|

|

|

|

|||||

|

|

Circle Internet CRCL and TeraWulf WULF are a couple of cryptocurrency-exposed stocks that have been gaining traction in recent times. Circle offers a USDC stablecoin and focuses on developing stablecoin-based payments infrastructure, while TeraWulf is a vertically integrated owner and operator of next-generation digital infrastructure that supports bitcoin mining and high-performance computing (HPC) workloads.

Cryptocurrencies have been benefiting from the liberal policies of U.S. President Donald Trump. Bitcoin, the most popular cryptocurrency, has been soaring due to increasing acceptance as a non-sovereign asset, as well as higher institutional and corporate adoption. Stablecoins benefit from the passage of the GENIUS Act, paving the way for more enterprise adoption. Both WULF and CRCL benefit from these factors. However, which stock has an edge right now? Let’s find out.

Circle is expected to benefit from the growing demand for the USDC stablecoin, which is redeemable on a one-for-one basis for U.S. dollars and is backed by reserves consisting of highly liquid, price-stable cash and cash equivalents. As of Oct. 23, $76.4 billion USDCs were in circulation, rising from $61.3 billion at the end of the second quarter of 2025.

As of July 28, USDC lifetime onchain transaction volume hit $33.97 trillion. In the second quarter of 2025, USDC onchain transaction volume grew 5.4 times year over year to nearly $6 trillion, reflecting growing usage. Meaningful wallets, defined as wallets holding more than $10 of USDC, surged 68% year over year, further indicating growing USDC adoption globally.

The launch of Circle Payments Network, a platform for financial institutions to use stablecoins for payments, with more than 100 institutions in the pipeline, reflects Circle’s focus on developing USDC-backed payment infrastructure. Currently, Hong Kong, Brazil, Nigeria and Mexico are the active payment corridors. Circle Gateway, introduced in July, enables seamless cross-chain USDC usage and is currently supported by eight new blockchain partners. Circle Internet introduced Arc, an open Layer-1 blockchain purpose-built for stablecoin finance and compatible with Ethereum infrastructure.

An expanding partner base, which includes the likes of Kraken, Binance, Corpay, FIS, Fiserv, OKX, Finastra and Fireblocks, is noteworthy. Circle recently inked a partnership with Fireblocks, under which the former’s stablecoin network will complement Fireblocks’ custody and payments infrastructure tools to provide cross-border treasury and tokenization asset settlement. The partnership with Finastra now enables banks to integrate USDC settlement into cross-border payment flows. FIS and Circle are enabling U.S. financial institutions to offer their customers the option to make domestic and cross-border stablecoin payments using USDC.

TeraWulf is on track to deliver 72.5 MW of HPC colocation capacity under its data center lease agreements with Core42 Holding for GPU compute workloads. The WULF Den and CB-1 leases with Core42 are expected to start generating revenues in the third quarter of 2025.

WULF inked a deal with Fluidstack to deliver more than 360 MW of critical IT load at its Lake Mariner data center campus in Western New York. The Lake Mariner facility can expand up to 500 MW in the near term and up to 750 MW with targeted transmission upgrades. At the end of the second quarter of 2025, the facility had 245 MW of energized capacity supporting bitcoin mining infrastructure. The deal represents roughly $6.7 billion in contracted revenues, with total contract revenues expected to hit $16 billion, which provides a boost to long-term growth prospects.

WULF also secured a long-term ground lease for approximately 183 acres at the Cayuga site in Lansing, NY. The lease provides TeraWulf with exclusive rights to develop up to 400 MW of digital infrastructure capacity, with 138 MW of low-cost, predominantly zero-carbon power expected to be ready for service in 2026.

However, TeraWulf is facing tough competition, along with volatility in bitcoin price that can be attributed to a challenging macroeconomic environment, tariff headwinds and uncertainty over the U.S. government shutdown. Moreover, WULF expects 2025 selling, general and administrative expenses between $50 million and $55 million compared with previous guidance of $40-$45 million due to accelerated growth in the company’s HPC business. This is expected to keep the margin under pressure.

The Zacks Consensus Estimate for WULF’s 2025 loss is pegged at 36 cents per share, wider by 3 cents over the past 30 days. The company reported a loss of 19 cents per share in 2024.

TeraWulf Inc. price-consensus-chart | TeraWulf Inc. Quote

The consensus mark for Circle’s 2025 loss is currently pegged at $1.94 per share, much narrower than $2.13 per share over the past 30 days.

Circle Internet Group, Inc. price-consensus-chart | Circle Internet Group, Inc. Quote

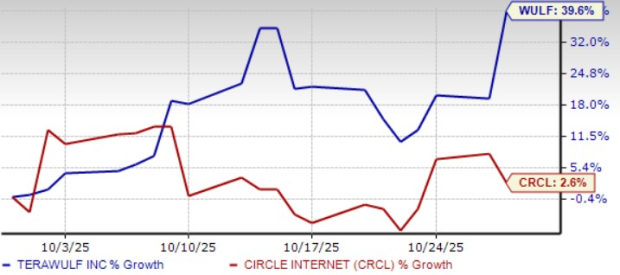

In the past month, TeraWulf shares have jumped 39.6%, outperforming Circle, shares of which have climbed 2.6%.

Both WULF and Circle are overvalued, as suggested by the Value Score of F.

An improving regulatory environment and growing demand for stablecoins like USDC bode well for Circle’s prospects. The company’s initiatives to build USDC-based payment networks bode well for its long-term prospects. However, TeraWulf suffers from bitcoin price volatility and higher expenses related to its HPC business. These factors make the stock risky for investors.

Circle carries a Zacks Rank #3 (Hold) at present, while TeraWulf has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 |

Bitcoin Price Crash Rattles Trump's Crypto Progress. Here's The Upshot For Investors.

CRCL +6.02%

Investor's Business Daily

|

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite