|

|

|

|

|||||

|

|

Becton Dickinson and Company BDX, popularly known as BD, is scheduled to report fourth-quarter fiscal 2025 results on Nov. 6, before market open.

In the last reported quarter, the company’s adjusted earnings per share (EPS) of $3.68 surpassed the Zacks Consensus Estimate by 7.6%. Over the trailing four quarters, its earnings outperformed the Zacks Consensus Estimate on all occasions, delivering an earnings surprise of 6.5%, on average.

Let’s check out the factors that have shaped BDX’s performance prior to this announcement.

BD Medical’s strong third-quarter fiscal 2025 performance is expected to carry into the fiscal fourth quarter as key growth drivers remain intact. In the fiscal third quarter, strong biologics demand in Pharmaceutical Systems, solid expansion in Medication Management Solutions driven by Infusion Systems and Pyxis platform adoption, and robust momentum in Advanced Patient Monitoring fueled by the HemoSphere Alta launch all contributed to segment strength. This is likely to have continued in the to-be-reported quarter, supported by sustained demand for biologics and GLP-1 therapies, ongoing customer adoption of connected infusion and monitoring technologies, and benefits from BD Excellence initiatives improving productivity and supply reliability.

On third-quarter fiscal 2025 earnings call in August, management announced that the BD Libertas Wearable Injector has entered its first pharma-sponsored clinical trial. The device is being used for self-injection of complex biologic drugs by patients at home rather than going to an infusion clinic. This looks promising for the stock.

The Zacks model estimates the BD Medical segment’s revenues in the fiscal fourth quarter to be $3.28 billion, up 15.5% year over year.

In May, BDX announced the global commercial launch of BD FACSDiscover A8 Cell Analyzer, featuring breakthrough spectral and real-time cell imaging technologies. This is expected to enable more researchers across a wider range of applications to uncover deeper insights and dynamics from cells once invisible in flow cytometry experiments with increased ease and throughput. This is likely to have witnessed encouraging product adoption during the to-be-reported quarter, thereby driving the segmental revenues.

On third-quarter fiscal 2025 earnings call, management confirmed that BD is currently launching its first Made in China for China clinical analyzer. During the quarter, BDX received the FDA’s 510(k) clearance for the BD Veritor System rapid point-of-care COVID-19 test. These raise our optimism about the company.

However, BD continued to face market dynamics in China and Europe, which led to a year-over-year decrease in instrument sales. The company’s research funding in Europe continued to be constrained within its prior expectations. These raise our apprehension about the company’s performance in the to-be-reported quarter.

The Zacks model estimates the BD Life Sciences segment’s revenues in the fiscal fourth quarter to be $1.27 billion, down 4.9% year over year.

On third-quarter fiscal 2025 earnings call, management stated that BD is continuing to expand indications for Phasix with the European Union launch of the first reservable scaffold with broad indications to prophylactically prevent incisional hernias. The company’s Urology & Critical Care business unit’s performance was driven by the recent launches of PureWick Flex at Home and PureWick Male. Per management, this continued to outpace the new product ramp of PureWick Female. Surgery business unit’s performance was driven by strength in the advanced tissue regeneration platform from incremental investments in Phasix sales force, the recent Phasix umbilical launch and continued adoption of GalaFLEX for plastic and reconstructive surgery.

We expect the robust adoption of BD’s products to have continued in the fourth quarter of fiscal 2025, driven by sustained demand, thereby significantly pushing up segmental revenues.

The Zacks model estimates the BD Interventional segment’s revenues in the fiscal fourth quarter to be $1.35 billion, up 7.1% year over year.

For fourth-quarter fiscal 2025, the Zacks Consensus Estimate for revenues is pegged at $5.91 billion, implying an improvement of 8.7% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at $3.91, indicating an increase of 2.6% from the prior-year period’s reported number.

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold), along with a positive Earnings ESP, has higher chances of beating estimates. This is not the case here, as you can see below.

Earnings ESP: BD has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Becton, Dickinson and Company price-eps-surprise | Becton, Dickinson and Company Quote

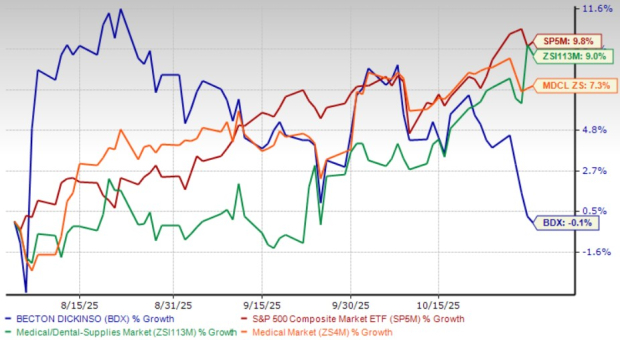

Over the past three months, BD’s shares have lost 0.1%, underperforming the Medical - Dental Supplies’ 9% gain. BDX’s shares also underperformed the Zacks Medical sector’s increase of 7.3% and the S&P 500’s growth of 9.8%.

BD’s peer, McKesson Corporation MCK, has outperformed the company, while other peers like The Cooper Companies, Inc. COO and CONMED Corporation CNMD have underperformed. MCK, COO and CNMD’s shares are up 14.1%, down 2.2% and down 17.7%, respectively, in the same time frame.

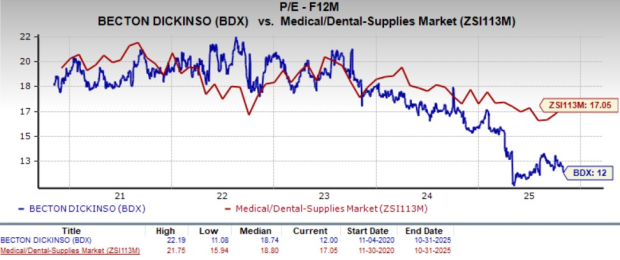

From a valuation standpoint, BDX’s forward 12-month price-to-earnings (P/E) is 12X, a discount to the industry's average of 17.1X.

The company is trading at a discount to its peers, McKesson and Cooper Companies, while it is trading at a premium to CONMED. McKesson, Cooper Companies and CONMED’s P/E currently stand at 19.7X, 17.1X and 9.5X, respectively.

This suggests that investors may be paying a lower price relative to the company's expected sales growth.

During the fiscal third quarter, BDX submitted the FDA application for the at-home BD Onclarity HPV (human papillomavirus) Assay that includes a fiber swab for self-collection, is fully automated on the BD COR System and reports more high-risk HPV strains than any other test currently available.

On the fiscal third-quarter earnings call, management confirmed the BD Life Sciences segment’s Biosciences (BDB) business unit's research and development pipeline currently includes more than 25 new product launches across instruments, reagents and informatics, as well as continued expansion in the high-growth Single-cell Multiomics segment. In the Diagnostic Solutions (DS) business unit, BDX is focusing on the next-generation BACTEC launch in fiscal 2026, as blood culture momentum continues. This is expected to have driven renewal of legacy systems and accelerated share gains in the to-be-reported quarter.

On the same call, management also stated that in the BD Life Sciences segment, BD MAX IVD continued to grow and showed strength on the back of favorable reimbursement dynamics in the molecular diagnostics space that were growth tailwind for this platform. Management expects these positive trends to continue and the temporary growth headwinds to continue to fade, thereby putting the Biosciences and Diagnostic Solutions business on a sound trajectory back to its historic mid-single-digit plus growth rate.

In August, BD announced its plans to invest more than $35 million and expand prefilled flush syringe manufacturing at its Columbus, NE, facility. The investments will likely support new BD PosiFlush Prefilled Flush Syringe production lines, product innovation and operational efficiencies, enabling BD to produce hundreds of millions of additional units annually to meet growing demand from U.S. hospitals and health systems.

In July, BD announced a definitive agreement with Waters Corporation to combine its BDB & DS business with Waters. Per BD’s management, the agreement will likely bring together complementary portfolios and channels that create an industry-leading life science and diagnostics company. This looks promising for BD as it is expected to enhance its strategic focus as a medical technology company.

For fiscal 2025, management is optimistic about witnessing increasing momentum from BD Excellence. Per management, the BD Excellence operating system continues to be a key enabler of the company’s strong margin execution and is expanding its competitive advantage in manufacturing, streamlining internal processes and optimizing its supply chains in the current tariff environment.

However, BD’s strong performance in the fiscal third quarter was partially offset by continued market dynamics in China, which is likely to have continued in the to-be-reported quarter. The current unstable macroeconomic business environment is also likely to have weighed on the company’s fiscal fourth-quarter revenues, raising our apprehension.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite