growth driver. The general availability of GitLab 18, featuring major innovations across core DevOps workflows, security and compliance, and AI capabilities natively integrated into the platform has been noteworthy.

GitLab Duo Workflow, a secure agentic AI, which is in beta is expected to improve GTLB’s footprint across SDLC. GTLB has a rich partner base with cloud hyperscalers, including Google Cloud and Amazon Web Services.

GitLab has an expected revenue and earnings growth rate of 23.8% and 12.2%, respectively, for the current year (ending January 2026). The Zacks Consensus Estimate for current-year earnings has improved 10.7% over the last 60 days.

GTLB has an expected revenue and earnings growth rate of 19.9% and 16.7%, respectively, for next year. The Zacks Consensus Estimate for next-year 2025 earnings has improved 2.1% over the last 30 days.

Zacks Rank #2 BILL Holdings primarily caters to small and medium businesses (SMB) with its AI-enabled financial software platform that connects customers with their suppliers and clients. BILL is benefiting from an expanding clientele, and a diversified business model.

BILL is also gaining from the strong adoption of its AI-powered financial operations platform to enhance customer experience by offering easier-to-use, more automated and predictive solutions. BILL’s partnerships with top accounting firms and leading financial institutions strengthen its market position.

BILL’s leadership in automating financial operations for SMBs has been a major growth driver. Its expanding product portfolio has been a key catalyst, while its strong balance sheet and free cash flow-generating ability remain noteworthy.

BILL Holdings has an expected revenue and earnings growth rate of 10.5% and -3.2%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 30 days.

BILL has an expected revenue and earnings growth rate of 14% and 16%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 0.8% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite