|

|

|

|

|||||

|

|

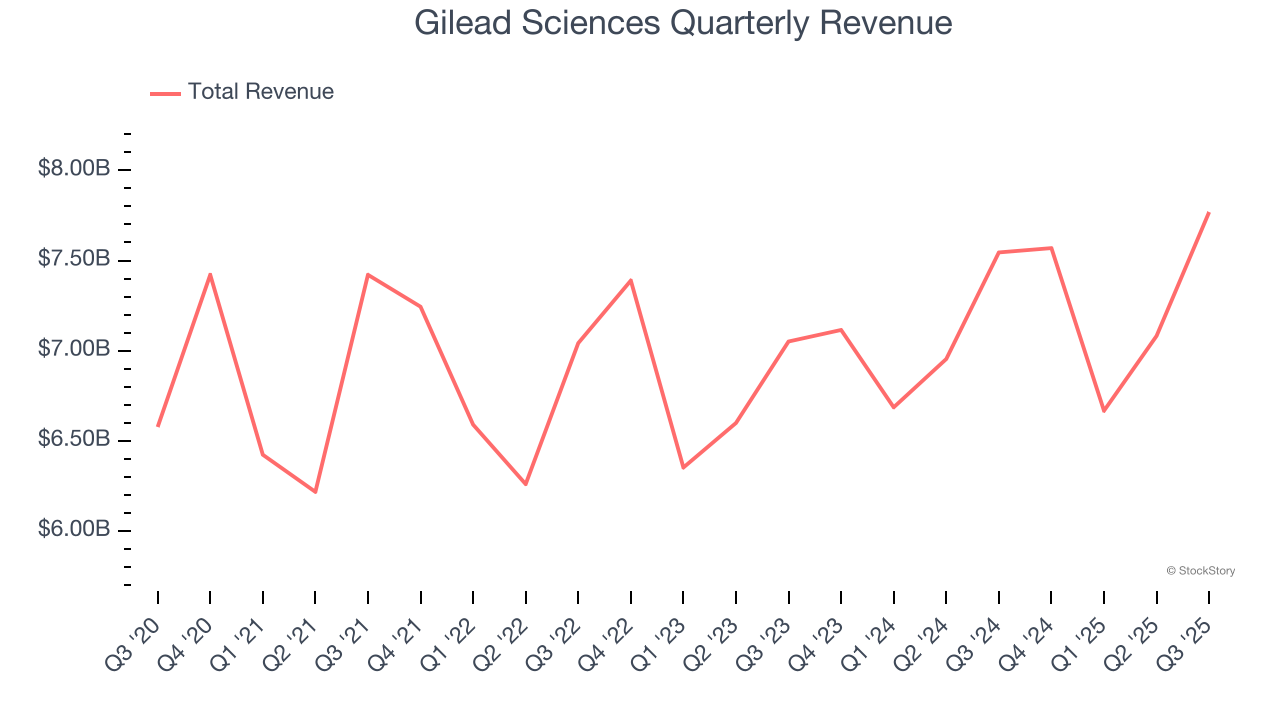

Biopharmaceutical company Gilead Sciences (NASDAQ:GILD) announced better-than-expected revenue in Q3 CY2025, with sales up 3% year on year to $7.77 billion. On the other hand, the company’s full-year revenue guidance of $28.55 billion at the midpoint came in 1% below analysts’ estimates. Its non-GAAP profit of $2.47 per share was 15.7% above analysts’ consensus estimates.

Is now the time to buy Gilead Sciences? Find out by accessing our full research report, it’s free for active Edge members.

From its groundbreaking work in developing the first single-tablet regimens for HIV treatment, Gilead Sciences (NASDAQ:GILD) develops and markets innovative medicines for life-threatening diseases including HIV, viral hepatitis, COVID-19, and cancer.

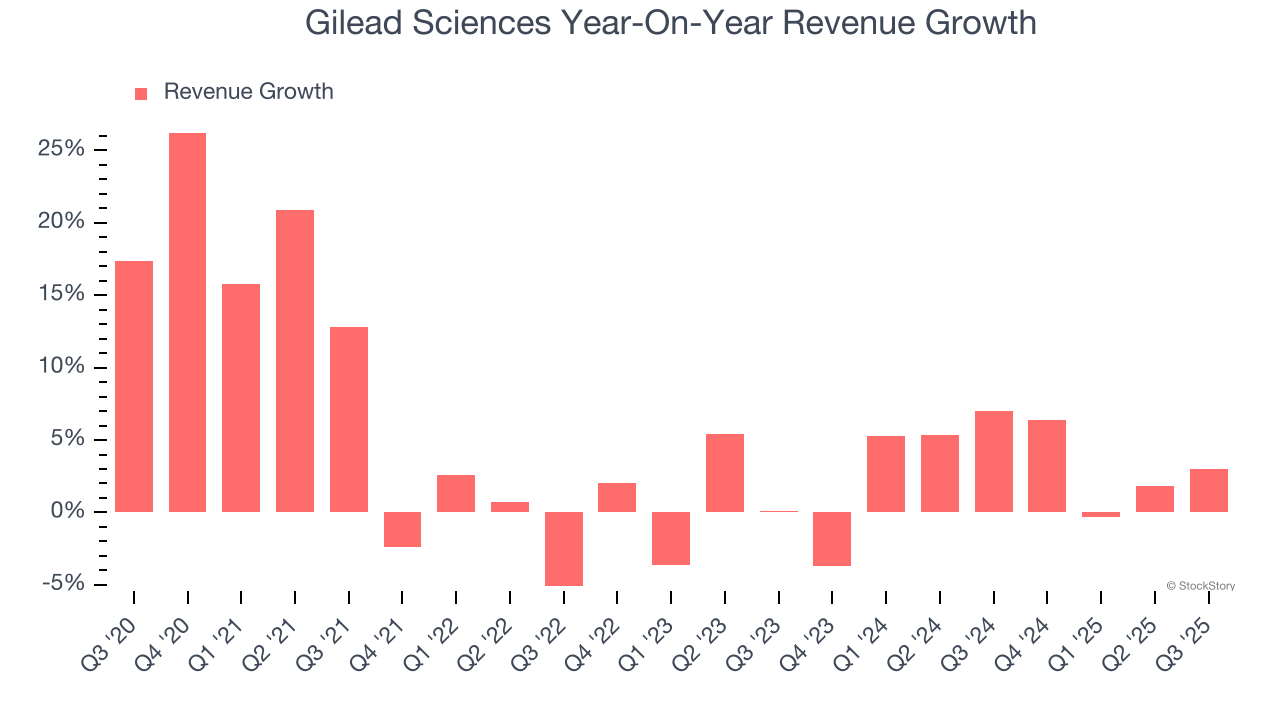

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Gilead Sciences grew its sales at a mediocre 4.7% compounded annual growth rate. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Gilead Sciences’s recent performance shows its demand has slowed as its annualized revenue growth of 3% over the last two years was below its five-year trend.

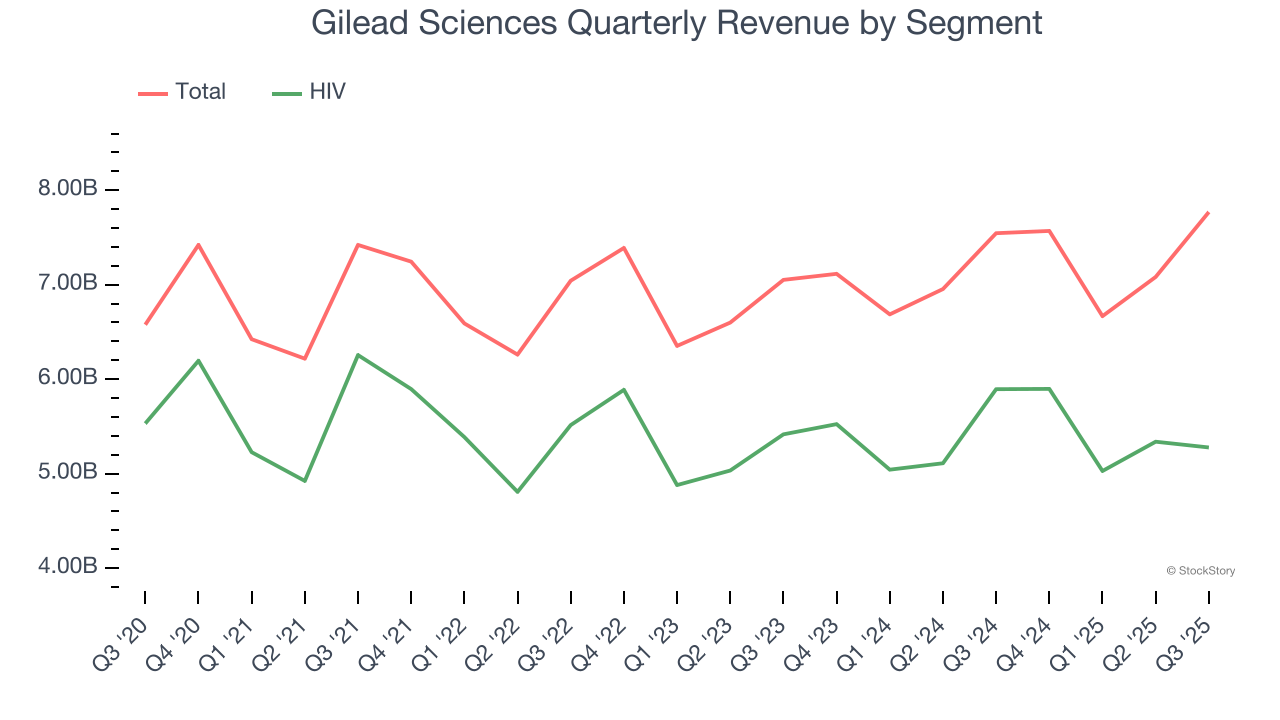

Gilead Sciences also breaks out the revenue for its most important segment, HIV. Over the last two years, Gilead Sciences’s HIV revenue was flat. This segment has lagged the company’s overall sales.

This quarter, Gilead Sciences reported modest year-on-year revenue growth of 3% but beat Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not lead to better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

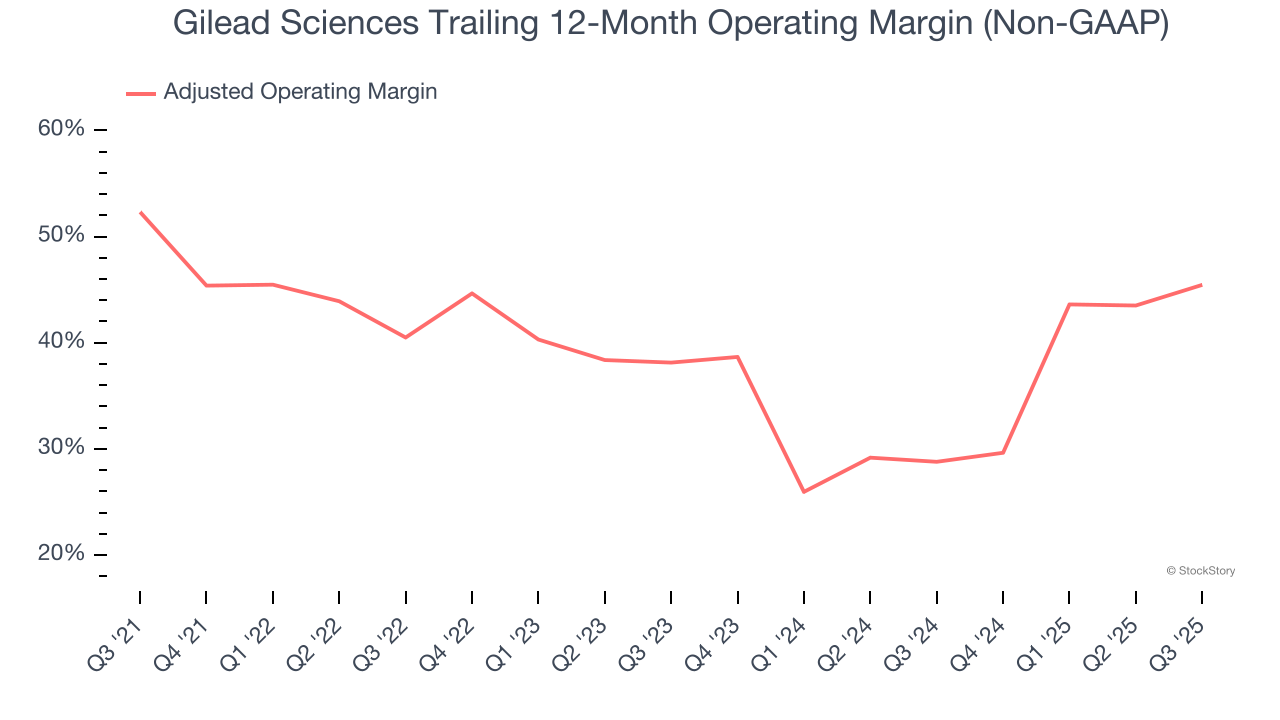

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Gilead Sciences has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 41%.

Analyzing the trend in its profitability, Gilead Sciences’s adjusted operating margin decreased by 6.9 percentage points over the last five years, but it rose by 7.3 percentage points on a two-year basis. Still, shareholders will want to see Gilead Sciences become more profitable in the future.

This quarter, Gilead Sciences generated an adjusted operating margin profit margin of 50.5%, up 7.3 percentage points year on year. This increase was a welcome development and shows it was more efficient.

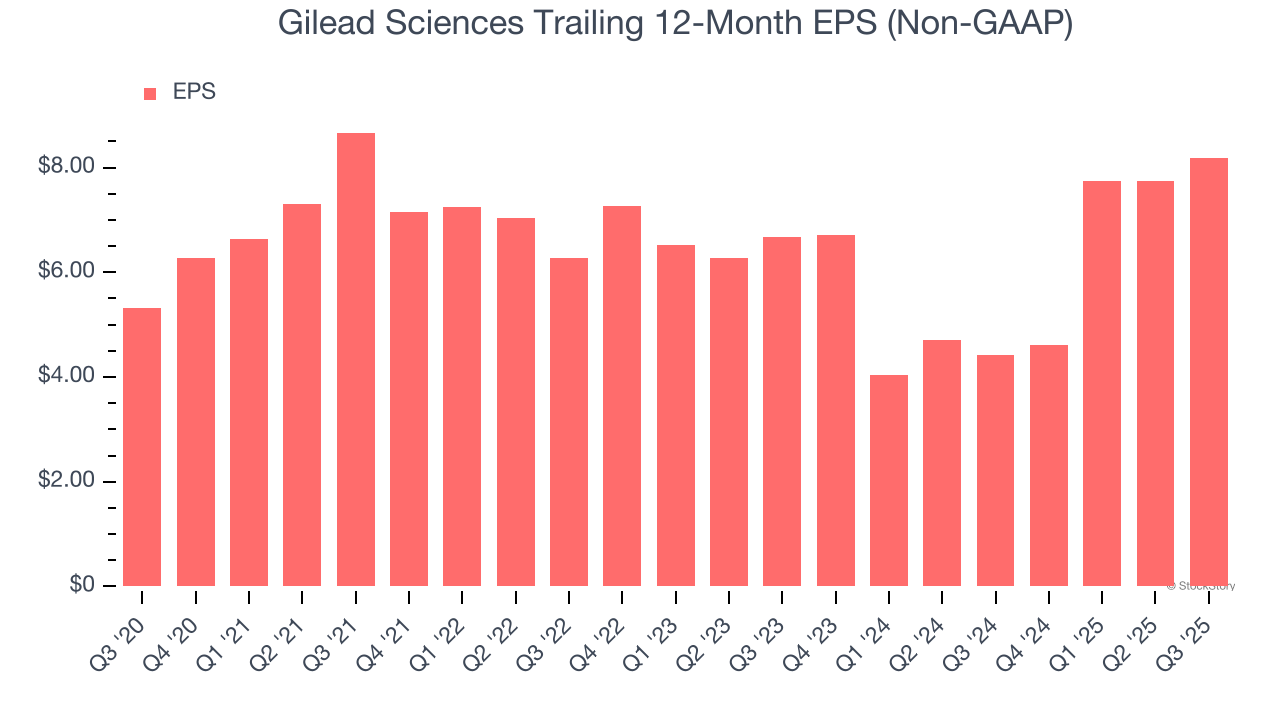

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Gilead Sciences’s EPS grew at a remarkable 9% compounded annual growth rate over the last five years, higher than its 4.7% annualized revenue growth. However, we take this with a grain of salt because its adjusted operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q3, Gilead Sciences reported adjusted EPS of $2.47, up from $2.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Gilead Sciences’s full-year EPS of $8.19 to grow 4.1%.

We enjoyed seeing Gilead Sciences beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed. This outlook seemed to weigh on shares, and the stock traded down 4.3% to $113.31 immediately following the results.

So should you invest in Gilead Sciences right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| 2 hours | |

| 5 hours | |

| Mar-09 | |

| Mar-08 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite