|

|

|

|

|||||

|

|

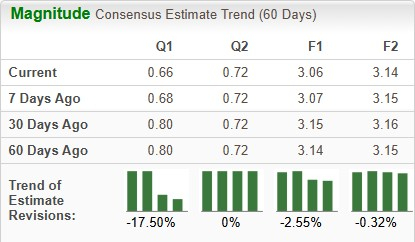

Pfizer PFE will report its third-quarter 2025 earnings on Nov. 4, before market open. The Zacks Consensus Estimate for sales and earnings for the third quarter is pegged at $16.6 billion and 66 cents per share, respectively. Estimates for Pfizer’s 2025 earnings have declined from $3.15 to $3.06 per share over the past 30 days.

The healthcare bellwether’s performance has been solid, with the company exceeding earnings expectations in each of the trailing four quarters. It delivered a four-quarter earnings surprise of 43.78%, on average. In the last reported quarter, the company delivered an earnings surprise of 34.48%, as seen in the chart below.

Pfizer has an Earnings ESP of -2.74% and a Zacks Rank #4 (Sell).

Per our proven model, companies with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) have a good chance of delivering an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Higher sales of products like Vyndaqel family, Padcev and Lorbrena are likely to have driven top-line growth. Sales of some other key products like Prevnar, Xeljanz and Eliquis also improved in the second quarter from first-quarter levels. We expect the positive trend to have continued in the third quarter, with these products also contributing to top-line growth.

The higher manufacturer discounts resulting from the Medicare Part D redesign under the Inflation Reduction Act (IRA) are likely to have impacted U.S. revenues, particularly sales of Vyndaqel, Eliquis, Ibrance and Xtandi.

In Primary Care, alliance revenues and direct sales from Eliquis are likely to have risen, driven by higher demand trends globally, partially offset by IRA-driven lower pricing and price erosion in some ex-U.S. markets. Sales of the key vaccine Prevnar are likely to have risen, driven by strong uptake of the adult indication.

The Zacks Consensus Estimate for alliance revenues from Eliquis is $1.94 billion, while our model estimate is $1.89 billion.

The Zacks Consensus Estimate for sales of the Prevnar family of vaccines is $1.79 billion, while our model estimates Prevnar family vaccine sales to be $1.77 billion.

Pfizer records direct sales and alliance revenues from its partner, BioNTech, for the COVID-19 vaccine, Comirnaty. Revenues from Pfizer/BioNTech’s COVID vaccine, Comirnaty, as well as antiviral pill for COVID, Paxlovid, are likely to have risen in the third quarter, similar to the second quarter.

The Zacks Consensus Estimate for direct sales and alliance revenues from Comirnaty is $1.14 billion, while that for Paxlovid is $1.17 billion.

Our estimate for direct sales and alliance revenues from Comirnaty is $1.19 billion, while that for Paxlovid is $1.73 billion.

Among the newer products, sales of the RSV vaccine, Abrysvo, are expected to have been hurt by limited recommendations for RSV vaccinations issued by the US Advisory Committee on Immunization Practices.

Pfizer’s oncology sales in the third quarter are expected to have been driven by higher sales of key drugs like Xtandi, Lorbrena and the Braftovi-Mektovi combination, which should make up for declining sales of Ibrance.

As regards the antibody-drug conjugates or ADCs added from the 2023 Seagen acquisition, competitive pressure in the United States is likely to have hurt sales of Adcetris, while strong demand trends are likely to have benefited Padcev’s sales.

In the Specialty Care unit, while sales of Vyndaqel are likely to have remained strong, driven by continued demand growth, sales of Xeljanz and Enbrel are likely to have declined.

The Zacks Consensus Estimate for sales of Vyndaqel/Vyndamax is $1.63 billion, while our model estimates the same to be $1.64 billion.

PFE’s EPS should include a one-time acquired in-process R&D charge related to Pfizer’s recent licensing agreement with Chinese biotech, 3SBio, which closed in July.

Nonetheless, a single quarter’s results are not so important for long-term investors. Let us delve deeper to understand whether to buy, sell or hold Pfizer stock.

So far this year, Pfizer’s stock has declined 8.4% against an increase of 3.4% for the industry.

From a valuation standpoint, Pfizer appears attractive relative to the industry and is trading below its 5-year mean. Going by the price/earnings ratio, the shares currently trade at 7.75 forward earnings, lower than 15.23 for the industry and the stock’s 5-year mean of 10.54.

After witnessing possibly its worst slowdown in 2023/2024, Pfizer made a comeback in 2025. Pfizer’s non-COVID operational revenues have been improving, driven by its key in-line products like Vyndaqel, Padcev and Eliquis, new launches and newly acquired products like Nurtec and those from Seagen (December 2023).

Pfizer is one of the largest and most successful drugmakers in oncology. The addition of Seagen strengthened its position in oncology.

Pfizer faces its share of challenges, including COVID-19 product-related uncertainty, U.S. Medicare Part D headwinds and the upcoming loss of exclusivity (“LOE”) cliff in the 2026-2030 period. Several of Pfizer’s key products, including Eliquis, Vyndaqel, Ibrance, Xeljanz and Xtandi, will face patent expirations in the 2026-2030 period. However, with COVID-related uncertainties diminishing, its revenue volatility is declining. Pfizer’s key drugs like Vyndaqel, Padcev and its recently launched and acquired products should help the company largely offset its LOEs over the next several years.

Though Pfizer does not expect strong top-line growth over the next three years due to the LOEs, it expects EPS growth. Pfizer’s dividend yield stands at around 7%, which is impressive.

Last month, Pfizer also announced a definitive agreement to acquire obesity drug developer, Metsera MTSR, for around $4.9 billion to re-enter the lucrative obesity space after it scrapped the development of danuglipron, a weight-loss pill, earlier this year. Incidentally, Novo Nordisk NVO, which holds a strong position in the obesity space, has submitted an unsolicited proposal to acquire Metsera for around $6.5 billion. As the obesity battle heats up, Pfizer, in response, called out NVO’s move as “reckless and unprecedented.”

Last month, Pfizer also signed a drug pricing agreement with the Trump administration. PFE has offered to cut prescription drug prices and boost domestic investments in exchange for a three-year exemption from tariffs on pharmaceutical imports. AstraZeneca AZN also signed a similar deal with the Trump administration. The deals between PFE and AZN and the Trump administration have raised hopes of a sustainable sector recovery, with the President offering to hold off the tariffs on pharmaceutical imports to sign similar deals with other drugmakers.

Pfizer’s recent acquisitions and licensing deals, like the proposed Metsera buyout and the global, ex-China licensing agreement with 3SBio, among others, are weighing on near-term earnings expectations. While these transactions will broaden Pfizer’s pipeline reach, they are likely to have added substantial near-term expenses, thus weighing on profitability and triggering downward revisions in EPS estimates. Short-term investors may consider selling the stock.

However, investors with a long-term horizon should stay invested in this stock due to its cheap valuation, significant upside potential, high dividend yield, and significant growth prospects. Its new drugs and a robust pipeline may help navigate the upcoming LOE period.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 hours | |

| 14 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite