|

|

|

|

|||||

|

|

The Clorox Company CLX is slated to report first-quarter fiscal 2026 earnings on Nov. 3, after market close. The company is expected to register year-over-year top and bottom-line declines when it posts the fiscal first-quarter numbers.

The Zacks Consensus Estimate for the fiscal first-quarter revenues is pegged at $1.39 billion, indicating a decline of 21.2% from the prior-year quarter’s actual. The consensus mark for quarterly earnings per share (EPS) has decreased by a penny in the past seven days to 78 cents per share, indicating a decline of 58.1% from the figure reported in the year-ago quarter.

CLX has a trailing four-quarter earnings surprise of 17.2%, on average, including a 28.1% positive surprise in the last reported quarter.

Clorox faced a challenging start to fiscal 2026 as the benefits from early ERP-related shipments in fourth-quarter fiscal 2025 created a significant headwind. Clorox’s first-quarter fiscal 2026 will likely mark a transitional, earnings-challenged period as the company digests ERP-related disruptions and navigates persistent macro and category headwinds.

The company expects the ERP Transition effects to remain the most significant near-term headwind in the fiscal first quarter. Retailers are expected to reduce inventory built up in late fiscal 2025, depressing shipments and earnings. This alone is expected to account for 14-15 points of sales decline and 200 basis points (bps) of margin pressure in first-quarter fiscal 2026.

Although management remains confident that results will improve in the back half of the year, as consumption stabilizes and ERP-related effects subside, these headwinds are expected to hurt results in the to-be-reported quarter.

On the last reported quarter’s earnings call, Clorox anticipated first-quarter fiscal 2026 net sales to decline 17-21% year over year, including the negative impacts of its ERP transition, as retailers draw down inventories built ahead of the system launch. An additional 2% headwind is anticipated from the prior-year divestiture of the Better Health VMS business.

The gross margin is projected between 41% and 42%, below historical levels, largely due to an estimated 200 bps of pressure related to the ERP transition. Moreover, margins are expected to face 100 bps of additional headwinds from expenses tied to storm-related damage at one of Clorox’s manufacturing facilities.

Our model predicts gross profit to decline 27.3% year over year to $586.9 million. The gross margin is expected to contract 380 bps to 42%.

The Clorox Company price-eps-surprise | The Clorox Company Quote

Clorox continues to operate in a challenging macroeconomic environment where consumers face ongoing financial pressures. The company has been contending with increased advertising expenses essential for maintaining brand visibility, which have weighed on its profitability. Clorox faces stiff competition in the consumer goods sector, which further pressures its market share and operational performance. The company is also contending with early impacts of tariffs, and elevated selling, general and administrative (SG&A) costs.

Our model predicts adjusted operating profit to decline 50.1% year over year to $165.5 million. The adjusted operating margin is expected to contract 700 bps to 11.8%.

However, several positives are expected to underpin Clorox’s fiscal first-quarter performance and set the stage for recovery in the second half. The company remains well-positioned, supported by its strong brand equity, disciplined cost management, and ongoing execution of its IGNITE strategy. Clorox continues to emphasize innovation and premiumization through superior product offerings and price-pack architecture designed to meet evolving consumer preferences.

The company’s holistic margin-management program, focused on cost savings, mix optimization and productivity gains, continues to generate fuel for reinvestment in growth initiatives. These efforts have strengthened profitability and provided flexibility to sustain elevated marketing and digital investments even amid near-term headwinds.

Additionally, Clorox is nearing completion of its multi-year digital transformation, including the full-scale rollout of its U.S. ERP system. This modernization, which accounts for about 70% of the company’s $560-$580 million transformation investment, is designed to enhance supply-chain responsiveness, demand planning accuracy and overall operational efficiency. The new ERP platform is expected to improve visibility and agility, enabling faster, data-driven decision-making across the organization.

Together with a robust pipeline of consumer-led innovation and continued investments in brand superiority, these initiatives are expected to lay a stronger foundation for sustainable growth once the temporary ERP-related disruptions subside.

Our proven model does not conclusively predict an earnings beat for Clorox this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Clorox currently has an Earnings ESP of +1.91% and a Zacks Rank of 5 (Strong Sell).

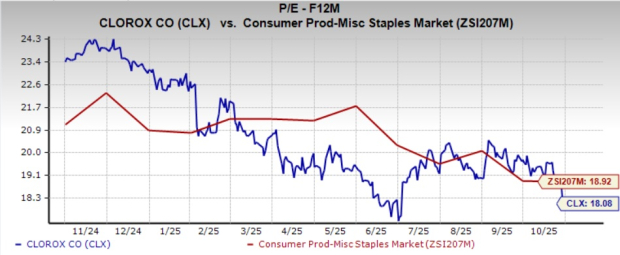

From a valuation perspective, CLX stock is trading at a discount relative to the industry. CLX has a forward 12-month price-to-earnings ratio of 18.08X, below the Consumer Products - Staples industry’s average of 18.92X.

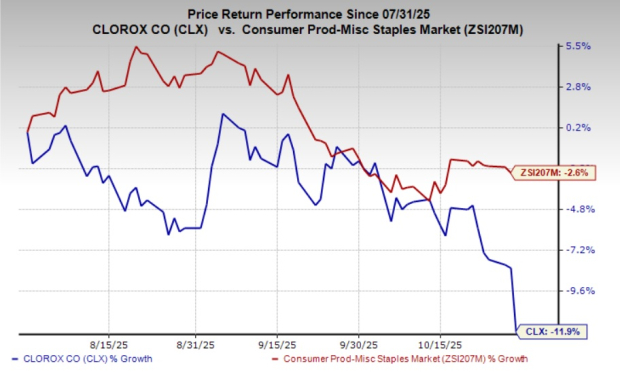

CLX has lost 11.9% in the past three months, underperforming its industry’s decline of 2.6% in the same period.

Here are a few companies, which, according to our model, have the right combination of elements to beat on earnings this reporting cycle.

Vital Farms VITL currently has an Earnings ESP of +8.84% and flaunts a Zacks Rank of 1. VITL is anticipated to register increases in its top and bottom lines when it reports third-quarter 2025 results. The Zacks Consensus Estimate for Vital Farms’ quarterly revenues is pegged at $191 million, indicating growth of 31.7% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Vital Farms’ bottom line has been unchanged in the past 30 days at 29 cents per share. This implies a surge of 81.3% from the year-ago quarter’s reported figure. VITL delivered an earnings beat of 35.8%, on average, in the trailing four quarters.

Corteva CTVA has an Earnings ESP of +4.82% and a Zacks Rank of 3 at present. CTVA is likely to register growth in its top line when it releases third-quarter 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $2.5 billion, which implies growth of 7% from the figure in the prior-year quarter.

The consensus estimate for Corteva’s bottom line has been unchanged at a loss of 49 cents per share in the past 30 days. The estimate indicates the loss to be in line with the year-ago quarter’s actual. CTVA delivered a negative earnings surprise of 4.4%, on average, in the trailing four quarters.

Monster Beverage MNST currently has an Earnings ESP of +0.82% and a Zacks Rank of 3. The company is likely to register increases in the top and bottom lines when it reports third-quarter 2025 numbers. The Zacks Consensus Estimate for quarterly earnings per share is pegged at 48 cents, suggesting 20% growth from the year-ago period’s reported number. The consensus mark has been unchanged in the past 30 days.

The consensus estimate for Monster Beverage’s quarterly revenues is pegged at $2.1 billion, which indicates growth of 12.1% from the prior-year quarter’s actual. MNST has a trailing four-quarter earnings surprise of 0.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 5 hours | |

| 15 hours | |

| 16 hours | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-08 | |

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite