|

|

|

|

|||||

|

|

Alnylam Pharmaceuticals ALNY reported third-quarter 2025 earnings of $2.90 per share, beating the Zacks Consensus Estimate of $1.67. The improvement was due to higher revenues from the sale of its lead drug, Amvuttra (vutrisiran). The company had incurred an adjusted loss of 50 cents in the year-ago quarter.

Alnylam recorded total revenues of $1.25 billion in the quarter, which surpassed the Zacks Consensus Estimate of $1.02 billion. In the year-ago quarter, total revenues were $500.9 million. The top line rose 149% year over year on a reported basis and 147% at a constant exchange rate (CER), mainly driven by increased Amvuttra sales following its label expansion.

Net product revenues were $851.1 million, up 103% year over year on a reported basis and 99% at CER, driven by strong growth in patient demand for Amvuttra, as well as for Givlaari (givosiran) and Oxlumo (lumasiran).

Despite the comprehensive earnings and revenue beat, ALNY shares lost 6.7% on Thursday, reflecting heightened investor caution following news of an external inquiry into certain commercial and pricing practices.

Net revenues from collaborators were $351.7 million, up significantly from the year-ago quarter, primarily due to a $300 million milestone payment received from Roche RHHBY in the reported quarter associated with the dosing of the first patient in the ZENITH phase III clinical study of zilebesiran. ALNY also recognized revenues under its ongoing collaborations with Regeneron. However, the company did not recognize any revenues from Novartis in the reported quarter.

Alnylam also recognized royalty revenues of $46.2 million in the reported quarter, up 98% year over year on a reported basis and at CER.

Onpattro (patisiran) is approved for the treatment of polyneuropathy of hereditary transthyretin-mediated (hATTR) amyloidosis. The injection recorded sales of $39.1 million in the reported quarter, down 22% on a reported basis. Onpattro sales missed the Zacks Consensus Estimate of $47.5 million as well as our model estimate of $49 million.

Amvuttra is FDA-approved for the treatment of adult patients with polyneuropathy of hATTR amyloidosis. The European Commission also approved Amvuttra for treating hATTR amyloidosis in adult patients with stage 1 or 2 polyneuropathy. A label expansion for the drug has also been approved in the United States and the EU for treating cardiomyopathy of wild-type or hereditary transthyretin-mediated amyloidosis (ATTR-CM) in adults to reduce cardiovascular mortality, cardiovascular hospitalizations and urgent heart failure visits.

Amvuttra generated sales worth $685.3 million in the third quarter, up 165% on a reported basis, driven by increased patient demand, mainly in patients with ATTR amyloidosis with cardiomyopathy in the United States, as well as several patients switching from Onpattro. Amvuttra sales beat the Zacks Consensus Estimate of $637.5 million as well as our model estimate of $546 million.

Givlaari, approved for the treatment of acute hepatic porphyria, recorded sales of $73.9 million, reflecting a year-over-year increase of 4% on a reported basis. Givlaari sales missed the Zacks Consensus Estimate of $79.5 million and our model estimate of $87.5 million. Oxlumo recorded global net product revenues of $52.8 million in the reported quarter, up 31% year over year on a reported basis. Oxlumo sales beat the Zacks Consensus Estimate of $50.5 million as well as our estimate of $49.1 million.

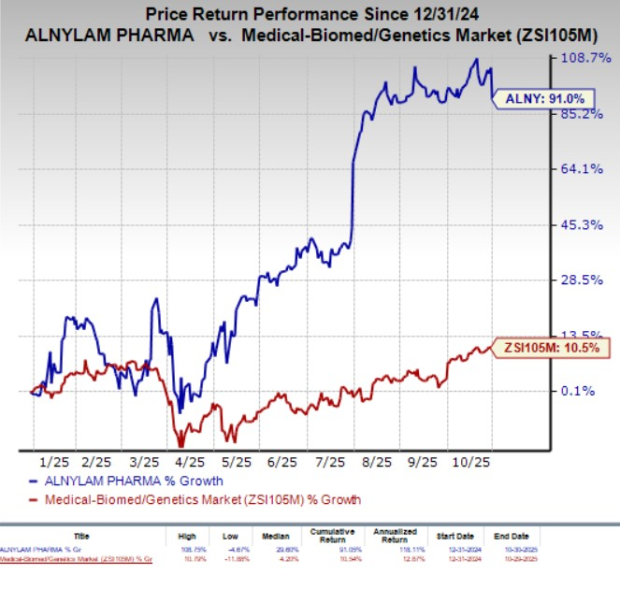

Year to date, ALNY stock has soared 91% compared with the industry’s 10.5% growth.

Adjusted research and development (R&D) expenses rose 23% year over year to $310.1 million. R&D expenses accounted for increased clinical study costs associated with the ZENITH phase III cardiovascular outcomes study, which will evaluate zilebesiran to treat patients with hypertension at high cardiovascular risk, in partnership with Roche. Expenses associated with the phase III TRITON-CM study, evaluating nucresiran in patients with ATTR-CM, also contributed to higher R&D costs.

Adjusted selling, general and administrative (SG&A) expenses increased 35% year over year to $262.6 million, primarily due to higher employee compensation costs, as a result of higher headcount and increased marketing investment associated with the Amvuttra launch in ATTR-CM.

Cash, cash equivalents and marketable securities as of Sept. 30, 2025, amounted to $2.7 billion compared with $2.9 billion recorded as of June 30, 2025.

Alnylam, in collaboration with Roche, is developing zilebesiran in a late-stage study (ZENITH) to evaluate the potential of zilebesiran to reduce the risk of major adverse cardiovascular events in patients with uncontrolled hypertension. ALNY entered a strategic collaboration with RHHBY to co-develop and co-commercialize zilebesiran for the treatment of hypertension in 2023.

Alnylam now expects its net product revenues for Onpattro, Amvuttra, Givlaari and Oxlumo in the band of $2.95-$3.05 billion for 2025, up from the previously guided range of $2.65-$2.80 billion.

The guidance for net revenues from collaborations and royalties is maintained in the range of $650-$750 million. Adjusted R&D and SG&A expenses are now expected in the range of $2.15-$2.20 billion, up from the previously guided band of $2.1-$2.2 billion.

Alnylam reported better-than-expected results in the third quarter of 2025, beating earnings and revenue estimates. The year-over-year increase in revenues has been mainly fueled by growing Amvuttra sales as a result of increased patient demand. The recent label expansion of the drug for the ATTR-CM indication in the United States and the EU has further expanded the eligible patient population for the drug, which is boosting sales and is expected to continue to do so in the quarters ahead. Sales of other products, Givlaari and Oxlumo, are also contributing to the top line.

Alnylam Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Alnylam Pharmaceuticals, Inc. Quote

Alnylam currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Beam Therapeutics BEAM and Amicus Therapeutics FOLD, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Beam Therapeutics' loss per share have narrowed from $4.36 to $4.23 for 2025. During the same time, loss per share estimates for 2026 have narrowed from $4.41 to $4.21. Year to date, shares of BEAM have lost 4.1%.

Beam Therapeutics’ earnings beat estimates in two of the trailing four quarters while missing the same on the remaining two occasions, the average negative surprise being 2.62%.

In the past 60 days, estimates for Amicus Therapeutics’ earnings per share have remained constant at 31 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from 69 cents to 70 cents. Year to date, shares of FOLD have lost 5.5%.

Amicus Therapeutics’ earnings beat estimates in one of the trailing four quarters, missing the mark thrice, with the average negative surprise being 24.38%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite