|

|

|

|

|||||

|

|

InfuSystem Holdings, Inc. INFU is scheduled to report third-quarter 2025 results on Nov. 4, before market open.

In the last reported quarter, the company’s earnings per share (EPS) of 12 cents surpassed the Zacks Consensus Estimate of 3 cents. Over the trailing four quarters, its earnings outperformed the Zacks Consensus Estimate on two occasions, missed once and broke even in the other, delivering an earnings surprise of 79.2%, on average.

Let’s check out the factors that have shaped INFU’s performance prior to this announcement.

InfuSystem’s Patient Services segment’s core purpose is to seek opportunities to leverage its know-how in clinic-to-home healthcare involving Durable Medical Equipment, logistics and billing capabilities, growing network of third-party payers under contract, and clinical and biomedical capabilities. The leading service within the Patient Services segment is INFU’s Oncology Business, with additional areas of focus being Pain Management and Wound Care, among others.

INFU’s second-quarter 2025 results were driven by higher treatment volume and increased third party payer collections in Oncology and Wound Care. This trend is likely to have continued in the soon-to-be-reported quarter. In the third quarter of 2025, margin might have continued to improve as enterprise resource planning (ERP)-related process upgrades and productivity initiatives begin to take effect. However, management has indicated a deliberate slowdown in Wound Care expansion to refine billing processes and control costs, which might have tempered momentum in the third quarter.

We expect Pain Management activity to have normalized in the to-be-reported quarter as the second-quarter shipment delays were largely timing-related, not structural. Oncology is expected to have remained stable, benefiting from durable payer relationships and consistent treatment volumes.

INFU’s Device Solutions segment’s second-quarter 2025 results reflected strong execution and improved operational leverage, supported by higher rental revenues from new customers and increased sales of used equipment. The rental business benefited from prior-year pump purchases, which continue to contribute to higher-margin recurring revenues. In the third quarter, performance is likely to have remained robust as these rental contracts mature, though margins might fluctuate with changes in sales mix — particularly between new and used pump sales.

Additionally, InfuSystem is restructuring its biomedical services relationship with GE Healthcare to address margin pressure, indicating near-term variability as pricing and service levels are renegotiated. Capital spending is expected to stay moderate, with management emphasizing less capital-intensive growth and continued benefit from prior device investments. Investors may focus on any potential discussion on restructuring initiatives during the third-quarter earnings call.

For third-quarter 2025, the Zacks Consensus Estimate for revenues is pegged at $37.2 million, implying an improvement of 5.3% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at 8 cents, flat compared with the prior-year period’s reported number.

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold), along with a positive Earnings ESP, has higher chances of beating estimates. This is not the case here, as you can see below.

Earnings ESP: InfuSystem has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

InfuSystems Holdings, Inc. price-eps-surprise | InfuSystems Holdings, Inc. Quote

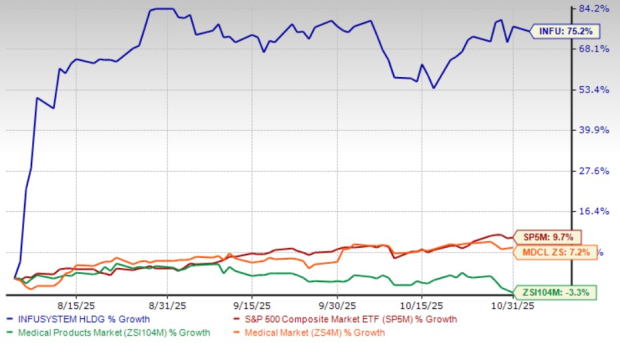

Over the past three months, InfuSystem’s shares have surged 75.2%, outperforming the Medical - Products’ 3.3% decline. INFU’s shares also outperformed the Zacks Medical sector’s increase of 7.2% and the S&P 500’s growth of 9.7%.

InfuSystem’s peers like Phibro Animal Health Corporation PAHC, Insulet Corporation PODD and LeMaitre Vascular, Inc. LMAT have underperformed it. PAHC, PODD and LMAT’s shares are up 50.3%, up 10.3% and up 1.9%, respectively, in the same time frame.

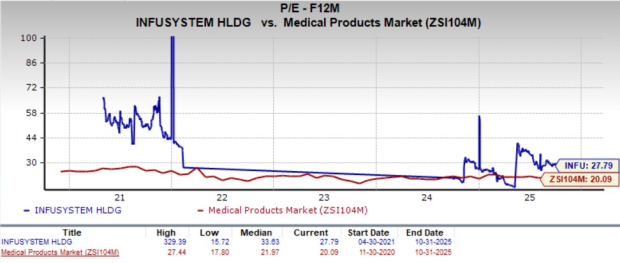

From a valuation standpoint, INFU’s forward 12-month price-to-earnings (P/E) is 27.8X, a premium to the industry's average of 20.1X.

The company is trading at a discount to its peers, Insulet and LeMaitre Vascular, while it is trading at a premium to Phibro Animal Health. Insulet, LeMaitre Vascular and Phibro Animal Health’s P/E currently stand at 56.1X, 34.8X and 15.9X, respectively.

This suggests that investors may be paying a higher price relative to the company's expected sales growth.

InfuSystem’s long-term investment visibility is underpinned by its focus on scalable operations, technology modernization and recurring-revenue models. The ongoing ERP implementation, slated for completion in early 2026, is central to this visibility. Management expects it to streamline billing, automate workflows and reduce processing inefficiencies across both Patient Services and Device Solutions.

In May, INFU acquired certain assets of Apollo Medical Supply (Apollo), a privately-held wound care service company based in Florida. As part of the company’s Patient Services segment, this acquisition is expected to supplement its existing wound care business by providing access to an advanced patient service fulfillment know-how and software platform that InfuSystem plans to integrate into its existing operations. This looks promising for the stock.

InfuSystem’s partnership with Smith & Nephew in Device Solutions highlights its shift toward asset-light, high-cash-margin models that require limited capital investment but yield steady revenue streams. These operational initiatives — centered on efficiency, automation and capital-light expansion — collectively strengthen INFU’s visibility into sustainable long-term returns.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite