|

|

|

|

|||||

|

|

On Wall Street, transformation is no longer a buzzword — it is a survival strategy. Both The Goldman Sachs Group GS and Citigroup, Inc. C are reinventing themselves for a new era of banking, defined by regulation, technology and shifting client expectations.

Goldman is trying to balance its dealmaking dominance with stable, recurring revenues. Citigroup, meanwhile, is fighting to simplify and refocus on its core business. The big question for investors: which transformation story offers greater long-term potential? Let us delve deeper and analyze.

Goldman has been a dominant player in mergers and acquisitions (M&A), trading and capital markets. Under CEO David Solomon, the company has embarked on a deliberate transformation to exit non-core consumer banking and double down on the divisions where Goldman maintains a clear competitive advantage: investment banking (IB), trading, and asset and wealth management (AWM).

In sync with its restructuring efforts, in October 2024, Goldman finalized a deal to transfer its GM credit card business to Barclays. In 2024, Goldman completed the sale of GreenSky. In 2023, it sold its Personal Financial Management unit to Creative Planning and also sold substantially all of Marcus’s loan portfolio, part of its broader retreat from consumer banking.

The benefits of business restructuring are beginning to show in the numbers. For the first nine months of 2025, Goldman’s IB revenues rose 19% year over year, supported by a rebound in global M&A activity and capital markets issuance. The company’s AWM division also posted a 4% increase in net revenues, reflecting growing fee income and strength in private credit.

GS is also accelerating growth via innovative partnerships and acquisitions. This month, it agreed to acquire Industry Ventures to expand its exposure to the innovation economy and solidify its position in the global alternatives market. Last month, Goldman expanded its alliance with T. Rowe Price to give individuals greater access to private markets, with new offerings set to launch in phases.

Goldman plans to ramp up its lending services to private equity and asset managers and expand internationally. The company's asset management unit intends to expand its private credit portfolio to $300 billion by 2029. Management expects to witness high-single-digit annual growth in private banking and lending revenues over time.

Citigroup’s transformation, by contrast, is far more sweeping. Under CEO Jane Fraser, the company is advancing its multi-year strategy to streamline operations and focus on its core businesses. Since announcing plans in April 2021 to exit consumer banking in 14 markets across Asia and EMEA, the company has completed exits in nine countries.

In September 2025, Citigroup announced an agreement to sell a 25% stake in Banamex to Mexican business leader Fernando Chico Pardo, reaching a milestone toward full divestiture and deconsolidation of Banamex. The bank is also progressing with the wind-down of its Korean consumer banking operations, the exit from Russia, and preparations for an IPO of its Mexican consumer, small business and middle-market banking operations. These initiatives will free up capital and help the company pursue investments in wealth management operations in Singapore, Hong Kong, the UAE and London to stoke fee income growth.

Aligned with its goal of achieving leaner operations, Citigroup has overhauled its operating model and leadership structure, reduced bureaucracy and complexity while enhancing efficiency. In January 2024, the company announced plans to cut 20,000 jobs (about 8% of its global workforce) by 2026, having already lowered headcount by more than 10,000 employees.

Fraser’s efforts are translating into tangible improvements. Citigroup expects total revenues to exceed $84 billion in 2025, with revenues projected to see a 4-5% CAGR through 2026.

In parallel, the company is deepening its presence in private markets and wealth management through partnerships that enhance revenue diversity and client engagement. In September 2025, Citigroup launched an $80-billion customized portfolio offering with BlackRock Inc., providing clients with tailored exposure across public and private markets. In June 2025, it partnered with Carlyle Group to expand asset-based private credit in fintech lending via the SPRINT platform. In September 2024, Citigroup and Apollo Global Management created a $25-billion private credit direct lending platform to meet rising corporate financing demand.

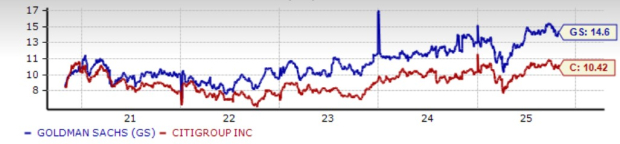

Over the past year, shares of Goldman and Citigroup rose 54.3% and 59.2%, respectively, compared with the industry’s growth of 42.6%.

Price Performance

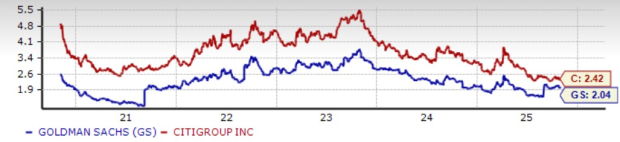

In terms of valuation, Goldman is currently trading at a 12-month forward price-to-earnings (P/E) of 14.6X. Meanwhile, Citigroup’s stock is trading at a 12-month forward P/E of 10.4X.

Price-to-Earnings F12M

Both are trading at a discount compared with the industry average of 14.7X. However, C stock is cheaper than GS.

Additionally, C and GS reward their shareholders handsomely. Post-clearing the 2025 Fed stress test, Citigroup hiked its dividend 7.1% to 60 cents per share. It has a dividend yield of 2.42%. Similarly, Goldman raised its dividend 33.3% to $4 per share post-clearing of the 2025 Fed stress test. It has a dividend yield of 2.04%. Based on dividend yield, C has an edge over GS.

Dividend Yield

The Zacks Consensus Estimate for GS’s 2025 and 2026 revenues reflects year-over-year rallies of 10% and 5.9%, respectively. Likewise, the consensus estimate for 2025 and 2026 earnings indicates increases of 19.8% and 12.6%, respectively. Over the past week, earnings estimates for 2025 and 2026 have remained unchanged.

Estimate Revision Trend

The Zacks Consensus Estimate for C’s 2025 and 2026 revenues suggests year-over-year increases of 6% and 3.1%, respectively. Also, the consensus estimate for 2025 and 2026 earnings indicates 27.2% and 30.1% growth, respectively. Over the past week, earnings estimates for 2025 and 2026 have remained unchanged.

Estimate Revision Trend

While both Goldman and Citigroup are executing ambitious transformation strategies, Citigroup’s overhaul appears to have the greater long-term upside. Goldman’s disciplined retreat from consumer banking and renewed focus on its core strengths in IB and AWM businesses are already delivering solid results. However, its growth remains closely tied to cyclical market activity, leaving earnings somewhat vulnerable to macro volatility.

Citigroup’s transformation is more structural and far-reaching. Under Fraser’s leadership, the bank is aggressively simplifying its global footprint, shedding non-core operations and redeploying capital toward high-return, fee-based businesses, such as wealth management and private markets. The company’s sweeping cost cuts, efficiency initiatives and partnerships position it to capture growth across emerging markets.

Valuation and earnings momentum further tilt the scales in Citigroup’s favor. Trading at a lower P/E multiple and offering a higher dividend yield than Goldman, Citigroup provides investors with both near-term value and long-term growth potential.

At present, both GS and C carry a Zacks Rank of 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 6 hours | |

| 7 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 14 hours | |

| 16 hours | |

| 16 hours | |

| 16 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite